Perfection

“If I waited for perfection, I would never write a word.”

– Margaret Atwood

Perfection is elusive. We all strive to use our God given talents as best we can in all we do but we are never perfect. Markets are also imperfect though they are reputed to be efficient. Some argue that no one can beat the major stock market indices as most mutual funds trail their benchmarks in most years. But this obscures the fact that numerous fund managers do outperform their indices, some more often than others. It is also a fallacy that investing via low cost, passive indexing is the best and least risky strategy. Last quarter we highlighted how investors ran up the prices of some large cap stocks tied to Artificial Intelligence (AI). These stocks far outperformed the S&P 500 index in the first half of this year. The strong move reminded us of the late 1990’s when the internet was relatively new and high-tech firm prices were up strongly for several consecutive years before the bubble burst. History may not repeat but it often rhymes.

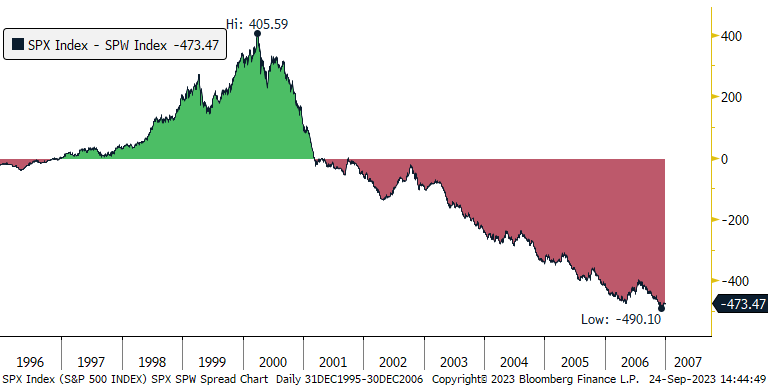

Figure One: Can anyone beat the S&P 500? S&P 500 Index vs. SPW Index (equal weight index) 1995-2004

Source: RWM, Bloomberg L.P.

Figure One depicts how the S&P 500 index rose over 20% annually from 1995-1999, far outpacing its equally weighted version. The market peaked in late 1999 and the bubble burst in 2000. From 2000-2006 the equally weighted version far outpaced the cap weighted S&P 500. If fact, the equally weighted version beat the basic index by a wide margin from 1995-2006. Many of the best performing stocks that investors had paid very high multiples for (price to earnings) crashed and burned after rising in an almost hyperbolic fashion during their go-go years.

Will AI stocks continue to grow and outperform before correcting sharply downward? AI is an exciting development that holds much promise for boosting efficiencies across many, if not all, industries. Will it mature commercial in short order or is its adoption and results several years away? Investing in stocks like Nvidia (NVDA) has worked well and may continue to be a winning bet but seems to us to be highly speculative1. We prefer to invest in leading companies that are more reasonably priced, have proven strong cash flow, and low debt. They might not double or triple in a year or two but have historically done well through business cycles.

In the just ended quarter, the S&P 500 Index dropped 3.3% as the previously out of favor energy sector rallied and the IT sector gave up some of its earlier gains. The tech-heavy NASDAQ dropped 4.1% but is still 26% higher year-to-date. International developed markets lagged U.S. stocks in the third quarter ended 9/30 as they shed 3-8% but have been competitive year-to-date. Bond yields remained volatile, and the Bloomberg U.S. Aggregate Bond Index lost 3.2% over the last three months and is now down 1.2% YTD. It now sports a 5.39% yield. Gold dropped 3.8% last quarter and is flat in 2023. Crude Oil (WTI Cushing Crude) jumped 29% and is now up 13.4% YTD as of 9/30/23.

Figure Two: S&P 500 Sector returns for Q3 ended 9/30/23.

Source: RWM, Bloomberg L.P.

Valuations

U.S. stocks (as measured by the S&P 500) are trading at average prices of 19.5 times (x) trailing earnings and 18.6x forward earnings, neither are historically cheap. Both are misleading and distorted by tech stocks. The S&P 500 Information Technology Sector trades at 28.2x trailing P/E. Software firms trade at 31x. In contrast GOOGL, AVGO, JPM, and BAC trade at 26.5x, 25x, 9.2x, and 7.7x, respectively.

Bond investors have shifted their expectations that the FED would lower rates in late 2023 and are now looking for rate cuts in 2024 after further possible rate hikes this year. Yields on two-year and ten-year Treasury notes have risen but may be close to peaking. The two-year yield historically drops along with Fed Funds once the FED lowers rates (in a recession) while bond investors may be attracted to a ten-year yield approaching 4.6%. Its yield has also dropped in prior recessionary periods.

Investment Strategy

We follow a balanced and disciplined approach to investing. Our individual equity investments include strong companies that trade at attractive prices relative to their inherent worth. Conversely, we won’t chase after the latest hyped-up firm or sector that is highly speculative. Our bond investments reflect the safety and value found in short term Treasuries offering 5% or more returns and complemented by investment grade corporate and municipal bonds and some higher yielding preferred stocks.

Outlook

The Fed may raise rates once or twice more before year-end as it combats inflation. While Covid-related government stimulus and zero official interest rates of recent years obfuscate fundamental monetary frameworks, a hawkish Fed (one that is raising rates) is likely to become neutral as inflation abates concurrent with lower economic growth. The highly expected recession may yet arrive in 2024 but we continue to expect it to be shallow and short lived. Technological advances should result in higher corporate productivity that may offset some demand slippage. Unemployment would rise in a recession but may remain below average.

Publicly traded cyclical and non-tech businesses are on average trading much cheaper than leading tech-oriented stocks. These may perform relatively well through the end of this cycle. We will continue aligning your financial plans with appropriately risked portfolios. While never perfect, we will continue to reflect our best thinking in constructing your portfolios.

Thank You for allowing us to be on your financial team and for referring us to those you care about most.

Click here to download printable version of this newsletter.

1 NVDA was trading at a P/E of almost 100x on 9/30/23.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.