Stock Wars – The FED Awakens

“Fear not. Prepared you will be.” – Andrew M. Aran, CFA

On December 16th, the Federal Reserve (Fed) awoke from its multi-year slumber of inaction raising the fed funds rate by one quarter of one percent (0.25%) to a 0.25% – 0.50% target. Even if they raise this rate four times in 2016 as they forecast, it will remain highly accommodative. We anticipate that the rate will be a little lower than the Fed expects; 1.25% a year from now.

The pace and scope of interest rate increases in this cycle will likely be slower with fewer hikes than past ones reflecting soft global demand. The yield on the ten year Treasury note will likely remain at or below 3.50% for some time (2.24% as of 12/31/2015). Nevertheless, the Fed move is the beginning of an important transition to more normal rates.

In mid-December a distressed debt mutual fund announced that investors would be unable to redeem shares due to lack of liquidity in the fund’s underlying investments. Financial media commentators had a field day. Investors in high yield ETFs and high yield mutual funds were not amused as their investments dropped as much, if not more, than stocks. The repricing of high yield bond risks, particularly in the higher rated and more liquid securities, appears transitory to us in the face of continued modest economic expansion in the US and Europe but it is a reminder of how illiquid the sector can be.

Returns and Valuations

Volatility escalated in 2015 after being low for three years. A “correction” in stocks (a decline of 10% or more from market highs) occurred in the third quarter followed by a strong October rebound and a modest rise in November before selling off in December. In 2015, stocks posted their first negative return year since 2008.

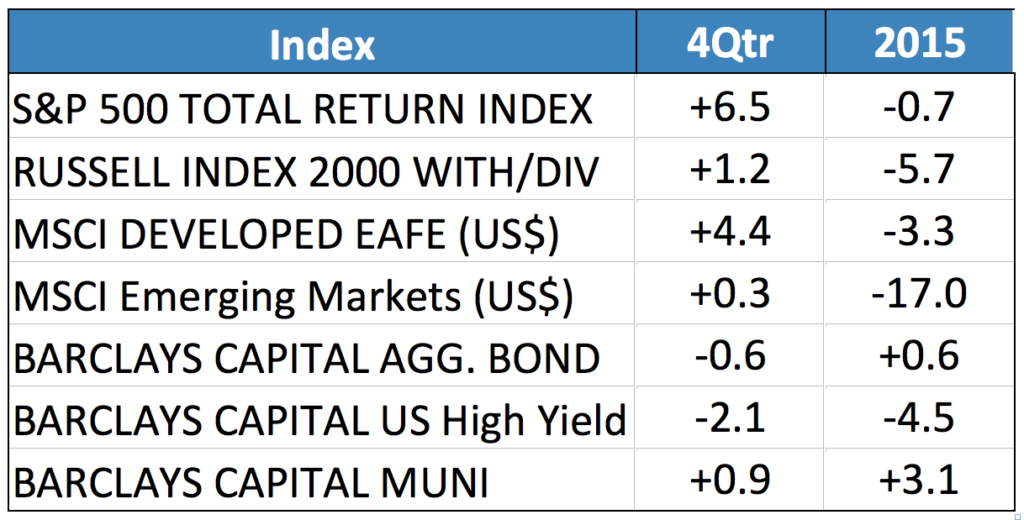

For the third consecutive year, most domestic and international equity indices (in US dollar terms) lagged the S&P 500 Index. Table One depicts the disappointing returns posted across major indices for 2015.

Table One: 2015 Index Returns

Ten year U.S. Treasury yields of 2.24% were little changed year over year but volatility was ample (peaking at 2.36% mid-year). The yield curve flattened modestly as investors anticipated some Fed action. The Barclays US High Yield Index dropped 4.5% in 2015. Municipal bonds performed admirably returning 3.1% in the year. Commodities weakened further with prices of oil dropping 38% and precious metals such as Gold declining 10.7% reflecting a lack of inflationary concerns.

