Be Happy

“Live, and be happy, and make others so.”

– Mary Wollstonecraft Shelley

Happiness and joy. Both are linked to wellbeing. The former is more likely to reflect current circumstances while the latter can be more intense and longer lasting. A sense of purpose and feelings of gratitude can undergird both. What do they have to do with investments? Finances can influence our moods, fears, and dreams. Money is a tool, not an end. Financial planning is important, not because it defines us but because it helps provide perspective as we pursue goals and weigh our lifestyle and philanthropic options. As has been said, if you don’t know where you are going, how will you know when you have arrived? Being good stewards of our resources, monetary and otherwise, frees us to look through near term challenges and focus on the long run. Building a nest egg by foregoing impulsive spending allows us to enjoy future debt-free experiences, give generously to those less fortunate and to ignore temporal headlines that are blown out of proportion. If we are grateful with what we have, plan, and are generous, we will be more joyful and maybe even happy.

Were investors “happy” with their investment returns in the first half of 2023? Some were, others less so. Those that owned tech firms that are involved in AI (Artificial Intelligence) rode a wave of speculation that drove up stock prices in hyperbolic fashion. After dropping 30% in 2022, the tech heavy NASDAQ Composite Index gained 31.7% over the six months ended 6/30/23. The S&P 500 Index was “only” up 15.9%. Both results are distorted by the indices’ capital weighted methodologies that reward larger companies[1]. Information technology represents over 28% of the S&P 500 Index, 10% more than it did five years ago. If you owned companies in this sector, you probably did well these last few months. Conversely, if you owned utilities, pharmaceuticals, telecommunications, energy, or banks you likely didn’t do as well.

Table One: S&P 500 Group returns 1H2023

Source: RWM, Bloomberg L.P.

The rebound in tech stocks allowed the NASDAQ to outpace other indices. International developed markets lagged U.S. stocks in the second quarter ended 6/30 but have been competitive year-to-date. Bond yields remained volatile, and the Bloomberg U.S. Agg lost 1% over the last three months, trimming its year to date (YTD) gains to 2.1%. Gold shed 3% this last quarter and is now up 5.2% in 2023. Crude Oil futures dropped over 6% last quarter and are down 12% YTD as of 6/30/23.

Valuations

It was only two years ago, when interest rates were zero, that the media called the stock market a “TINA” (There Is No Alternative) market. With money market funds paying 4.7-4.9% and short-term Treasuries yielding over 5%, we are far from TINA and arguably in “TAMA” land (There Are Many Alternatives). U.S. stocks (as measured by the S&P 500) are trading at average prices of 19.9 times (x) trailing earnings and 18x forward earnings, neither are historically cheap. Both are misleading and distorted by tech stocks. The S&P 500 Information Technology Sector trades at a 30.3x trailing price to earnings (P/E). Its software component trades at 36x. In contrast GOOGL, AVGO, JPM, and BAC trade at 18.9x, 19.7x, 10.2x, and 8.6x, respectively.

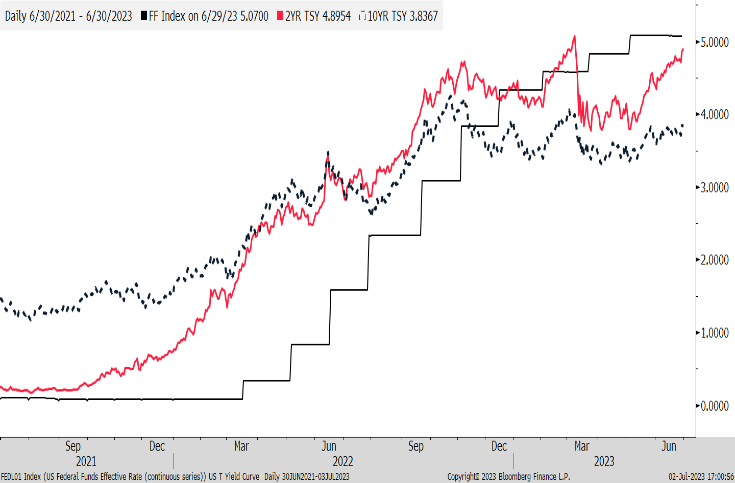

Bond investors have shifted their expectations that the Federal Reserve (FED) would lower rates in late 2023 and are now looking for rate cuts in 2024 after further possible rate hikes this year. Yields on two-year and ten-year Treasury notes have risen but may be close to peaking. The two-year yield historically drops along with Fed Funds once the FED lowers rates (in a recession) while bond investors may be attracted to a ten-year yield approaching 4%. Its yield has also dropped in prior recessionary periods.

Figure: Fed Funds Index vs. Two- and Ten-Year Treasury Yields

Source: RWM, Bloomberg L.P.

Investment Strategy

We maintain our balanced and disciplined approach to investing. Our individual equity investments include strong companies that trade at attractive prices relative to their inherent worth. Conversely, we won’t chase after the latest hyped-up firm or sector that is highly speculative. Our bond investments reflect the safety and value found in short term Treasuries offering approximately 5% or more returns, are complemented by investment grade corporate and municipal bonds, as well as some higher yielding preferred stocks.

Outlook

The FED may well raise rates further this year as it combats inflation. While Covid-related government stimulus and zero official interest rates of recent years obfuscate fundamental monetary frameworks, a hawkish FED (one that is raising rates) is likely, in our opinion, to eventually successfully lower economic growth. The highly anticipated recession may yet arrive later this year or in 2024 but we continue to expect it to be shallow and short lived. Technological advances should result in higher corporate productivity that may offset some demand slippage. Unemployment would rise in a recession but may remain below average.

Publicly traded cyclical and non-tech businesses are on average trading much cheaper than leading tech-oriented stocks. We expect many of these will perform well through the end of this cycle. We will continue to properly align your financial plans with appropriately risked portfolios. Patience and gratitude for what we have along with prudent planning and generosity will help all of us be happier and maybe even joyful.

We appreciate being on your financial team and referring us to those you care about most.

Thank You.

Click here to download printable version of this newsletter.

1 The larger the stock’s capitalization, the higher its weight in the index.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.