The British are leaving, the British are leaving…

“Goodness is the only investment that never fails.”

– Henry David Thoreau

Geopolitics can sometimes present a complex mirror of societal challenges and pressures. The June 23rd referendum vote in the United Kingdom to Leave the European Union (EU) reflects that country’s collective concern that liberal immigration was no longer desired. Growing nationalistic sentiment is not limited to the UK and if unchecked may further hinder travel, trade, and investment flows. Together, they could dampen already low global economic growth. One of the classic constants in the markets are that investors dislike uncertainty. Good thing that U.S. politics are without controversy!

Markets immediately reacted strongly to Brexit as they wrestled to ascertain if it marked the begin of a systemic wave or if it was one time event: Asian exchanges fell 1-3%, European stock markets dropped 6-7%, and U.S. stocks dropped 3-4% on June 24th. The US Dollar rose 11% vs. the British Pound Sterling, 3% vs. the Euro, and 4% vs. the Yen. Financial companies and banks, especially those in Europe, were hardest hit with some down 25% or more. After further weakness in Europe and the U.S. on Monday, June 27th, stock markets rebounded through month end. The S&P 500 index rose 1.9% in the second quarter and is up 2.7% year to date through June 30th. European stock markets dropped 5.9% or more in US dollar terms and 8% or more in Euros, over the six months ended June 30th. Gold spiked higher closing June 30th at $1,322/oz; up 24.6% in the first half of 2016. Consensus opinion indicates a wary view that the U.K. will likely (but not definitively) move to leave the EU within 2 to 2 ½ years without dour consequences to itself or the EU.

Our missive to clients on June 27th referenced details of the Brexit vote highlighting the near term uncertainty and possible ramifications to the U.K. and the Eurozone.

“In the intermediate-term, much work is ahead for the British. Trade agreements, treaties, and many regulations must be renegotiated and reworked. The U.K. economy and markets should experience significant volatility as the government seeks to reestablish its global relationships…

Long-term, the future of the EU is much more in doubt than it was a few days ago. Whether the British know it or not, they are being watched very closely by other members of the EU to see how they weather the coming months and years…, they could be paving the way for other countries to leave as well. Importantly, those countries sharing the Euro currency would have a much harder time of leaving the EU.”

Minimal short term economic activity in the U.K. makes a recession highly likely there and could reduce 2016’s European growth by 0.1 – 0.3% (PIMCO’s estimate).

U.S. remains steady

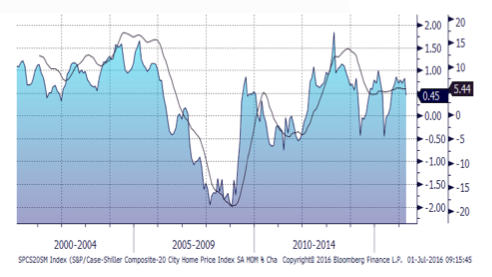

Domestically, employment and housing remain steady. Unemployment remains low at 4.7%. Average home prices rose 5.4% year over year in April as seen in Figure One.

Figure One: U.S. Housing Index

Rental markets remain strong and household demand is building as the pace of new construction has lagged new household formations. The latent purchasing power of Millennials (ages 18-36) will eventually kick in. This group, 77 million strong, is 40% larger than the baby boomers. When they start to buy homes to a greater extent, economic growth could increase meaningfully.

Bond yields are likely to remain low

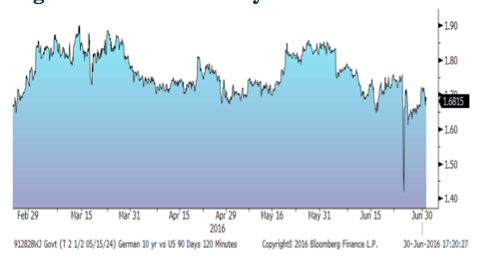

Perhaps the most likely impact from all of this is lower nominal and real (net of inflation) yields in developed markets for longer than anticipated. U.S. ten year yields dropped from 1.75% June 23rd to close at 1.47% on June 30. German 10 year Bunds closed the quarter at -0.13%. Figure Two highlights the yield advance that investors can get from U.S. ten year notes compared to Germany’s.

Figure Two: German 10 year Bund Yield vs. US 10 year Note, 2016

Last quarter we noted how savers and retirees faced negative real rates of return in domestic government bonds. We now think that this will continue in the near term and bond returns over the intermediate term could likely be anemic. The possibility of the next recession is now higher though still low in our opinion. The next FED rate hike is now forecast by some to be delayed until December, 2018!

Nevertheless, we continue to be wary of chasing (modest) yields. At current prices, owners could lose 18% on 10 year US Treasuries if yields rise 100 basis points (1.0%) in a year and 24% if yields rise 2%. Much has to occur (sustained economic growth, higher inflation, lower political uncertainty, etc.) before this scenario transpires but we dislike the skew in possible returns when we can make 1.5% or a little more if things go right (stable to lower rates) or lose 18% or more if they don’t.

Valuations

Price/earnings multiples for the S&P 500 Index closed June at 17.3 times (x) current earnings and 15.8x next twelve months’ estimated earnings – in line with long term averages but not cheap. Any earnings growth acceleration from higher demand along with low long-term interest rates could yet lead to a rebound in stock prices. Conversely, meaningful economic deceleration and more investment outflows could pressure equities further. The S&P 500 Index’s 2.18% dividend yield continues to be attractive relative to short-term and intermediate-term bonds yields.

Outlook

Volatility will remain elevated as we get closer to U.S. elections. Rates will stay low, even if the Fed surprises markets in raising its discount rate later this year. Having just celebrated our country’s independence, let’s hope the British don’t regret their path towards eco-political independence.

Call us with any questions.

Happy Summer!

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, CFP®, AAMS®