Jazz!

“If you have to ask what Jazz is, you’ll never know.”

– Louis Armstrong

U.S. stocks danced a jazzy tune in the quarter ended September 30th as earnings momentum emboldened investors to keep the party going in July and August before finetuning in September. As with all of 2018, returns were not broad-based with six industry sectors up and six down in the quarter. There was even greater decoupling of stock market returns globally (as shown in Figure One) with the S&P 500 Index rising over 6% while global developed and emerging market indices lagged.

Figure One: Global stock returns 2018

After decades of status quo, the Trump administration is aggressively negotiating tariff rates. As of 2017, the average U.S. import tariff was 3.4%, almost two-thirds lower than China’s 9.8%, and much lower than South Korea’s 13.7%. Mexico, EU, and Canada also impose higher rates on imports at 6.9%, 5.1%, and 4%, respectively[1]. The concept of levelling trade rules seems like a good idea but the practical negotiation and implementation is not simple or efficient. The recently announced preliminary agreement between the U.S. and Mexico to replace NAFTA[2] (with continued discussions with Canada) will require Congressional approval (post mid-term elections) and can then be reviewed by the World Trade Organization before implementation. The U.S. is also negotiating with China and the EU while increasing, or threatening to increase, current tariffs on their exports. A significant escalation of, and retaliation for, such increases might slow global growth, increase consumer costs and feed inflation. In contrast, decreases in global tariffs rates would likely be pro-growth. The brunt of tariff actions has been borne by emerging markets with the MSCI Emerging Markets Index down 6% in the first nine weeks of this quarter before rallying to end the third quarter down 0.8%. It has shed over 9% year-to-date. Stocks of international developed markets have also lagged as aforementioned. In turn, portfolio allocations away from U.S. stocks have dragged returns down thus far in 2018. In times like these, where returns diverge, investors should focus on the long term as diversification eventually pays off and tends to lower risks.

Earnings Growth

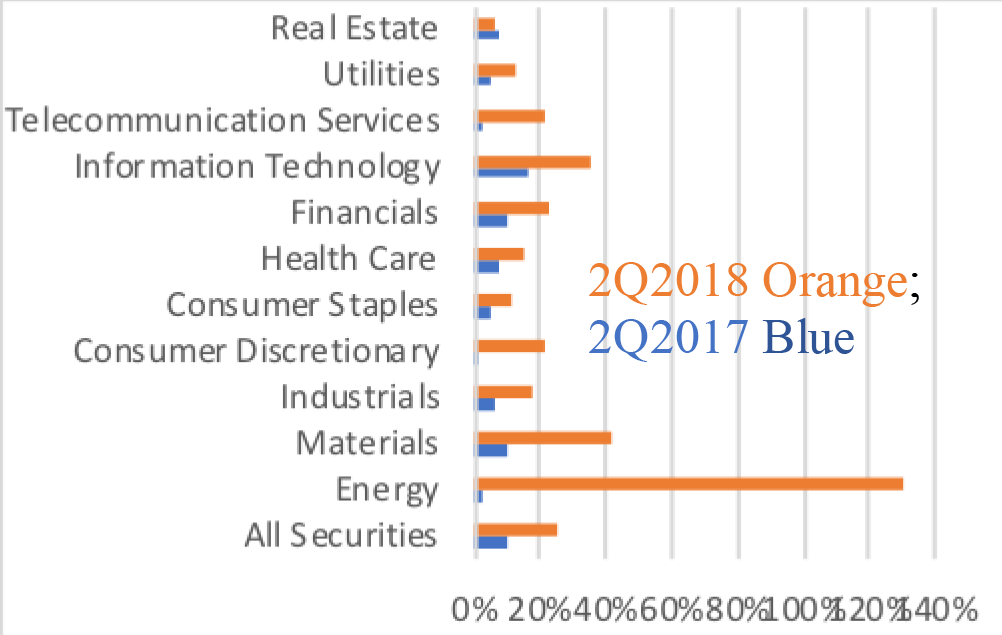

Companies in the S&P 500 Index posted impressive 25.3% earnings growth in the second quarter, 2018 from the prior year’s second quarter as shown in Figure Two. Revenue growth over the comparable period exceeded 9% with 10% plus growth in sales for Energy, Materials, Information Technology, and Real Estate sectors.

