Generosity

“Charity begins at home but should not end there.”

– Thomas Fuller

Generosity is a very personal thing within a person or family’s financial picture. How much we should save to support our lifestyle, retirement, health care, emergencies, etc. is a critical part of what many clients consider alongside their Regency team as they plan their finances. We also encourage all clients to consider how philanthropic they want to be. Some have generous charitable intent upon death. Others are generous while they live, and some do both. As we near the end of 2024 it is also important to consider tax efficiencies that charitable giving might provide. Call us for insights in this regard.

Markets

Ahead of the upcoming Presidential election, U.S. stock and bond markets were volatile in the quarter ended September 30th but investors were, on balance, in a risk-on mood. In both August and September, stock markets sold off early in the month only to quickly bounce back. Increasing conviction that the Federal Reserve Bank would lower interest rates in September, followed by a greater than expected rate cut, helped buyers put excess cash to work. Better than expected second quarter earnings also helped.

The S&P 500 Index rose to record highs, up 5.4% in the quarter. Importantly, the sleepier Dow Jones Industrial Average rose 8.2%. For the year-to-date (YTD), they are up 20.8% and 12.3%, respectively. The tech heavy Nasdaq Composite index rose “just” 2.6% but is up 21.2% YTD. Investors rotated out of the red-hot Artificial Intelligence and other fast-growing companies, expanding the latest bull run in stocks. For the quarter, Mid and Small-cap indices1 also moved higher by 6.6% and 9.7%, respectively. European and Asian stock market returns were varied, rising 5 to 20% for the third quarter ended September 30th.

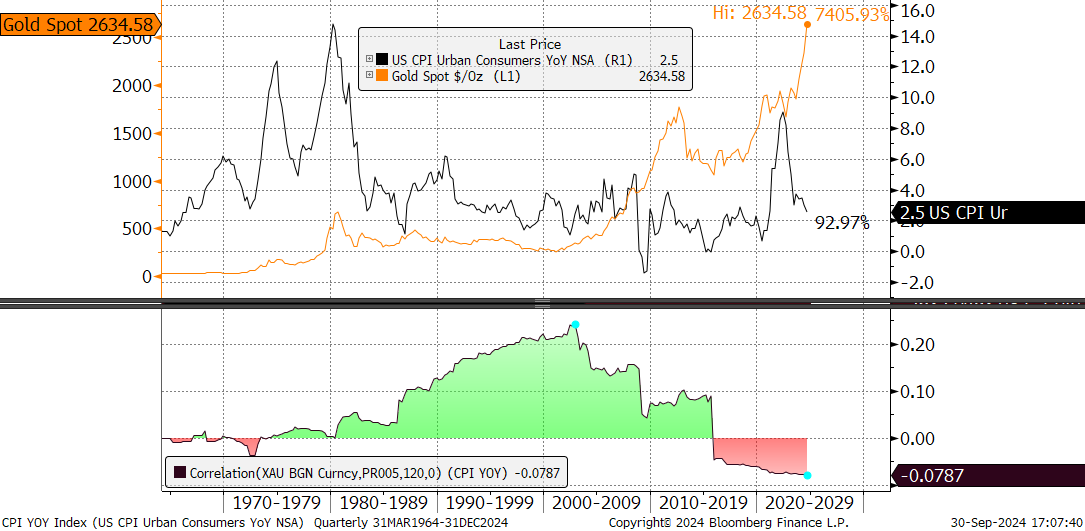

Expectations for Fed rate cuts were exceeded in September propelling bond yields lower as prices were bid higher. The Bloomberg U.S. Aggregate Bond Index (AGG)2 rose 5.8% for the quarter and is now up 4.5% YTD. With a 4.2% yield as of 9/30/2024 it is looking less attractive than three months ago and may fully discount FED expectations of a 150-basis points rate cut by the end of 2025. Crude Oil (WTI Cushing Crude) was off 18% while Gold rose 13%. Speaking of gold, it is in record territory with the latest spike reflecting renewed growth in M2 (a broad measure of the U.S. money supply) and lower inflation. Usually seen as an inflationary hedge by many, it has a low correlation to inflation (-0.08). It is also arguably much more speculative than stocks.

Figure One: Gold is glittering

Source: RWM, Bloomberg L.P.

