On the Ropes

“Your life is like a mosaic, a puzzle. You have to figure out where the pieces go and put them together for yourself.”

– Maria Shriver

At a youth summer camp in August, one of our partners found themselves 65 feet above ground at the top of a ropes course, depicted below. While firmly harnessed, they found it to be scary, challenging, and yet fulfilling. Focus on the element at hand and the landing platform ahead were essential. Looking down was discouraged. Noises from others ahead, behind, or below, were blocked out as they took one step at a time.

Investing in volatile markets has parallels to this balancing act. Harnessed by a solid financial plan, investors pursue their financial goals. With focus and careful study of the challenges at hand, investors can formulate tactics that stick to the strategy while ignoring immaterial noise. These days, we are bombarded with information, headlines, and tweets. Recently, investors continue to wrestle with the uncertainties surrounding U.S. – China tariff negotiations and slowing global economic growth. In late September, they also increasingly encountered political winds ahead of next year’s U.S. presidential election.

The S&P 500 rose in July, dropped in August, and rebounded in September resulting in an uninspiring 1.2% quarterly return; bringing its year-to-date rise to a robust +18.7%. Global equity markets were mixed with some markets beating U.S. indices in the quarter just ended but most are still lagging year-to-date. Bonds remained well bid but volatile. After dropping one half of a percent in yield to 2% in the second quarter, the ten-year U.S. Treasury note’s yield dropped to 1.4% in early August, rose to 1.8% in early September and closed the month at 1.67% (down 87.5 basis points in six months!). Negative yields moderated overseas but continue in the majority of European countries and Japan. Gold outshone most asset classes rising 3.8% over the last three months through September and 25% higher year-to-date.

Economic and Earnings Fundamentals

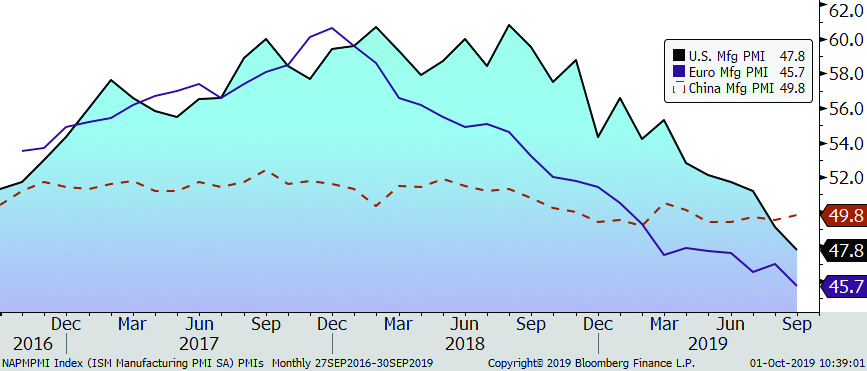

Global growth is slowing but remains positive. U.S. real GDP expanded at 2.0% in the second quarter, down from 3.1% in the first quarter, 2019, and is expected to expand around 1.8% in the second half of this year1. Manufacturing activity is now showing contraction in the U.S., Europe and China as reflected in Figure One. Lower PMIs signal contraction of corporate capital spending, partly reflective of uncertainty about future trade tariffs.

Figure One: Manufacturing Purchasing Managers Index

Fortunately, consumer spending remains strong in the U.S. and is still growing at a moderate pace globally. U.S. home sales also picked up late summer reflecting low mortgage rates as median sales prices in July rose 2.2% from a year ago. Off-again, on-again trade negotiations continue as October begins. Late September election and political news gathered increasing attention with Democratic presidential candidate hopeful, Elizabeth Warren improving in the polls and her party formally initiating impeachment investigations on President Trump. Your Regency team will continue to weigh developments into the November, 2020 elections. Current expectations are for neither party to control both the White House and Congress in 2021.

The Federal Reserve (FED) cut rates twice in the third quarter calling them “mid-cycle” reductions aimed at extending the current economic expansion and moderating its discourse about future cuts. Central Banks in Europe and Asia remain highly accommodative and foreign government bonds with negative yields now approach $15 trillion2, up from less than $6 trillion a year ago! We continue to view the chances of a U.S. recession before mid-2020 as low while the chance of a rebound in inflation is a possible outlier relative to market expectations.

Stock and Bond Valuations

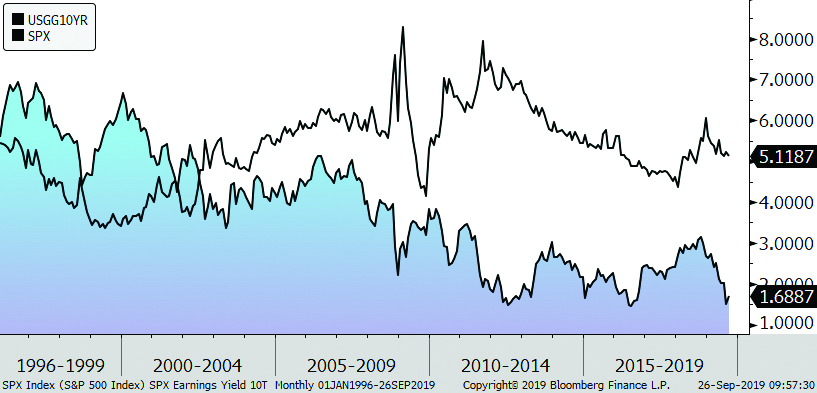

U.S. equity markets remain reasonably valued, in our opinion, in contrast to low bond yields that remain well below historical levels. Figure Two highlights the wide differential between S&P 500 earnings yields (close to its long term 5% average) and the ten-year US Treasury note’s yield (well below its 5% average). The top line reflects the yield that the average S&P 500 company would pay in dividends if all of their earnings were distributed this way to shareholders. The lower line is the yield on the ten-year U.S. Treasury. If the bond’s yield rises 20 basis points to 1.88% within a year, investors buying it at current rates lose 1.9%! If the yield declines 20 bps, they gain 1.4%.

Figure Two: S&P 500 Index Earnings Yield vs. 10- Year U.S. Treasury Yields

Outlook

Economic growth remains positive but mixed overseas and is expected to slow in the U.S. Stocks, while not cheap, are less expensive than bonds leading us to keep our neutral equity risk budgets. Low yields, reflecting moderating growth rates in the U.S. and slower economic growth internationally offer little reward for extending maturities so we are maintaining a conservative and limited exposure to interest rate sensitivity.

Much like a ropes course, focus and balance are advised. Much like a puzzle, pieces (or steps) fall into place and progress is made over the full course of the journey.

The Regency team congratulates Bryan Kabot on his recent promotion to Partner!

Click here to download printable version of this newsletter.

1Source: Bloomberg L.P. contributor composite forecast

2Source: Bloomberg Barclays Global Agg. Neg. Yielding Debt Index

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.