Eyes Wide Open

“Living is easy with eyes closed, misunderstanding all you see”

– John Lennon, “Strawberry Fields Forever”

The Beatles’ timeless song Strawberry Fields Forever offers a poignant reflection on perception versus reality. With all the chaotic headlines this past quarter (tariffs, war, tax policy, immigration, inflation), it felt as though many investors – understandably – were navigating the financial markets with eyes half-closed, bombarded by a barrage of headlines painting a picture of pervasive uncertainty and worry. Yet, when we open our eyes fully to look at the hard economic data, a different and more resilient landscape emerges. Despite the anxieties stirring us from the financial news, the underlying economic indicators continue to demonstrate remarkable resiliency, suggesting that what we’ve been hearing in the headlines may not be translating into the tangible economic shifts some might expect.

Markets

Just two days into the start of the second quarter, investors were met with the highly anticipated and steeper-than-expected reciprocal tariff announcement, sending shockwaves to the global capital markets. The S&P 500 dropped over -12% in just four trading days – the steepest four-day decline since the onset of the COVID-19 pandemic in March 2020. Investors reacted with uncertainty, fearing a full-blown global trade war and its potential negative consequences on corporate earnings and economic growth. Both US Treasuries and the US Dollar, traditionally seen as safe-haven assets, showed unusual behavior, raising questions about their safe-haven status amidst the trade uncertainty. Yields on Treasuries initially fell, then rose, indicating market stress.

After several fits and starts, clouded with great uncertainty day-to-day, President Trump announced a 90-day pause on the extra “reciprocal” tariffs for most countries, while still raising tariffs on Chinese imports.

For the quarter, the S&P 500 ended up +10.94% while the tech-heavy NASDAQ Composite ended up +17.86%. Overseas, we continued to see increased investor appetite for diversification from the US, with broader international developed markets represented by the MSCI EAFE Index returning +12.07% for the quarter. The Bloomberg Aggregate Bond Index (the AGG1) returned +1.21% for the quarter as bond yields were quite volatile and investors digested the ramifications of Washington’s new tax package and its potential implications for our nation’s fiscal deficit. In May, Moody’s downgraded the US credit rating from Aaa to Aa1, making it the last of the three major rating agencies to strip the US of its top-tier rating. Though the move is mostly seen as symbolic given the US Treasury’s continued role as a global safe-haven asset, Moody’s pointed to the nation’s “inability…to address large and growing deficits” and “growing interest costs” as primary drivers. Crude Oil (WTI Cushing Crude) was down -8.9% for the quarter despite heightened geopolitical uncertainties in the Middle East, while Gold continued its rise, up +5.8% for the quarter.

“Hard Data” vs. “Soft Data” – Eyes Wide Open?

There have been a lot of headlines this year around the fallout of consumer sentiment. And why shouldn’t there be? Each day we are bombarded with one news after the next: Tariff uncertainty, fears of a resurgence in inflation, concerns about reckless government spending, escalating geopolitical tensions in the Middle East, news of deportation, the list goes on. However, we feel it is important to recognize and delineate between “soft data” (i.e. qualitative survey data) and “hard data” (i.e. quantitative and measurable data). Many economists point to the University of Michigan Consumer Sentiment Survey as a leading economic indicator that provides valuable insights into the mood of the American consumer. After all, consumer spending is the largest component of the US economy, accounting for about 70% of the nation’s GDP. It should come as no surprise that after this quarter’s tariff announcements, consumer sentiment fell off a cliff and reached its lowest levels since April of 2022. Though many economists and investors put great weight into this monthly reading, we feel it is not the most accurate representation of forward-looking expectations.

