Debatable

“You can observe a lot just by watching.”

– Yogi Berra, HOF NY Yankees Catcher and Humorist

Watching TV or streaming shows, original series, movies and more has likely increased in 2020 as viral restrictions kept most of us at home. What did we observe? Were many of the “original” shows laced with “colorful” language and violence? Was kindness profiled or rarely displayed? How about greed, unfaithfulness, lies or truth, dependability? Were you a traveler, movie goer, or foodie? Are you more avid about your relationships or your politics? Did you panic over your finances in March and sell at the lows or raise cash ahead of the near-term elections? How wisely have we traversed through this strange year? Admittedly, this has been a challenging year for most of us. Hopefully you have fared reasonably well. If you work in health care or public service, thank you for your heroic work on our behalf.

In late September, the two U.S. Presidential candidates held their first of three debates amidst frequent interruptions and dissonance. Uncertainty often surrounds elections but may be higher than normal this year reflecting Covid-19 induced elevated mail in ballots. Results may not be finalized for weeks after the elections. Many individual investors of either party are considering raising cash to avoid possible sell-offs. Historically, timing the markets for any reason, politics or otherwise, has seldom been a winning strategy.

Markets

U.S. and global stock markets rose steadily after the pandemic induced sell off in March. By early September, some major indices had recovered much if not all of their losses. But observing beyond the headlines, not all sectors participated equally in the rebound. In fact, a handful of tech and communication firms drove the indices’ rise.

