Triple Crown

“A nickel ain’t worth a dime anymore.”

– Yogi Berra

Justify became the thirteenth Triple Crown winner on June 9th. After winning on muddy tracks at The Kentucky Derby and The Preakness Stakes, Justify claimed the Belmont Stakes, widening his lead as he approached the finish line. The U.S. corporate earnings recovery over the last ten years has also been muddy, improving, and is accelerating late in its race; justifying investor confidence in current and prospective valuations.

Earnings, Real Estate, and Unemployment; An Investment Triple Crown?

U.S. firms’ earnings’ growth, solid real estate markets, and record-low unemployment are constructive to the investment landscape. S&P 500 Index companies earnings rose over 23% year over year in 2018’s first quarter. Some investors seemed wary that earnings growth this late into an expansion cycle cannot last. They may yet be surprised as lower tax rates underpin near term strength. S&P 500 Index valuations are reasonable as estimated price to earnings (P/E) twelve months out are below 16 times. Forward earnings multiples relative to trailing P/E have widened as shown in Figure One.

Figure One: S&P 500 Index Trailing and Forward Price/Earnings ratio

Residential real estate prices were expected to moderate post the new tax rules limiting SALT (State and Local Tax Deductions) but have yet to weaken visibly. In April, national average home prices were up 6.4% year over year.[1] Mortgage applications have declined, reflecting lower refinancing activity and moderately higher mortgage rates. Employment continues to improve with unemployment estimated at 3.8%.

U.S. Stocks Claw Back

For the quarter ended June 30th, the S&P 500 Index rose 2.9%, about 5.4% below its record high reached on 1/26/2018. Year-to-date it is up 1.7%. Other than the tech-heavy NASDAQ, the S&P 500 is the only major global stock index that is up this year when measured in U.S. dollars.

Bonds Slump, Then Steady

Global bond investors are increasingly wary of how Central Banks will reduce accommodative policies and excess liquidity without tipping their economies into the next recession. The bond market benchmark, the Bloomberg Barclays Aggregate Index is down 1.6% so far this year and would lose about 2.5% more if rates rise another 1% in 2018.

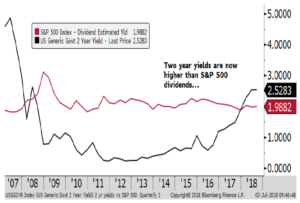

The Federal Reserve, as expected, increased the targeted discount rate by 0.25% in March and again in June to 1.75-2.0%. Importantly, they now anticipate raising it twice more this year and three to four times next year. The ten-year bond yield reached 3.1% before rallying back to close the quarter at 2.86%, only thirty basis points above the two-year note. Recall that a zero or inverted differential typically denotes recession – something we are hard-pressed to see before 2020. Cash rates are now yielding about 1.4%, up from near zero a year ago. The European Central Bank officially lowered its growth expectations for the year and announced that it will end its current ultra-easy monetary policy later this year but doesn’t plan to raise its official rate until mid-2019. The U.S. two-year treasury note is now yielding about 0.55% more than the dividend yield of the S&P 500 Index as depicted below.

Figure Two: Treasury two-year notes vs. S&P 500 Index Dividend Yields

Economic Fundamentals Remain Constructive

U.S. GDP (Gross Domestic Product) grew at 2.0% in the first quarter of 2018 and is expected to exceed 3% for the quarter ended June 30th (some estimates are near 4%). Uncertainty over recently imposed and prospectively threatened tariffs by the Trump administration and the possible retaliation from affected trading partners may act to decelerate global growth and/or increase inflation. Speaking of inflation, it has finally started to climb from very low levels in the U.S. and in Europe but is still a non-factor in Japan as shown in Figure Three.

Figure Three: Inflation: U.S., Europe, Japan

Outlook

A stronger U.S. dollar likely dampened U.S. companies’ earnings growth in the quarter ended June 30th but year over year earnings improvements are still expected to surpass 15% for the S&P 500 Index. A stable dollar should allow earnings growth to accelerate in the second half before moderating in 2019.

Political uncertainties continue to spread; a populist government coalition emerged from recent Italian elections and a left-wing President was elected in Mexico. Trade and tariff uncertainties will continue to weigh on investor sentiment but we are encouraged by valuations and constructive on near term economic growth.

On balance we are maintaining moderate risk in portfolios (midpoint of stock exposure and lower than index duration). Diversification, diligence, and patience will likely be rewarded.

Thank you for your continued trust in the Regency team. We are committed to working with you over the long term to help you reach your financial goals through collaboration, teamwork, and transparency – our “triple crown”. Please call us to share any thoughts, concerns, or insights.

Please call us to share any thoughts, concerns, or insights!

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, CFP®, AAMS®

[1 ] S &P/Case-Shiller U.S. National Home Price Index tracks the value of single-family housing within the United States. The index is a composite of single-family home price indices for the nine U.S. Census divisions.

Click here to download a printable PDF copy of this newsletter

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.