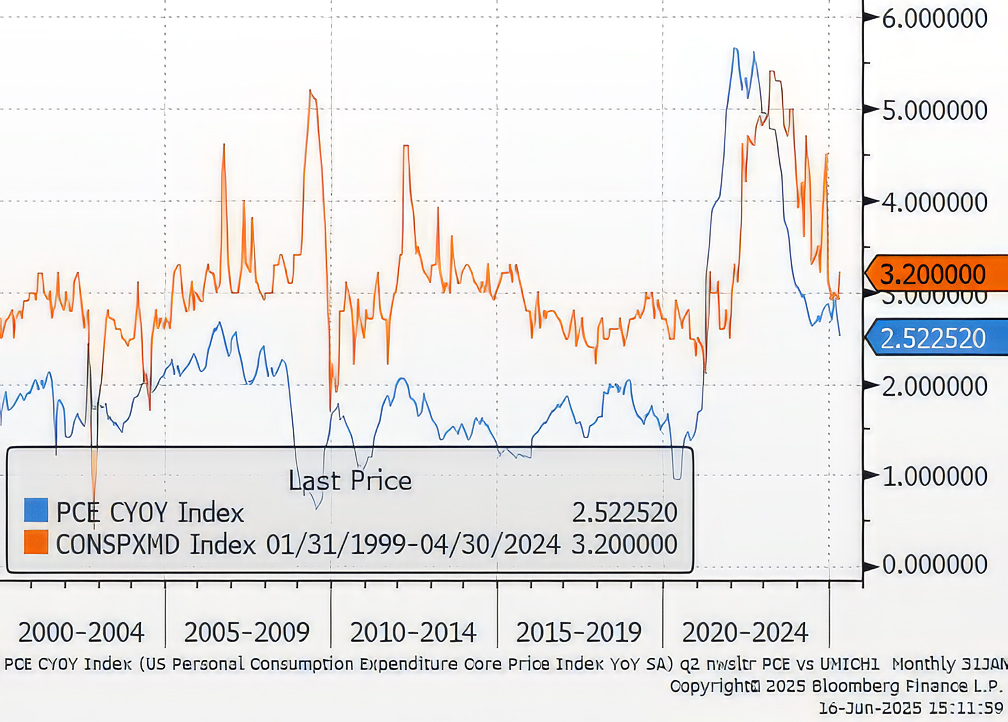

First, one of the survey questions asked is what respondents’ inflation expectations are in the next 12 months. A recent survey this quarter had the 12-month inflationary expectations hovering north of 7% with a sharp drop in economic growth expectations. However, the personal consumption expenditure (PCE) Index, the Fed’s favored measure for inflation, just printed a 2.1% year-over-year reading; one of the lowest year-over-year inflation readings in years and in line with the Fed’s 2% long-term target. Figure 1 highlights the actual PCE data with consumer survey data (on a one-year lag to line up expected vs. actual). Survey responses tend to be significantly higher than actual realized inflation.

