Storms

“Creativity is the power to connect the seemingly unconnected.”

– William Plomer

Volatility in stock and bond markets awakened from a multi-month lull as geopolitical risks reappeared in the quarter ended 9/30/2017. Markets struggled to ascertain if North Korean saber rattling would overwhelm constructive economic and earnings trends. High stock and bond market valuations and domestic U.S. political cross winds (uncertain health care and tax reform) left investors noncommittal and cautious. Underlying fundamentals seem positive and could accelerate if geopolitical tensions ease and tax reform is forthcoming. While U.S. and international economic growth is firming, earnings are growing, real estate is healthy, unemployment is low, and stock valuations are high. Some sectors seem expensive (FANG stocks – Facebook, Amazon, Netflix, and Google). Unfavorable geopolitical events or continued gridlock in Washington could tilt markets into a correction. Consequently, we continue to target a little less risk than the midpoint identified for each of our clients.

Stocks reach highs, bond yields trending modestly higher

U.S. stocks, as measured by the S&P 500 composite index, rose 3.9% in the third quarter of 2017. International developed and emerging stock markets did even better, up 5% and 7%, respectively, in part reflecting a modestly weaker U.S dollar. Global bond yields, while still low, rose modestly as investors start discounting tighter monetary policies in 2018. The challenge to Central Bankers is to reduce the extraordinary amounts of liquidity injected into bond and lending markets without derailing nascent economic recoveries. The European Central Bank will likely modestly tighten monetary policy in 2018-2019.

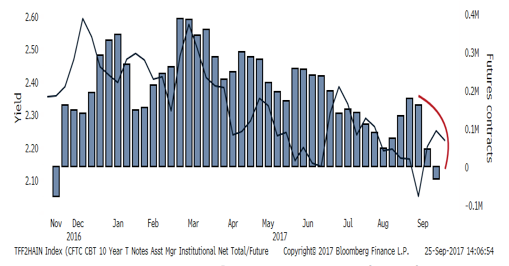

Domestically, the Federal Reserve confirmed its intentions to begin reducing its balance sheet in October. The U.S. ten year Treasury yield started July at 2.3%, rallied to 2.02% in early September and closed at 2.34% on 9/30/17. Institutional asset managers, as reported to commodity regulators, went short Treasuries in mid-September, as shown in Figure One.

Figure One: Institutional Asset Managers’ Treasury net futures contracts, 9/19/17

We anticipate U.S. bond yields may drift higher with the U.S. dollar marginally stronger as a result. Oil prices rebounded post hurricane Harvey yet remain bounded near $50/barrel ($51.70 at 9/30/2017). Gold prices jumped over $100/ounce to $1,351/oz in early September from June 30th before closing the month at $1,287/oz.

Figure Two: S&P CoreLogic Case-Shiller 20-City Composite Year Over Year, July, 2017

Economic Fundamentals Improved

U.S. second quarter 2017 economic growth rebounded to 3.1% as personal consumption rose. Spending was undergirded by rising incomes, low unemployment, and steady housing prices: unemployment at 4.4% and average home prices up 5%+ year-over-year. European and Japanese economic growth is trending at 2%+ contributing to an evolving synchronized global expansion.

Outlook

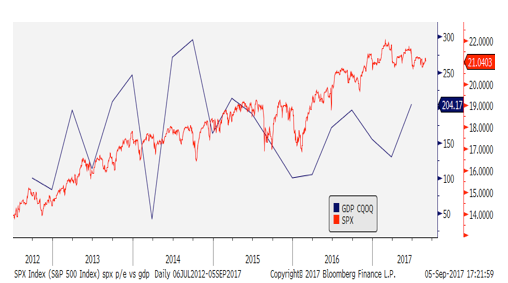

We mentioned last quarter that significantly higher stock market returns over the next few years will likely require higher earnings and faster economic growth. The second quarter’s 3.1% GDP growth rate for the U.S. moved in the right direction as shown in Figure Three, below. Third quarter’s pace will likely be distorted to the weak side by hurricanes Harvey and Irma but the rebuilding of Houston and Southwest Florida will spur investments over the next few quarters.

Figure Three: S&P 500 P/E vs. normalized GDP%

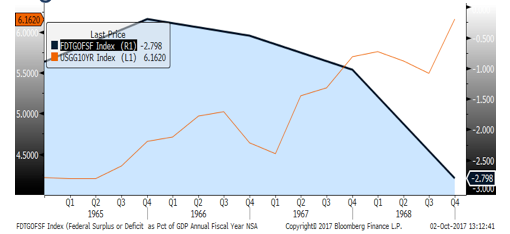

War with North Korea is likely a low probability but high impact event that, while impossible to predict, would likely be near term disruptive to markets but, if contained, not likely result in permanent impairment. Tax reform is being debated as we go to press but may not be finalized, if enacted, until 2018. If passed, tax reform may cut upwards of $1.5 trillion in taxes and possibly propel a near term rise in capital equipment spending. A tax holiday enabling U.S. companies to bring overseas cash home may prompt higher dividends, stock buybacks, acquisition and/or higher capital spending. Longer term, deficit spending may well carry negative consequences for economic and earnings growth as well as the cost of debt. In the mid 1960’s higher deficits (right axis in Figure Four, below) led to higher debt costs (U.S. ten year Treasury yield on left axis).

Figure Four: U.S. Federal Deficit/GDP 1965-1968 led to higher interest rates

As of year-end 2016, our government’s debt of $19.5 trillion represented 105.9% of GDP[1]. Eventually, higher debt issuance to fund fiscal deficits should cost more (i.e. higher interest rates). The pace and degree of higher interest rates over the next few years will be important to investors as it impacts governments, companies, and individuals’ borrowing costs and inflation.

Thank you for allowing us, your Regency team, to “connect the dots” as we review short term trends and keep you on course to achieve your long term financial goals.

Please call us to share any thoughts, concerns, or insights!

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, CFP®, AAMS®

[1] usgovernmentspending.com/debt_deficit_history

Fill in your name and e-mail to download a newsletter PDF.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.