Perspective

“Start where you are. Use what you have. Do what you can.”

– Arthur Ashe

Perspective. In life, our perspectives regarding circumstances can be encouraging, discouraging, convicting, or revealing. They tend to reflect our collective experiences, upbringing, culture, education, health, etc. Investment perspectives can also reflect our behavioral biases. If your portfolio is up, do you feel better? If it is down, do you feel worse? Studies have shown that most people derive less pleasure from investment gains than the pain they derive from losses. In other words, they value the protection of their nest egg more than gains.

Professional investors overlay risk against returns; they refer to this as risk adjusted returns. They define risk as variability of results. Yet, most people measure their portfolios against simple market indices like the S&P 500 Index. Many expect their money managers to beat the index – in up and down markets. After all, what are they paying them for if not to “beat the market”? Financial advisors like Regency typically focus on a third objective: meeting the client’s financial goals. What good is beating the market in the near term if the risk taken later comes home to roost in a down market and threatens to derail the financial plan? Your Regency team works with you to determine the appropriate risk that you can afford to take and then constructs portfolios accordingly to increase the odds of meeting your financial goals (fund education, retire, buy a second home, philanthropy, etc.). Sometimes these portfolios beat “the market”. Sometimes not. But their risk is intended to be aligned with your best interests and goals. Our perspective is a disciplined one with one objective – to help you achieve your goals.

Markets

Much has been written about the AI (Artificial Intelligence) themed market that has risen strongly since late 2022. In our previous newsletter we cautioned readers about chasing high valuations at this early phase of AI’s development as eventual winners may not be clear for some time. Bulls point to significant increases in AI related companies’ earnings. The masses are buying, propelling the S&P 500 Index to new record highs as shown in Figure One. The index is now up an impressive 32% since late October 2023.

Figure One: S&P 500 Total Return Index

Source: RWM, Bloomberg L.P.

For the quarter ended 6/30/2024, the S&P 500 Index rose 3.9%. The tech-heavy NASDAQ was 8.3% higher while the DJIA lagged, dropping 1.7%. Small and mid-cap indices were 3.6% and 3.8% lower, respectively. International stocks were flat to mostly lower; France’s CAC 40 at -8.7%, Euro Stoxx Index -3.5%, FTSE 100 rose 2.7%. Asian stock indices were largely unchanged. Bond yields were volatile and higher as aggressive expectations for Fed rate cuts were unmet and their timing extended. The Bloomberg U.S. Aggregate Bond Index (AGG)[1] rose a modest 0.1% for the quarter narrowing its YTD loss to 0.7%. With a 5% yield as of 6/30/2024 it is looking more attractive. Gold rose 5.9% while Crude Oil’s (WTI Cushing Crude) was off 2.6%.

