Growing Pains

“A good head and a good heart are always a formidable combination.”

– Nelson Rolihlahla Mandela

Earnings posted by S&P 500 companies rebounded strongly in the second quarter of 2021 as economies reopened and low base effects made for easy comparisons. The results, while highly anticipated, were still welcome. Less welcome are lingering COVID-19 virus concerns and political rhetoric. We don’t foresee a return to economic lockdowns because of virus variants but also accept that the full re-opening is likely slower and later than expected. We also expect that the U.S. debt ceiling will be raised, and default will be averted despite ongoing political discord in Washington D.C.

Fundamentals and Markets

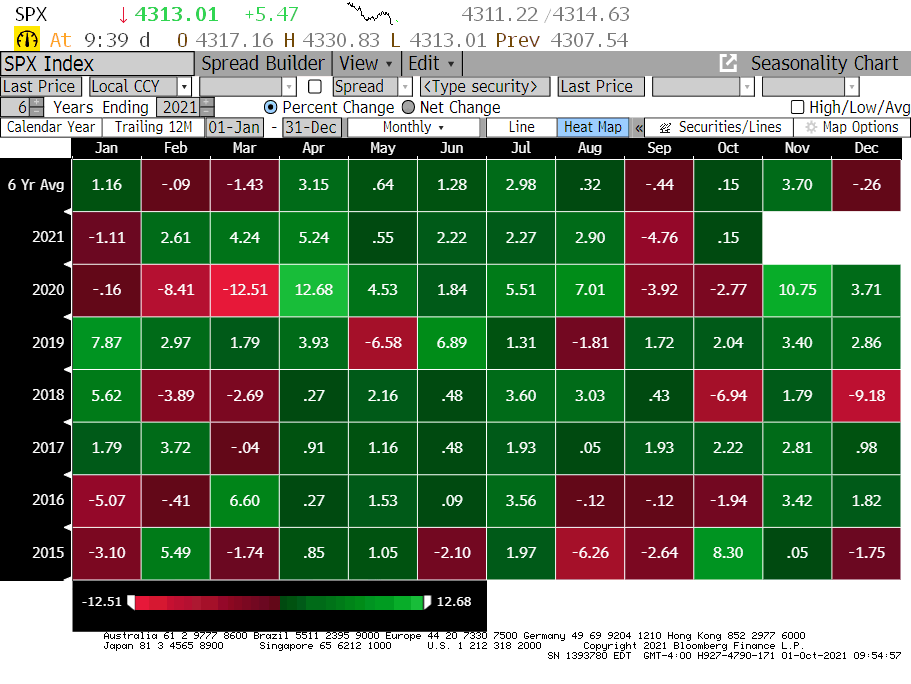

Economic progress may temporarily decelerate but virus variants may be close to cresting and the economy will likely remain open. Job growth seems sustainable, stock valuations reasonable, and bond yields remain pressured. As reflected in Figure One, U.S. stocks finally sold off in September (-4.7%) after seven consecutive months of positive returns.

Figure One: S&P 500 Index Monthly Returns

In the quarter ended 9/30/2021, the S&P 500 rose 0.2%, European developed equity markets shed 2-4%, and Asian stock indices were fractionally lower. After falling in the second quarter, bond yields rose with U.S. ten-year Treasury yields at 1.49% at 9/30/21, up from 1.44% at 6/30/21. Year-to-date (YTD), the S&P 500 is up 14.7%, besting all other developed markets equity indices save for Canada’s. The Bloomberg U.S. Aggregate Bond Index dropped 0.87% in September and is down 1.55% YTD.

