The “What’s Next?” Market

“Yesterday don’t matter if it’s gone”

– Keith Richards, “Ruby Tuesday”

Although the Rolling Stones probably didn’t write Ruby Tuesday as an allusion to the financial markets, this perfectly captured lyric can summarize a key and distinct theme of the broad capital markets: past performance is no guarantee of future results. This disclaimer is plastered across all financial media and literature. The analogy is an important one, as the parallel can be made to highlight the recent success of certain companies and sectors in the market. With these successes have come increased investor appetite, substantial flows into these categories, lofty valuations, pockets of euphoria and a wall of uncertainty about potential risks abound. While the remarkable success of a handful of companies has been great, what does it (yesterday) matter if it’s gone (tomorrow)? How should investors be positioned given yesterday’s success?

Markets

The global capital markets continued their rally in the third quarter, recovering significant ground from the April lows post-Liberation Day which sent shockwaves through the broader markets. The broad-based rally in risk assets saw global equities climb, with the S&P 500 nearing all-time highs. The rally was not uniform, however, as certain sectors significantly outperformed. Large-cap US growth stocks, particularly those in IT and Communication Services, led the charge. Analysts continue to point to the AI theme as a key driver, as companies have begun to show how AI adoption is positively impacting their bottom line. In contrast, sectors such as Healthcare and Energy lagged. For the quarter, the S&P 500 ended up +8.24% while the tech-heavy NASDAQ Composite ended up +12.16%. Market leadership has broadened beyond just the mega-cap technology stocks, with both cyclical and defensive sectors contributing to gains. Overseas, the rally in international equities represented by the MSCI ACWI ex-US Index returned +6.18% for the quarter on the heels of fiscal stimulus in Germany, a weaker US Dollar, and interest rate cuts by the European Central Bank all contributing to strength in the broader markets. The Bloomberg Aggregate Bond Index returned +2.07%. The Federal Reserve delivered a 0.25% rate cut in September and penciled in two more reductions this year as bond market participants have been grappling with a mix of slowing growth, persistent inflation, weakness in the labor market and rising budget deficits, with the 10-year Treasury yield fluctuating between 4.00% and 4.50% before ending the quarter at 4.13%. West Texas Intermediate (WTI) Crude oil ended the quarter down -4.7% to $62.37 per barrel while gold continued its climb, up +15.58% to $3,859 per ounce.

Yesterday Don’t Matter if it’s Gone – what about tomorrow’s opportunities?

The AI theme continues to dominate the landscape. Companies in the Bloomberg Magnificent 7 Index (“Mag 7”)1 have reported significant growth in earnings where the adoption of AI is credited with positively influencing revenues and net earnings. At the same time, this concentrated growth in a few mega-cap names has led to elevated valuations not only in certain market segments, but on the S&P 500 Index as a whole. Our concern is that these multiples may be inconsistent with an economy that is otherwise positioned for slowing or moderate growth. AI’s influence is seen as a crucial tailwind for productivity, yet also one where the risks of a potential slowdown in company capital expenditures could have severe implications on broader market sentiment.

So where are tomorrow’s opportunities? Should investors continue to ride the AI wave where a very slim margin of error could send sharp selloffs in these companies and the broader markets as a whole? Our investment view continues to be one of prudent fundamental analysis and identifying quality companies trading at a discount to their intrinsic value.

