Slower Growth

“The trees that are slow to grow bear the best fruit.”

– Jean Baptiste Poquelin “Moliere”

Economic expansions do not die of old age, as someone once said, they are murdered by the FED.1 The FED was slow to realize that 2021’s inflation was not transitory and pivoted to a hawkish stance in addressing inflation by raising interest rates by an aggressive 3% from March to September. Higher rates historically slow economic activity, but with a lag of 9-18 months. Overabundant COVID-era government stimulus will likely delay the pain as excess liquidity drains out of the system. In contrast to trees, slower economic growth does not bear better fruit in the near term but can at times produce sour fruit (recession). Many developed countries may experience recession2 within the next year or two. Fortunately, we enter this slowdown with strong employment and high liquidity. The strong labor picture, solid real estate markets, higher (but still below average) interest rates, and strong banking, corporate, and consumer balance sheets should delay and help cushion the economic pain. The strong fundamental backdrop may also result in shorter and shallower recessions than the average one. But how adjustments evolve are hard to predict.

Markets

After the S&P 500 Index entered a bear market (defined as 20% or more lower than its high) in the first half of 2022, declining 20.7% through June 30th, it rebounded 9.1% in July before weakening in August and September. The stock market sell-off was accompanied by lower bond prices as both stocks and bonds reacted poorly to the FED’s more aggressive posture in September.

The FED’s more hawkish tone and faster pace of anticipated rate hikes led to a 4.2% pullback in August and a further 9.3% drop in September resulting in a -5.3% drop in the S&P 500 Index for the quarter ended September 30th. Most European markets dropped over 10% this past quarter. Most Asian stock markets also dropped but the dispersion was broader, down 6-22%. Bond prices also dove (and yields rose) resulting in a drop in the Bloomberg US Aggregate Bond Index of 4.8% in the quarter ended 9/30/22. This index is down a record 14.6% year-to-date through 9/30th, The only good news is that it now offers a 4.75% yield, up from 1.75% nine months ago.

Valuations

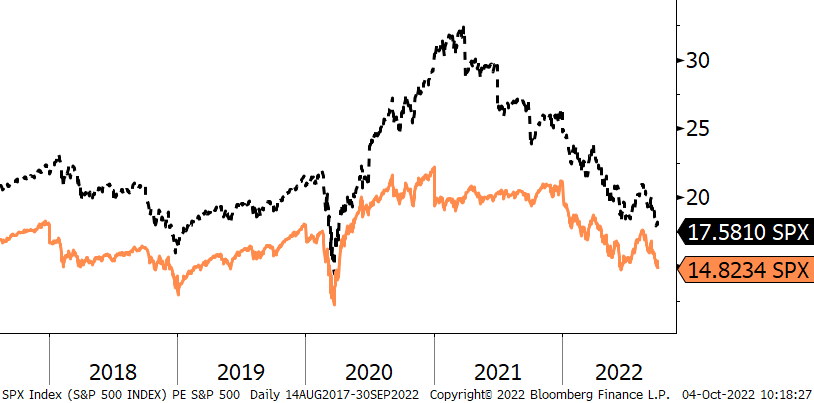

Lower valuations render most indices near historical averages. U.S. stocks as measured by the S&P 500 are trading at P/Es below 18 times trailing earnings (—dotted line) and below 15x forward price/earnings (- solid line), as depicted in Figure One. Volatility has been high and is likely to continue elevated as the year unfolds unless inflation moderates.

Figure One: S&P 500 Index price/earnings multiples

U.S. interest rates rose across the maturity spectrum with the two-year note and the ten-year bond yielding 4.2% and 3.8%, respectively. U.S. bond yields may rise further as FED hikes progress, but their pace and scope will depend on how inflation data progresses. Inflation is running a hot 8.3% but some components are likely to contribute less to inflationary measures this quarter. The rate of increases for gasoline may have peaked but smanyome service-related prices are rising.

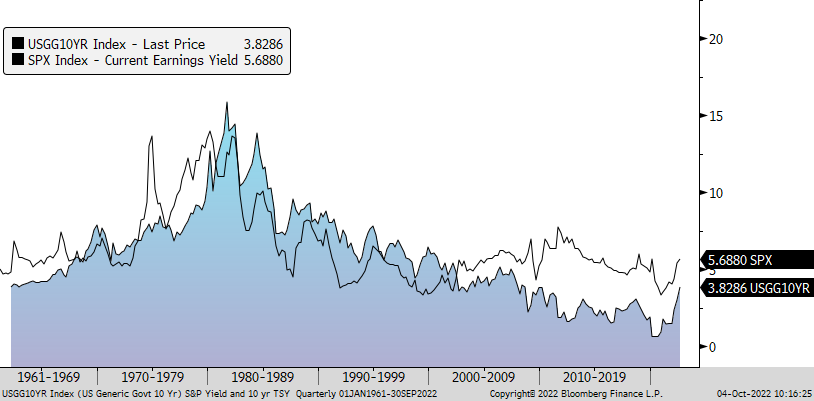

The inherent yield of S&P 500 stocks, measured by Earnings/Price (if each stock paid out all earnings as dividends) and the U.S. Treasury’s 10-year yield have both risen, offering better long-term values.

Figure Two: Comparison of Current Yields; S&P 500 earnings yields vs. 10-year T bonds

The U.S. dollar has strengthened materially against most major currencies signaling varying levels of stress and low investor confidence abroad. Its strength may have precluded gold price returns from performing better in an otherwise higher inflationary environment.

Investment Strategy

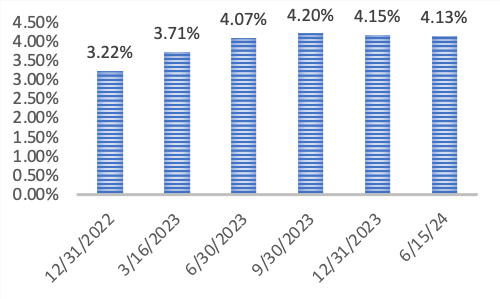

While the next recession may be a year or so away, stocks can still record positive returns before and through the recession if inflation expectations moderate and earnings stabilize. The market already seems to be pricing an imminent and more severe recession than we expect. We are therefore maintaining a neutral, diversified, and partly hedged risk allocation. Regency has de-risked fixed income exposures by eliminating high yield positions. Importantly, the bond market selloff has created an opportunity to take advantage of yields in the front end. We have added to our “mini-ladder” in portfolios – that allows us to earn close to 4% within the next two years with no loss potential if we hold these to maturity.

Figure Three: U.S. Treasury Mini-Ladder

Outlook

Losses are painful and it is hard, but smart, to remain patient and have a long-term perspective. Markets will continue to react to economic and geopolitical developments and volatility may not abate until inflation decreases. Historically, stock prices always rebound – sometimes quickly (2020) and other times more slowly (2009-2013).

Our goal-based investment process should allow our clients to hang in there during these tough times and avoid selling into weakness. Thank you for allowing our team to assist you in your financial journey. May slow growth, over time, bear much fruit in our portfolios.

Your Regency team remains available for in person meetings, telephonic and/or video calls to discuss any issues and questions.

Click here to download printable version of this newsletter.

1 FED=Federal Reserve Board

2 A recession is confirmed by NBER, the National Bureau of Economic Research as involving significant declines in economic activity spread across sectors and lasting more than a few months.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.