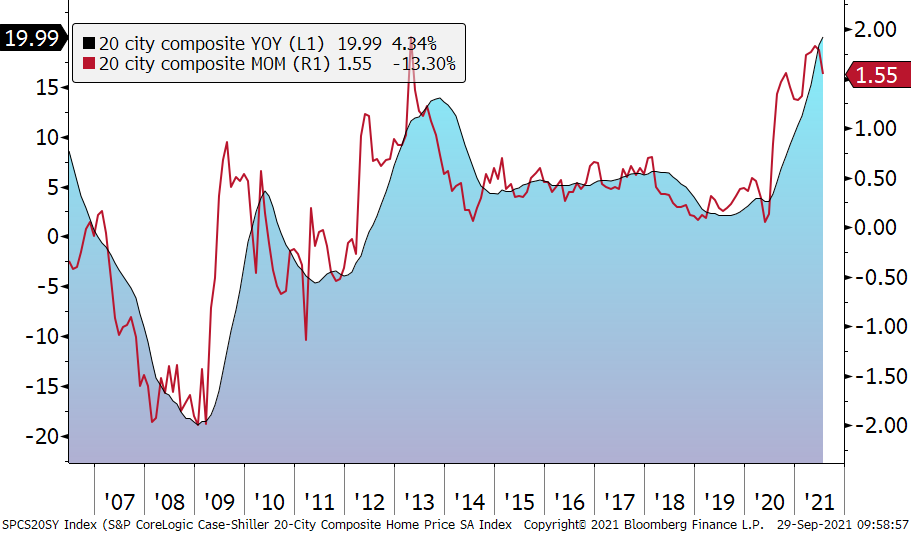

The pace of economic growth is likely to decelerate in the remainder of 2021 and all of 2022 as we manage through supply chain bottlenecks, higher energy and transportation costs. Unemployment should fall further from June’s 5.2% as businesses slowly fill vacancies. Real estate prices have jumped and first time home buyers are finding it harder to buy as they increasingly compete against commuters that are relocating into and working from suburbia.

Figure Two: U.S. Housing Price Gains

Figure Two depicts the rise in average home prices; up almost 20% in July from a year ago – the highest price change in thirty years! Pending home sales are also rising (up 8% in August).

Investment Strategy

We have modestly increased our risk posture to slightly above neutral for our diversified stock portfolios and are maintaining a marginally shorter duration (a measure of interest rate sensitivity) in bonds. Valuations are not cheap in either stocks (25.8 times price/earnings) or bonds (negative real yields). However, we still find relative value in stocks of companies with solid balance sheets, strong cash flows, and low leverage. International developed markets equity returns are lagging U.S. counterparts reflecting lower inoculation rates and spreading Delta COVID variants. Collectively, these stocks appear relatively attractive and should rally as their economies re-open later this year. The potential for a weaker U.S. Dollar (given America’s high debt levels) would also help international equity returns.

Bonds still offer little value in our opinion, so we are maintaining a lower sensitivity to interest rates and resisting the temptation to reach for yield in a low-rate environment. Investment grade U.S. bonds are collectively yielding an average of just 1.56% as measured by the Bloomberg U.S. Aggregate Bond Index.

Outlook

Ongoing headlines surrounding China Evergrande Group’s high indebtedness as China’s second largest real estate builder are causing some concerns about the country’s economic growth rate slowing. We do not anticipate any substantive negative repercussions from any default or restructure of the company. Political rhetoric in Washington D.C. about the U.S. debt ceiling will continue through early December but are most likely to be resolved without a default.

Investors remember historically sharp drawdowns in October, 2008 and 2018, dropping 17% and 7%, respectively. While stocks, as measured by the S&P 500 Index, have declined in three of the last five Octobers, index returns rose in 13 out of the last 20 years. In short, the month gets a bad rap.

As Nelson Mandela said, “A good head and a good heart are always a formidable combination.” For us in the context of achieving our financial goals, we take this to mean that we should, with humility and wisdom, look beyond near-term volatility. We should also do so with compassion and charity to those less fortunate.

Your Regency team remains available for in person meetings, telephone and/or video calls to discuss any issues and questions.

Click here to download printable version of this newsletter.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.