Transitionary Inflation

“The measure of who we are is what we do with what we have.”

– Vince Lombardi

Inflation is back. Is that a good thing? After billions of fiscal stimuli directed at bridging the COVID lockdowns to reopening the economy (still in process) is it surprising that prices are rising? The trillion-dollar question is, will higher prices be transitory, as expected by the Federal Reserve Bank and other central bankers, or stickier and economically more troublesome? So far, the bond market votes for the former. We are less sanguine. The repercussions of how the inflation trajectory evolves could be significant.

Fundamentals and Markets

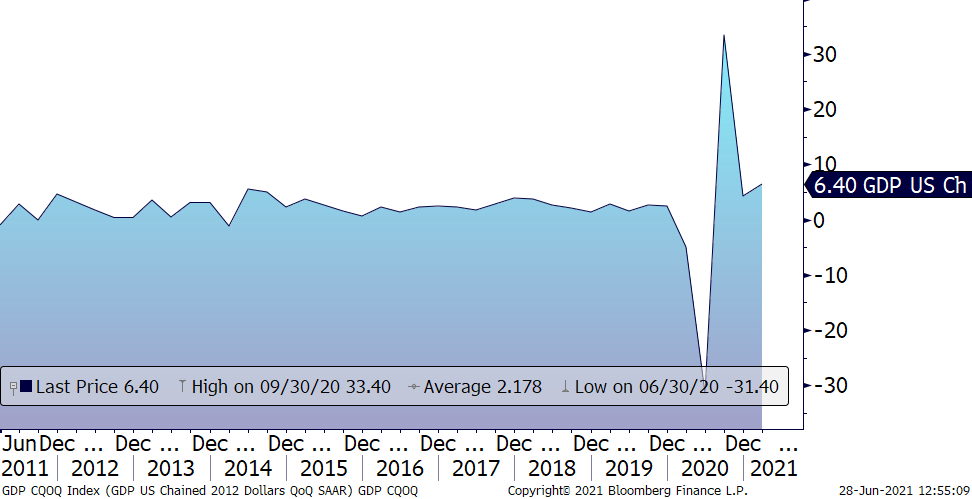

The U.S. economy is hot but its near term pace is likely unsustainable. Coming off last year’s lockdowns there is a (low) base effect. Figure One shows the sharp rebound in domestic economic growth.

Figure One: U.S. GDP Quarter Over Quarter Seasonally Adjusted Annual Rate

The pace of quarterly expansion is likely to have peaked and annual growth may subside in 2022. Unemployment fell to 5.8% in May, 2021 as businesses resumed hiring (but are finding it increasingly difficult to fill opportunities). Manufacturing activity also accelerated but delays for numerous products (from appliances to computer chips) are evident. Earnings are rebounding from weak 2020 levels with the S&P 500 consensus anticipating a 40% rise in year over year earnings for 2021. Inflation readings have jumped with May’s CPI (consumer price index) index up 0.6%. This brings the twelve month rise to 5.0% and the core (ex-food & energy) to a 3.8% yearly rise, both well above the Federal Reserve Bank’s 2% long-term target. Housing prices rose 14.9% in April vs. a year ago, the fastest rate in over thirty years!

The outlook for inflation is muddied by uncertainty surrounding the fiscal and monetary stimuli that has transpired over the last 18 months. Who can forecast how consumer savings and spending will transition as special unemployment checks end, taxes rise, and things get back to normal? The Federal Reserve anticipates a temporary inflation bounce but has signaled that it is closer to tapering (being less accommodative) its monetary policies and may raise rates once or twice before the end of 2023.

In the quarter ended 06/30/2021, the S&P 500 rose 8.1%, European developed equity markets rose around 3-10%, and Asian stock indices were mixed (+/-1%). After yields rose in the first quarter, bond markets rebounded as ten-year Treasury yields dropped from 1.74% at 03/31/2021 to 1.44% at 06/30/21. Consequently, the widely followed Barclays US Aggregate Bond Index narrowed its year-to-date losses to -1.7% through 06/31/2021. The bond rally is impressive when one considers recent inflation.

Figure Two compares annual CPI to the ten-year treasury yield in the top panel and the ratio of the ten-year yield to the average dividend rate of the S&P 500 Index in the bottom panel. The divergence between May’s inflation and the ten-year yield is striking while the yield to dividend ratio is low. The latter bodes well for equities but the former is out of balance. Either inflation must drop or bond yields will rise. If yields rise, they may pressure demand for stocks as some investors will take the higher Treasury yield rather than less yield from stock dividends.

Figure Two: Bond Yields vs. Inflation and S&P 500 Index’s Dividends

Investment Strategy

We continue to express a neutral equity risk posture in our diversified portfolios and a marginally shorter duration (a measure of interest rate sensitivity) in bonds. Valuations are not cheap in either stocks (30 times price/earnings) or bonds (negative real yields) in the aggregate. However, we still find relative value in the stocks of a number of companies with solid balance sheets, superior cash flows, and low leverage. International developed markets equity returns are lagging U.S. counterparts reflecting lower inoculation rates and spreading Delta COVID variants. Collectively these stocks appear relatively attractive and should rally as their economies re-open later this year. The potential for a weaker US Dollar (given America’s high debt levels) would also help international equity returns.

Bonds still offer little value in our opinion, so we are maintaining a lower sensitivity to interest rates and resisting the temptation to reach for yield in a low-rate environment. Investment grade U.S. bonds are collectively yielding an average of just 1.4% as measured by the Bloomberg Barclays US Aggregate Bond Index.

Outlook

Anytime markets are at or near record highs investors fret about the correction. While no one can predict future market returns, high stock valuations are likely to be already discounting some of the expected good economic and earnings growth news that may lie ahead. It would not be surprising to see both recovering earnings and multiple contraction¹ this year. Should interest rates, as measured by the U.S. ten-year treasury yield, rise to 2.5% or more, some investors may reduce their stocks and increase their bond allocations. Cyclical sectors may do better as we reopen in a post-vaccine world. Investors started to reposition portfolios away from growth stocks towards cyclical and value plays earlier this year but partly reversed this in June and currently seem to be more balanced.

What we do with what we have (time, talent, & treasure) before we depart this earth also has timeless significance as the iconic, oft quoted, hall of fame coach, Vince Lombardi reminds us in our headline quote, “the measure of who we are is what we do with what we have.” Few can argue that financial markets have generated surprisingly robust gains in this pandemic. Let’s all make the most of it!

Your Regency Team remains available for in person meetings as well as phone and/or video conference calls to discuss any issues and questions.

Click here to download printable version of this newsletter.

[1] Stock price multiples defined as price/earnings

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.