Forecasts

“I not only use the brains I have, but all I can borrow.” – Woodrow Wilson

Forecasts can be helpful in planning our lives and investing our money but can also lead to indecision, paralysis, missed opportunities, and gasp, even over packing. Weather forecasts are notorious for their error rate but who doesn’t check them before heading on a trip? Stock market forecasts are even less dependable and are often rife with “bomb throwers” who may or may not actually believe their dire predictions but are typically selling their latest book or some high priced alternative investment (gold, futures, or less liquid investments that “can’t lose”). Their headlines are typically attention grabbing; “What is your day after plan? a CIA economist reveals…”, “Why Every American Must Learn How to Hide Money From the U.S. Government”, “Dow Crosses Over 17,000 – …is about to crash…”, “Top Ten Signs of the Coming Stock Market Crash” (these headlines are “real” and recent). There is no shortage of those who prey on fear. One reason they sometimes find a receptive audience is that people generally place less value on investment gains than they place on losses (Prospect Theory¹). In other words, gains usually engender less positive emotions than losses engender negative ones. This can lead to irrational investment behavior such as taking less risk than is warranted, selling winning investments prematurely, or hanging on to losing investments for too long. Some investors fled the stock market in early 2009 and have missed the strong rebound since. Others stayed in but are five years older and may not want to repeat a down draft. After all, stock markets are near record highs! But so are earnings…

Second quarter revenues and earnings of S&P 500 companies rose at strong levels concomitant with the strong rebound in GDP. Year over year revenue growth for S&P 500 companies averaged 4.4% in the quarter ended June 30th while average earnings per share rose a strong 9.5%. The U.S. economy, as measured by GDP, rebounded nicely from the revised first quarter 2.1% contraction to a 4.6% expansion in the second quarter.

¹ Kahneman and Tversky, 1979 – Investopedia

Figure 1: GDP rebounded in the second quarter

New jobs creation allowed the unemployment rate to drop to 5.9% in September. While still high, the progress is directionally constructive. Job growth is unlikely to pressure wage gains and feed inflation until we approach full employment. In short, the economy is growing and unemployment is dropping. Nevertheless, volatility increased and stock markets diverged in the latest quarter. Volatility returned reflecting crosscurrents of geopolitical uncertainty leading to down markets in July and September with a strong month of August in between. The S&P 500 Index and the Dow Jones Industrial Average were almost flat for the third quarter ending September 30th (up 1% and 1.9% respectively). Smaller U.S. companies had negative returns. All major European stock markets (measured in US Dollars) dropped in the third quarter (between Switzerland’s -4% to Germany’s DAX -11%). Asian stocks also dropped with the Nikkei down 1% and the ASX 200 down 7%. Emerging markets were mixed returning (measured in USD) as much as 53% in Argentina, 27% in Dubai, and 16% in Shanghai while losses were recorded in Eastern Europe – Russia’s MICEX dropped 17%. Consequently, diversification away from U.S. large cap stocks detracted from performance this past quarter as shown in Table One.

Table 1: Third Quarter 2014 Returns, MSCI

Larger U.S. firms have largely refinanced their balance sheets, locked in historically low borrowing costs and pushed out maturities thereby lowering their financial risks. This, along with continued low interest rates may yet propel the stock markets to record highs amid multiple expansion before this bull market ends.

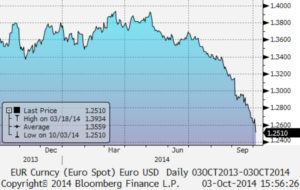

After holding up well over the last few years, the value of the EURO finally weakened relative to the US dollar in the third quarter dropping from 1.36 to 1.26 and continues to weaken in early October (as shown in Figure 2). The other side of the coin: a stronger dollar will likely shave some revenue and earnings from multinational, U.S. based firms later this year and into 2015. Conversely, a weaker EURO should help European corporations increase their foreign sales and earnings.

Figure 2 : EURO/USD weakening

Bonds rally again

Investors’ flight to quality rally continued in the third quarter. Geopolitical uncertainties in Eastern Europe and the Middle East were joined by Ebola concerns in Africa and pro-democracy protests in Hong Kong. The EURO’s aforementioned weakness may reflect European investors buying U.S. government bonds. The U.S. ten year note’s yield fell to 2.49% as of 9/30/14, well below the year end 2013’s 3.03% but off its low of 2.34% reached in late August, 2014. The end of the Federal Reserve’s quantitative easing in October may test the underlying market demand for treasuries and mortgages in the fourth quarter. However, low international bond rates will likely dampen any selling pressures and keep U.S. interest rates low longer than we had expected earlier this year. German 10 year BUNDS were yielding 0.93% and Japan’s 10 year note was just 0.52% as of 9/30/2014. Even Italy and Spain’s 10 year notes were yielding only 2.3% and 2.1%, respectively!

We continue to caution that the risk/reward in bonds remains unappealing to us. Returns are limited if things go right and the losses might well be significant when rates rise. Our portfolios will continue to favor shorter bond maturities complemented with higher yielding credit sensitive sectors (corporates, high yield loans & bonds, and preferred stocks).

Outlook

Our forecast for the fourth quarter of 2014 is for variable geopolitical headlines, partly nervous investors with occasional bouts of volatility. All kidding aside, we expect continued modest economic progress in the U.S. with solid S&P 500 earnings growth and modestly higher interest rates. That said, we are hedging our forecasts by keeping portfolios broadly diversified.

Call us with any question.

Thank you for allowing us to be on your team as we manage through conflicting forecasts.

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, AAMS®