Valuations

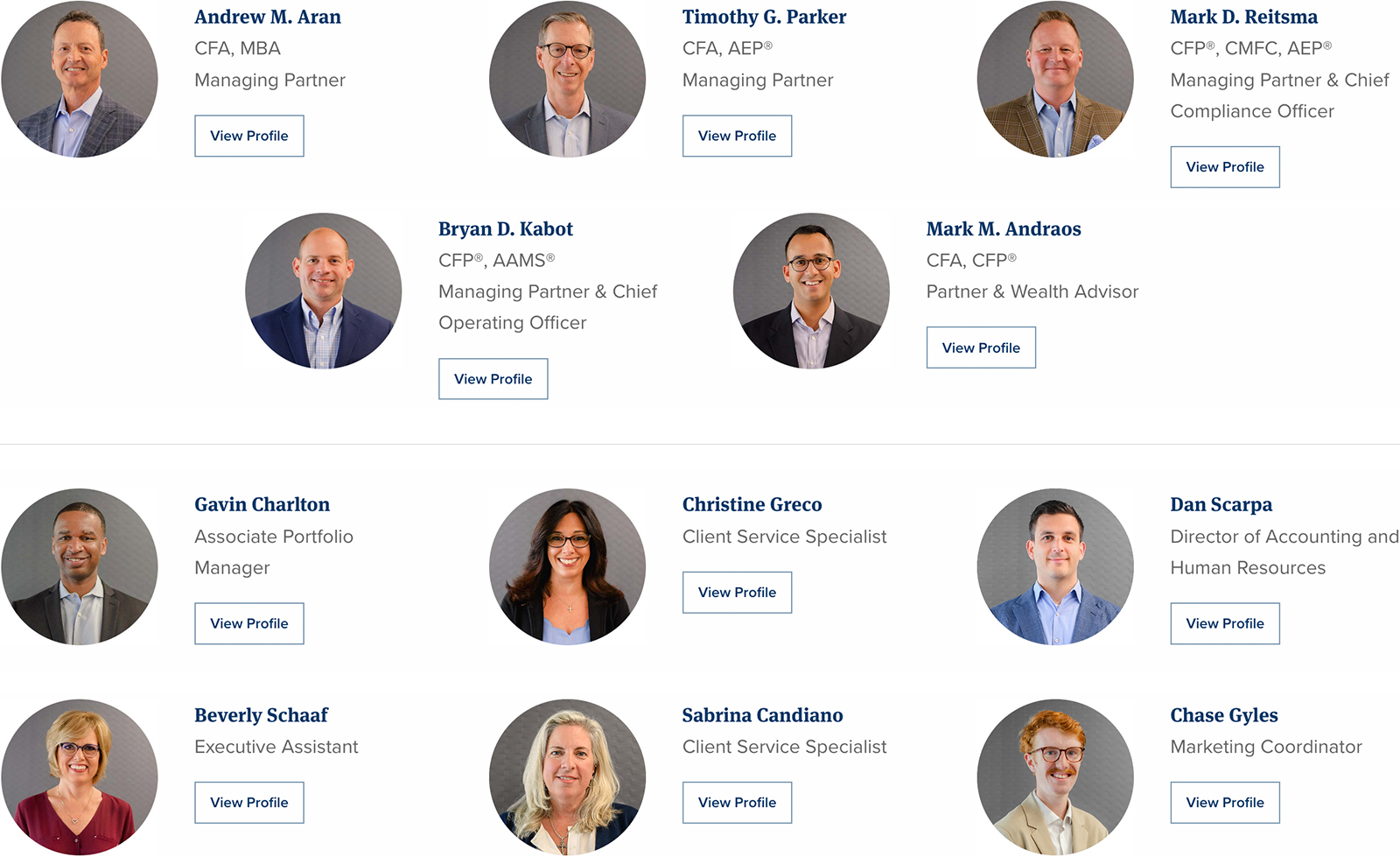

U.S. stocks (as measured by the S&P 500) are trading at average price/earnings (P/E) of 25.6 times trailing earnings and 19.7 times (x) forward estimated earnings; both well above historical averages. International developed market P/Es are more reasonable but also reflect their lack of leading IT and communications companies.

Figure Two: S&P 500 and EURO STOXX50 Index P/E and forward P/E.

Source: RWM, Bloomberg L.P.

Bond yields rose in most major markets in the three months ended June 30th. The U.S. 10-year note is yielding 4.4% and now offers a modest 1% real yield (after inflation). Two-year notes yield 4.75% continuing a curve inversion normally signaling that a recession is near. Canada and Euro Central Banks lowered their discount rate in early June by 0.25%. Their lower rates will boost the U.S. Dollar relative to the Canadian Dollar and the Euro.

Fundamentals

The Federal Reserve (FED) has reiterated its expectations that rates are likely to move lower but is waiting until inflation shows more signs of dropping. It may cut rates as early as September but may wait until December 2024. Unemployment rates have inched up to 4%, still low but up from 3.4% a year ago. Residential real estate markets are neutral but commercial real estate remains pressured. Higher stock markets are contributing to consumer confidence, but consumer and commercial delinquencies are trending up modestly.

Outlook and Investment Strategy

From our perspective, the U.S. stock market as measured by the S&P 500 Index has more risk today than it had a few years ago before AI technology firm valuations exploded to the upside. While it is hard to say how long that will continue there are still numerous other companies with good businesses and strong cash flows that trade at more reasonable valuations. Our individual stock buy list that represents approximately half of the U.S. stocks in our client portfolios have an average P/E of 19.3 x. Bond yields are also more attractive and may offer competitive returns in the second half of 2024 and 2025 if inflation declines. Our nine-month ladder of U.S. Treasury notes is yielding an annualized 5.1%. As we near a U.S. Presidential election, we anticipate that stock market volatility may rise and create further investment opportunities.

Together, we can navigate uncertain markets while maintaining a proper long-term perspective.

Thank You for allowing us to be on your financial team and for referring us to those you care about most.

Click here to download printable version of this newsletter.

[1] The “AGG” is a commonly used measure of US$ investment grade government, mortgage, and corporate bonds.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.