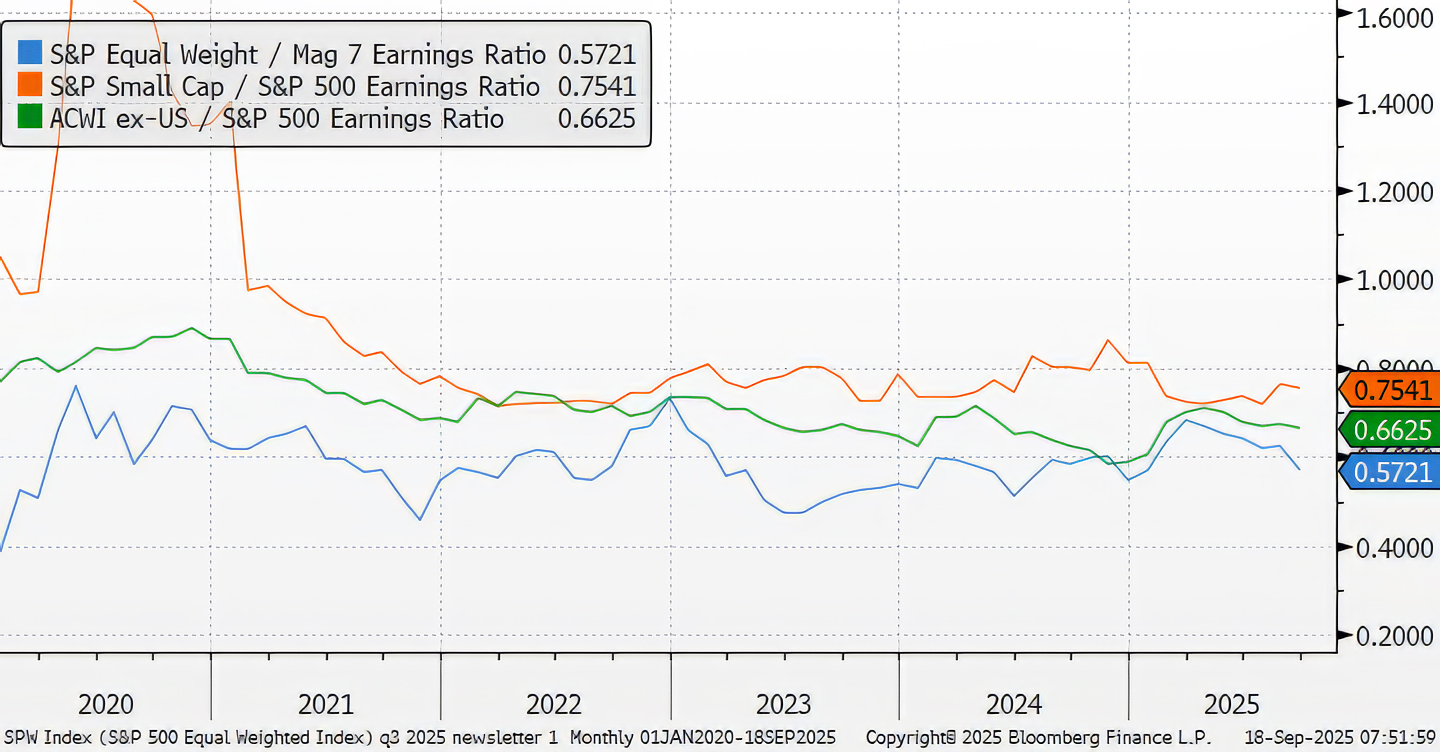

Figure 1 shows three distinct ratios of earnings relative to other indices. In blue, we take the forward price/earnings ratio of the Mag 7 Index and compare it to that of an equal-weighted index of all S&P 500 companies. The blue line shows that an equal weight index of the 500 largest US companies trades at about a 43% discount to that of its 7 mega-cap counterparts. To further illustrate the disparity in valuations, the orange line highlights the discount in earnings-generating US small cap companies relative to the S&P 500 Index. At a 25% discount to the S&P 500 Index, opportunities to own quality companies at attractive valuations offer compelling risk/reward characteristics in the small cap universe, particularly as a rate-cutting environment is seen as a tailwind to smaller companies. Finally, overseas companies are trading at a 34% discount to that of the S&P 500, as noted in green.

Figure One: Relative P/E Ratios Across Indices

Those making the argument for investing in AI stocks despite the high valuations often point to the transformative growth, even if an investor must pay a premium to own such stocks. While we believe earnings in mega-cap tech names can continue their above-market growth trajectory, the price is rich at these levels.

Outlook and Investment Strategy

In an environment dominated by narratives of concentration risk, our investment strategy remains grounded in a disciplined, selective approach. If the Rolling Stones’ lyric “yesterday don’t matter if it’s gone” serves as a metaphor, we believe past performance in certain sectors is not indicative of future results, but rather opportunities abound in the broader market.

Our focus remains on identifying and investing in high-quality companies that are trading at a discount relative to their intrinsic value, regardless of their size or geographic location. This approach has served our clients well by seeking to capture opportunities in areas such as international equities and other large and mid-cap names in addition to some included in the Magnificent 7.

We believe the US economy remains on solid footing, making the probability of a recession relatively low. We do, however, expect slower growth ahead and are closely monitoring the labor market, which shows some signs of softening in hiring, as well as consumer spending, where pockets of stress are emerging in lower-income households. The recent tariff uncertainty has been skillfully navigated by companies, but we anticipate it will contribute to some inflationary pressure in specific sectors. While we are not immune to these crosscurrents, we are confident our strategic, diversified approach is well-suited to navigate the quarters ahead.

As always, we thank you for allowing us to be on your financial team and for referring us to those you care about the most.

Click here to download printable version of this newsletter.

[1] The “Magnificent 7” is a group of seven of the largest and most influential technology companies in the US stock market. The companies are GOOGL, AMZN, AAPL, META, MSFT, NVDA and TSLA and, combined, represent over 34% of the S&P 500’s weighting.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.