Figure Two: S&P 500 Index Earnings Growth 2Q

Economic Fundamentals

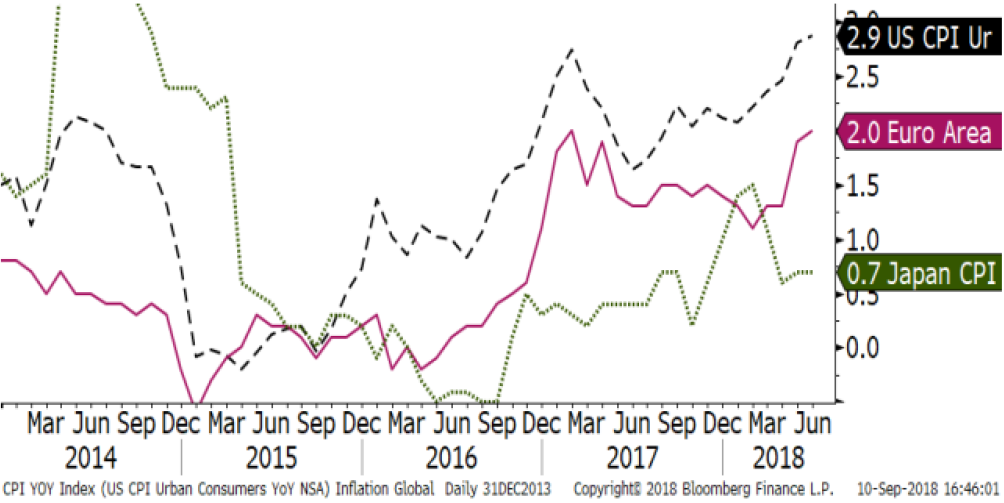

Second quarter U.S. GDP (Gross Domestic Product) grew at a better than forecast 4.2% and is expected to exceed 3.5% for the quarter ended September 30, 2018 (some estimates exceed 4%). Inflation is rising gradually in the U.S., Europe, and Japan.

Figure Three: Inflation: U.S. Europe, Japan

Outlook

Earnings for U.S. multi-national firms for the quarter ended September 30th may have benefitted from overseas orders being front ended ahead of possible tariffs and may offset otherwise negative effects from a stronger U.S. dollar. S&P 500 Index 2018’s year-over-year earnings improvements are still expected to surpass 20%. A stable dollar may allow S&P 500 companies’ earnings growth to accelerate in the fourth quarter of 2018 before moderating in 2019 to below 10% growth rates. As always, a number of risks lie ahead: a fiscal impasse may threaten a U.S. government shutdown in the fourth quarter, November’s mid-term elections, higher interest rates, and ongoing trade war fears. Emerging market stocks may rebound from recent trade war concerns as U.S. trade only represents 8.1% of their direct revenues[3].

Introducing Regency-Constructive Sustainable Investing (R-CSI)

Increasingly, concerns over Environmental, Social, and Governance issues (ESG[4]) are factoring into our lifestyles and investment choices. Investing to positively impact these issues is undoubtedly a force in the modern world, and at Regency Wealth Management we believe that ESG investing can also be a smart financial option. R-CSI, Regency Constructive Sustainable Investing, is our portfolio construction process incorporating these issues. Complementary to our historical asset allocation approach, we seek well run companies with solid profiles that also offer value. For ESG mandates we incorporate companies (and funds that invest in them) exhibiting constructive values, building sustainable footprints, and that are investable at reasonable valuations. While we and our clients can’t solve the world’s major issues (health, social, environmental, human rights, etc.) we can, collectively, influence these and other issues by investing in the leading companies that are making a difference; those that are contributing to constructive solutions. Considering who is making the world better, and investing in these firms, goes well beyond short term returns on investment. If enough people follow suit, it can become a sustainable virtuous cycle. In the interim, returns should be competitive with traditional investments. Just like the team of CSI: Crime Scene Investigation that scours the crime scene to solve the mystery, together we can look for constructive evidence of sustainable corporate efforts, invest in them, and make a difference in our world. We believe that with careful consideration and trustworthy advice, we can help clients incorporate passions and values into their financial plans and investment strategies. That could indeed be a jazzy tune!

Thank you for your continued trust in the Regency team. We are committed to working with you over the long term to help you reach your financial goals through constructive and impactful collaboration. Please call us to share any thoughts, concerns, or insights or if you would like more information about R-CSI, our investment allocation methodology, or financial planning.

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan Kabot, CFP®, AAMS®

[1] World Trade Organization 2018 statistics, tariff profiles; Simple average MFN applied

[2] North America Free Trade Agreement, 1994.

[3] Goldman Sachs 9/10/2018 Emerging markets refers to 25 countries: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Russia, Qatar, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. As of July 6, 2018.

[4] ESG investing is generally defined as the practice of considering environmental, social, and governance factors alongside financial factors when making investment decisions.

Click here to download a printable PDF copy of this newsletter

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.