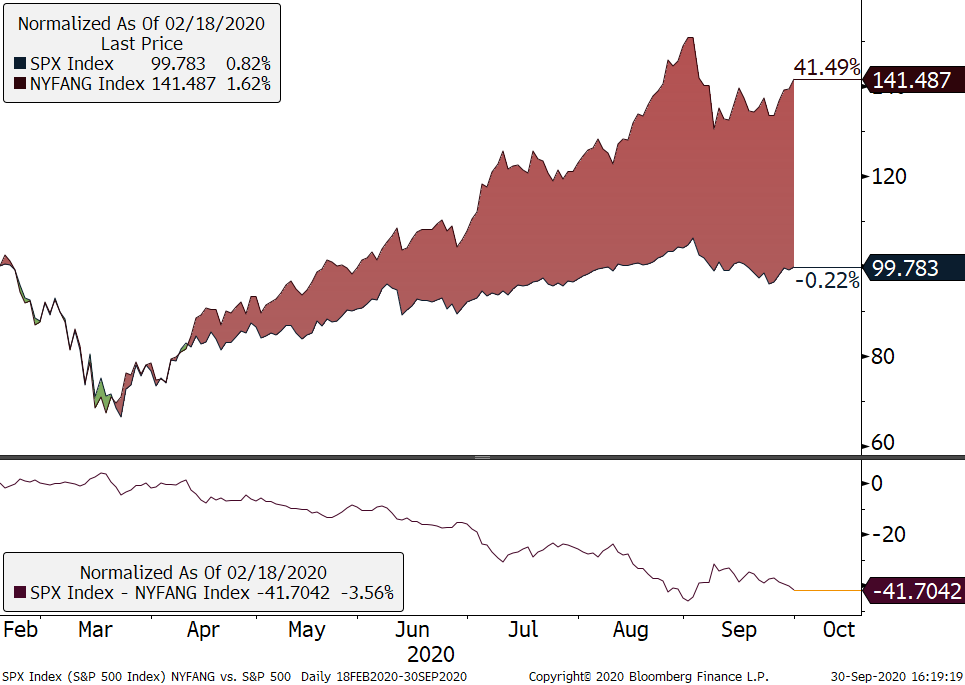

Figure One: Bifurcated Market

Figure one depicts the stellar performance of the NYFANG+ Index1, up 41%+ from mid-February through September 30th, 2020, contrasted to the rest of the S&P 500 Index’s meager return. This handful of stocks did very well while the rest of the index was down as investors expressed their desire to own shares in tech and communication firms that are well positioned to grow revenues and earnings in a low interest rate, lower growth world that is voraciously consuming high-tech solutions. The lack of commissions on buying or selling stocks together with momentum driven strategies also likely contributed to the run up of these popular stocks. It can be fun to own high flyers when they are rising sharply but…they don’t always rise. After peaking on August 2nd, these stocks dropped 13.5% in four, yes FOUR, trading days and then rebounded 7% in the subsequent five trading days. Holy volatility Batman! We will keep watching this phenomenon with some skepticism regarding the investment (vs. speculative) merits of chasing many of these fine companies at any price.2

For the quarter ended September 30th, the S&P 500 rose 8.5% and is up 4% year to date. International stock market returns were mixed but positive in the third quarter of 2020: Stockholm, and Germany (DAX Index) fared best, returning over 14% and 8%, respectively. Russia and Hong Kong stocks trailed. Oil was fairly stable at $39.9/bbl while gold closed September at $1,893/oz. up $83/oz in the quarter after hitting $2,000/oz in August. The ten-year U.S. Treasury note yield dropped three basis points (bps) last month closing September at 0.68%. Credit spreads (the premium that investors require above government debt) widened in the third quarter ended September 30th, reflecting investor caution amidst heavy new issuance. Investment grade credit spreads closed at 200 bps, up from 150 bps in June. Likewise, high yield bond yields ended September at 5.9%, up from 5.5% in August.

Investment Strategy

We observed that investors, generally, seem to have been more active in stock markets in 2020 as measured by small lot trades of equities and options. No doubt many of them who bought the hot stocks felt very skilled and proud of their investment acumen as they watched them rise steadily from April through August. How many “rebalanced” portfolios and took some profits before the mid-September sell-off? As many of you know, we held the course in late March but took some important actions in the midst of much uncertainty in fully discretionary portfolios: adding a hedge to cushion possible turbulence ahead, holding a modest gold position, eliminating an interest rate hedge, modestly reducing credit exposure, and looking for opportunities amidst the rubble. Having entered the second quarter with below average risk relative to the range, we periodically rebalanced as markets rebounded. In the quarter ended September 30th, 2020, we marginally repositioned individual stock portfolios by selling some traditional cyclicals and replaced them with more defensive consumer discretionary and consumer staples companies. We also initiated a position in a basket of innovative companies that may be better positioned for the new environment. Finally, we have also extended the interest sensitivity of bond portfolios (duration) that might cushion returns should a risk off environment arise.

Economy

Second quarter U.S. GDP dropped 31.4% (annualized) marking our first economic recession in over ten years. Fortunately, in part reflecting Federal government stimulus efforts, U.S. GDP is anticipated to rise 30% or more in the third quarter of 2020 before steadying and growing at a moderate pace through 2021. Official unemployment claims surged reaching 14.7% in April but reportedly dropped to 8.4% in August as the economy re-opened after a lockdown. Roughly one in four unemployed in April were on furlough and many may return to work soon. Manufacturing activity has also resumed.

Outlook

It remains debatable how attractive the U.S. stock and bond markets are given the continued economic, political, and pandemic uncertainties we face. The pandemic also obfuscates the near-term prospects for international economies and stocks. We continue to watch and observe for opportunities to protect and grow your investments.

Your Regency team remains available for telephone and video calls to discuss any issues or questions and eagerly awaits seeing you in person as conditions allow. We hope that you have stayed the course in most areas of your life and perhaps gathered insight into some of what you have observed. Thank you for your continued confidence and trust. Stay safe and healthy!

Click here to download printable version of this newsletter.

1NYFANG+ Index is an equal-dollar weighted index composed of high quality tech and tech-enabled firms including Facebook, Apple, Amazon, Netflix, and Alphabet’s Google.

2Many of Regency portfolios own AAPL.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.