Turbulence

“A great book begins with an idea; a great life, with a determination.”

– Louis Dearborn L’Amour

Turbulent and weaker markets were evident in the second quarter ended 6/30/2022. The accelerating transition from easy money at low rates to higher interest rates added to the stormy conditions. Russia’s invasion of Ukraine in late February fueled an oil and food price shock that squeezed consumers. Ample liquidity and strong corporate and consumer balance sheets, propped up by pandemic era stimulus, may cushion and delay the pain but not forestall it. Higher interest rates normally erode demand meaningfully. We expect a recession is likelier than not but may be later than most expect and milder than average.

In contrast to the 2008-2009 recession, employment, real estate, and leverage are all more constructive now. Unemployment was 5% in late 2007 but is currently just 3.6%. Moreover, there are now more than twice as many job vacancies as job seekers. Residential real estate is also in much better shape now. The annual rate of growth in home mortgages from March 2017 to March 2022 was 4.3%, much lower than the 12.4% annual rate from March 2001 to September 2006.1 Weak underwriting standards during the early 2000s allowed home buyers and real estate speculators to purchase homes with very low down payments before housing prices declined by 4.4% annually from 2005 to March 2009. In contrast, the 7.8% annual home price appreciation from 2017 to March 2020 reflected a market with more traditional mortgages at very low fixed rates. The recent price increases have created a cushion in homeowners’ equity values whereas the last cycle eroded or eliminated them leading to high foreclosure rates. Consequently, homeowners that lose their jobs this time around will have labor mobility to where the jobs are. Systemic leverage is also lower– commercial U.S. banks have more than twice the capital/assets ratios than they did last cycle. They also have much lower reliance on wholesale funding, 10% as of 12/31/21 down from 35% at the end of 2008. Broker-dealers are currently at historically low levels of leverage. Only the life insurance sector has modestly increased leverage.2 Together, these factors should moderate economic weakness as demand weakens in response to higher interest rates.

Markets

Forecasts for slower economic growth and uncertainties surrounding inflation and earnings significantly hit both stock and bond markets in the first half of 2022. Steady selling pushed the S&P 500 Index into a bear market (defined as 20% or more lower than its high). Year-to-date, this index declined 20.7% through June 30th. Most European markets dropped over 20% with Spain and the UK dropping 15% and 13%, respectively. Most Asian stock markets also dropped 15-25%.

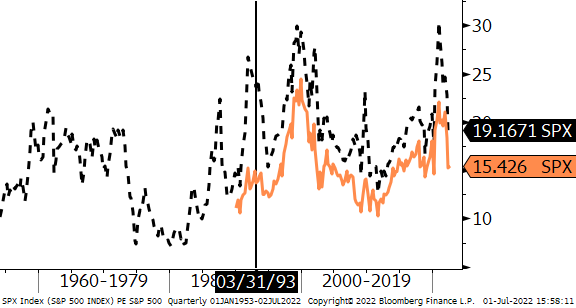

Lower valuations render most indices near historical averages. U.S. stocks as measured by the S&P 500 are trading at P/Es of 19.3 times trailing earnings (—dotted line) and 15.5 times forward price/earnings (- solid line), as depicted in Figure One. Volatility has been high and is likely to continue being elevated as the year enfolds unless inflation moderates.

Figure One: S&P 500 Index price/earnings multiples

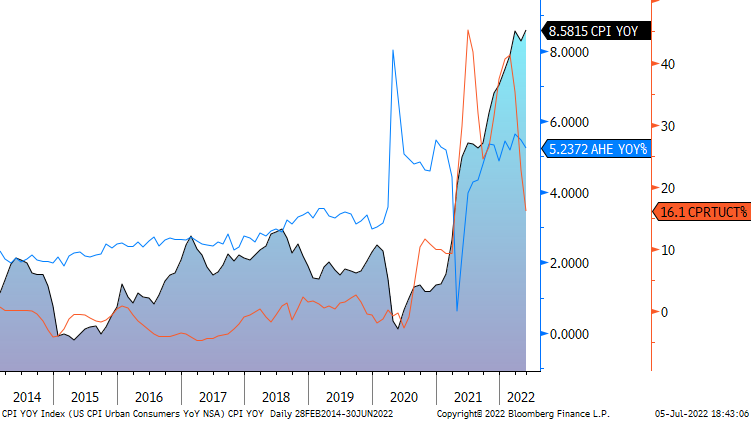

The Federal Reserve (FED) raised rates by 75 basis points in June and plans several further rate hikes later this year, with the pace and scope depending on economic data. The European Central Bank will likely begin to tighten monetary conditions in July. Bond markets dropped significantly in the first half of 2022 with the Bloomberg U.S. Aggregate Bond Index dropping 10.4% – a record. The U.S. ten-year Treasury yield ended June yielding 3.02%, more than 70 basis points higher than three months prior, and more than double where it ended 2021. Shorter rates rose at a faster rate and the difference between the 2-year Treasury yields and the ten-year yield was a slim six basis points at June 30 after being briefly inverted in May. Yield inversions often portend that a recession is coming within 18 months. U.S. bond yields may rise further as FED hikes progress, but their pace and scope will depend on how inflation data progresses. Inflation is running a hot 8.5% but some components are likely to contribute less to inflationary measures in the second half of the year than they did over the last twelve months. Used car prices rose 40% in 2021 but have moderated to 16%. The rate of increases for gasoline may have peaked as well.

Figure Two: US Consumer Price Index, Wages, used autos % change

Investment Strategy

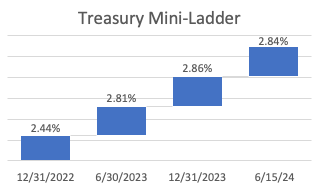

While the next recession may be a year or two away, stocks can still record positive returns in the interim if inflation expectations moderate, earnings stabilize, and the recession is mild. The market appears to already be pricing an imminent and more severe recession than we expect. We are therefore maintaining a neutral, diversified, and partly hedged risk allocation. The bond market selloff has created an opportunity to take advantage of a very flat yield curve in the front end. We have established a “mini-ladder” in most portfolios that allows us to earn close to 3% within the next two years with no loss potential if we hold these to maturity (2.84% as of July 1st).

Figure Three: U.S. Treasury Mini-Ladder July 1st

Outlook

Markets will continue to react to economic and geo-political developments. Volatility will likely abate once inflation decreases. Historically, stock prices have rebounded. Sometimes they recover quickly (2020) and other times more slowly (2009-2013) but eventually make up for their decline.

Looking beyond the recent turbulence, we are determined to provide best in class assistance in navigating these storms as they form, strike, and subside. Thank you for allowing our team to assist you in your financial journey. May the ride be smoother and safer in the months and years ahead.

Your Regency team remains available for in person meetings, as well as telephone or video calls to discuss any issues and questions.

Click here to download printable version of this newsletter.

1 Source: Regency Wealth Management, Board of Governors Federal Reserve System Financial Stability Report May 2022, Bloomberg L.P.

2 Board of Governors Federal Reserve System Financial Stability Report May 2022.