Fundamentals

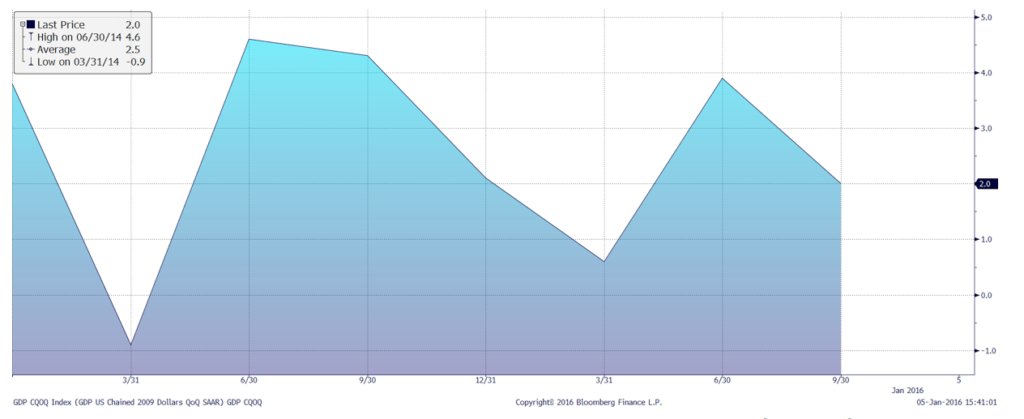

The U.S. economy grew at a modest pace in 2015, paralleling 2014’s pattern.

Figure One: U.S. GDP Growth: choppy but positive

Third quarter U.S. economic growth decelerated to 2% after +3.9% in the prior quarter. Job growth continued, pushing down the unemployment rate to 5.0%. Constructive signs of growth continue to be evident in rising household income, high new-auto sales, and consumption spending. However, corporate earnings were lackluster for the year: S&P 500 firms likely grew at a low single digit pace reflecting continued weak Energy prices and a stronger US dollar. Health Care and Telecommunication Services industries held up best in 2015.

Outlook

For 2016, we anticipate more stable energy prices, modestly higher interest rates and a stable US dollar supporting higher demand and a modest rebound in stock prices. Alternatively, meaningful economic deceleration would pressure equities and keep interest rates near current levels. The S&P 500 Index’s 2.15% dividend yield continues to be attractive relative to short-term and intermediate-term bonds yields. Some snippets from Wall Street forecasters: “Flat is the new up,” was the catch phrase for Goldman Sachs’ analysts last August. In “Outlook 2016”, they predicted U.S. stocks will have limited upside and expressed concern that positive economic news may bring additional Fed tightening. Goldman expects global growth to stabilize during 2016 as emerging markets rebound, with Europe and Japan showing improvement. Jeremy Grantham of GMO, who is known for gloomy outlooks, is not concerned about the Federal Reserve raising rates, according to Financial Times (FT). FT quoted Grantham as saying, “We might have a wobbly few weeks…but I’m sure the Fed will stroke us like you wouldn’t believe and the markets will settle down, and most probably go to a new high.” Grantham expects the high to be followed by a low. He has been predicting global markets will experience a major decline in 2016 for a several years, and he anticipates the downturn could be accompanied by global bankruptcies. PWC’s Trendsetter Barometer offered a business outlook based on surveying corporate executives. After the third quarter of 2015, it found, “U.S. economic fundamentals remain strong, but markets and executives like predictability, and that’s not what we’ve been getting lately… Trendsetter growth forecasts are down, so are plans for [capital expenditure] spending, hiring, and more. It doesn’t help that we’ve entered a contentious 2016 election season…” The Economist had this advice for investors who are reviewing economic forecasts, “Economic forecasting is an art, not a science. Of course, we have to make some guesses. The

average citizen would be well advised, however, to treat all forecasts with a bucket (not just a pinch) of salt.”

The future is uncertain by its very nature. In an environment of modest growth, average equity valuations, aging populations, low rates and dangerous radical international foes it seems a stretch to expect high investment returns in the near term. The backdrop is not a secret and thus, we argue, is probably discounted (i.e. priced into markets). Future changes or surprises will determine the possibilities of lower or higher market prices and returns. Higher terrorist concerns that lead to lower travel and entertainment spending globally could hurt investments. Conversely, higher global demand and growth could spur investment returns higher. China’s economic growth rate will continue to influence global inflation, trade flows and investor confidence. All of these issues are considered in our investment process. Our main goal is to allow our clients to meet their financial goals without taking on more or any less risk than appropriate. No one has “the” crystal ball this side of Heaven. A prudent, highly diversified approach that reflects your financial flexibility, time horizon, and risk profile will continue to serve clients well. “Fear not. Prepared, you will be.”

Call us with any questions.

Thank you for your continued trust in us.

Happy New Year!

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, CFP®, AAMS®