Figure One: PCE Inflation YoY vs. UMich Inflation Survey

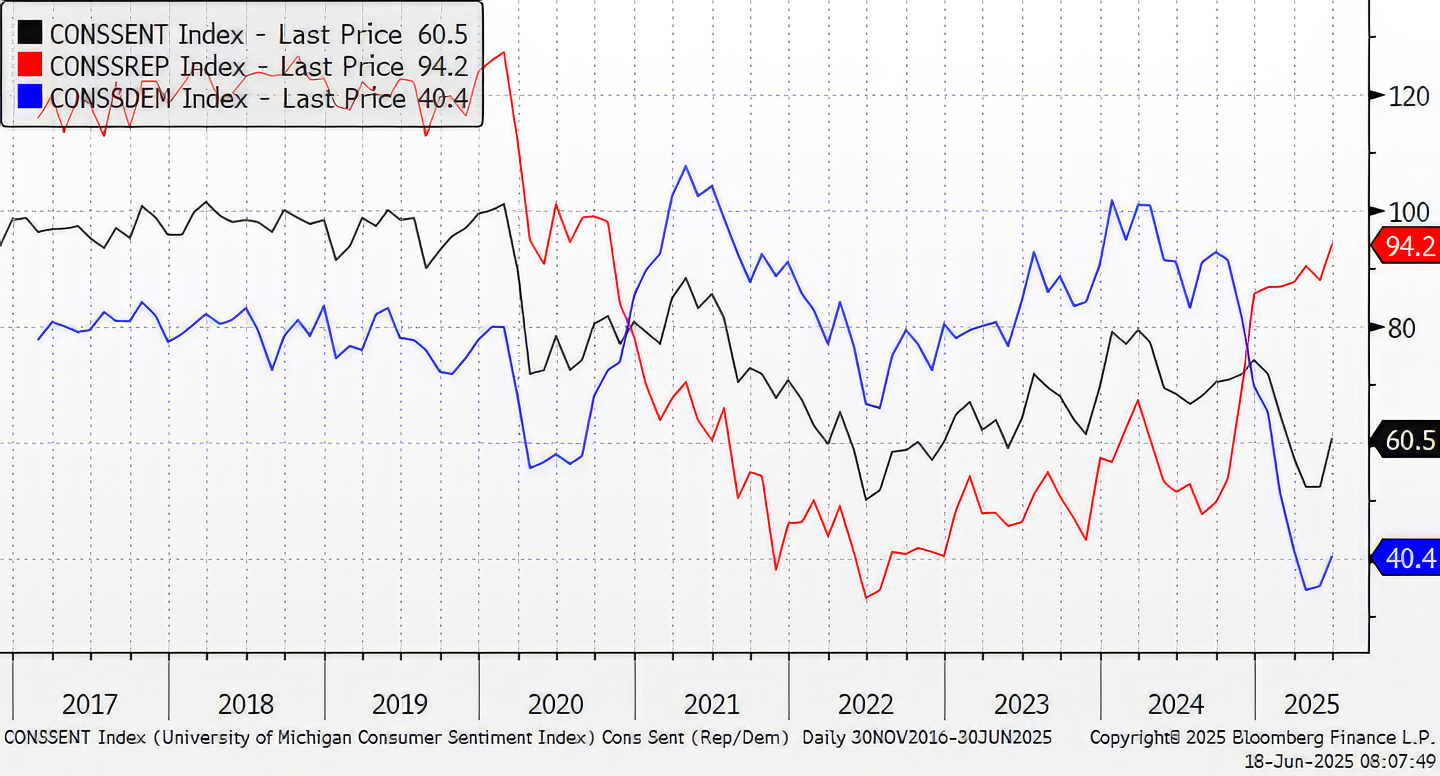

Second, the Survey’s data tends to be highly politicized and, in our opinion, clouds objective analysis. The data in the survey reveals clear political bias and tends to show Democrats as bearish & Republicans bullish under a Republican President, with the reverse true under a Democrat president. With generally half of the country claiming one side and the other half the other side, it does not move the needle too much. Figure 2 illustrates this, as a sharp reversal in sentiment across political parties occurs at the change of the party holding the presidency. In our view, this level of partisanship undermines the credibility of the survey’s data. In recent weeks, we’ve seen credit card delinquencies and net charge-off rates decline both at JPMorgan and Bank of America, pointing to a stronger credit environment and directionally stronger financial health for consumers.

Figure Two: Consumer Sentiment by Political Party, 2016-present

Outlook and Investment Strategy

In the short term, the general market outlook seems cloudy at best. Despite that, we remain patient and prudently optimistic in the quarters ahead. For the first quarter, the S&P 500 companies continued to grow revenues at 5% year-over-year and net earnings at 13%. Additionally, markets outside of the US have garnered much interest and investment in the past few quarters, with several constructive tailwinds in place for US investors overseas.

Though we won’t know what the impact of the recent tariff announcements will be for second quarter results until several weeks after quarter-end, we have observed general signs of optimism as a handful of S&P 500 companies have issued upside earnings guidance, signaling the potential for better-than-expected results for this quarter. Furthermore, producer prices (costs borne by businesses) are rising at a slower rate than consumer prices (costs paid by the end consumer); which signals that businesses have some resilience and may not be forced to pass along these additional costs to consumers while still maintaining consistent or improving operating margins.

Regarding the bond market, we continue to keep a sharp eye on the 30 year treasury yield and its implications as it relates to safe haven status and potential implications around continued deficit spending. We anticipate the Fed could be on hold longer than expected due to the unclear economic outlook. Fed Chair Jay Powell has continuously reiterated that they will remain data dependent and are assessing the potential implications of trade policy as they navigate potential rate cuts in the short term. Last quarter, our base case assumption was that the Fed cuts 2-3 times in 2025. But given the Fed’s messaging around trade, our base case scenario is that the Fed cuts rates once this year, with the potential for a second cut at the tail-end of the year. As always, prudent diversification and risk management are paramount.

Closing Thoughts

Just as the lyrics in Strawberry Fields Forever invite us to look beyond the surface, we encourage our clients and friends to maintain a similar depth of perception with the financial media. While the daily headlines often echo tunes of anxiety and apprehension, the resilient hum of hard economic data tells a different story. Despite a slowdown and continued uncertainty, our moderately optimistic outlook is grounded in the belief that the hard data, despite a slowdown, continues to show signs of resiliency and strength.

As always, we thank you for allowing us to be on your financial team and for referring us to those you care about the most.

Click here to download printable version of this newsletter.

[1] The “AGG” is a widely recognized benchmark for the US investment-grade bond market and includes government, corporate and securitized bonds.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.