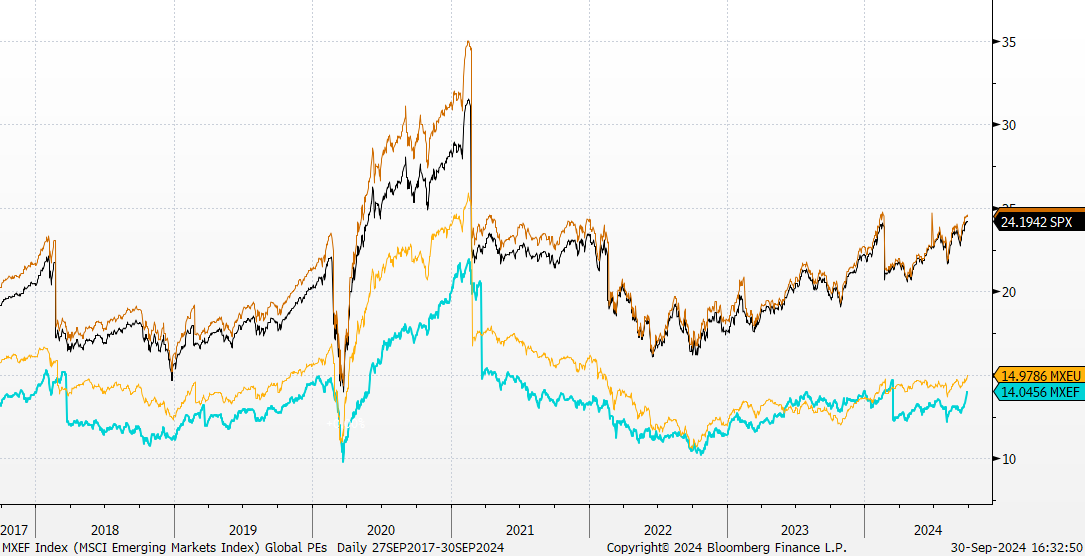

Figure Two: S&P 500 and EURO STOXX50 Index P/E and forward P/E.

Source: RWM, Bloomberg L.P.

Valuations

U.S. stocks (as measured by the S&P 500 Index) continue to trade at a significant premium to their European counterparts. In part this reflects our leadership in technology and communications but may also reflect home bias. Bond yields dropped in most major markets in the three months ended September 30th. The U.S. 10-year yield dropped to 3.61% when the FED cut rates but drifted higher to 3.79% by the end of September; meaningfully lower than the 4.4% yield a quarter ago. Two-year note yields dropped much more, ending September at 3.64%, 1.1% lower than in June. The yield curve has moved from 26 months of inversion (where two-year T-bills yielded more than the ten-year Treasury bond) to a more normal positive slope (short-term rates lower than long-term rates). Globally, rates were also lower over the last three months. The U.S. Dollar rose against most major currencies as U.S. rates remain higher than most developed countries.

Fundamentals

Higher stock markets are contributing to consumer confidence, but consumer and commercial delinquencies are trending up modestly. Lower interest rates should awaken a moribund housing market where first-time home buyers found higher prices and higher mortgage rates hard to digest. Modestly lower inflation should also help consumer spending but may be offset by modestly higher unemployment rates. Corporate liquidity and credit availability remain ample and lower borrowing costs may help smaller firms.

Outlook and Investment Strategy

Investors anticipate that the FED will be successful in generating a soft landing where inflation is modest and economic growth remains positive. A surprise recession would likely be bullish for Treasury yields but bearish for stocks while higher inflation may hurt both stocks and bonds. As we near a U.S. Presidential election, we anticipate that stock market volatility may rise and create further investment opportunities. Neither political party in the U.S. even hints at fiscal responsibility so the yield curve may steepen further from current levels. Geopolitical risk remain elevated and could affect energy prices, rates, and economic growth if they worsen.

Our individual stock buy list that represents approximately half of the U.S. stocks in our client portfolios have an average price to earnings ratio (P/E) of 19.3x. Discipline and diversification with a quality, free cash flow orientation should continue to serve us well.

As we look back on a strong period of investment returns, let us continue to be generous to others including those that have suffered from domestic storms, people caught in violent international conflicts, and all others that are challenged by difficulties in life.

Thank you for allowing us to be on your financial team and for referring us to those you care about most.

Click here to download printable version of this newsletter.

[1] The S&P 400 Mid-Cap Index and the S&P 600 Small Cap Index

[2] The “AGG” is a commonly used measure of US$ investment grade government, mortgage, and corporate bonds.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.