Navigating the Rapids

“How wonderful it is that nobody need wait a single moment before starting to improve the world.”

– Anne Frank

Markets navigated the rapids of heightened volatility in the quarter ended June 30th. After a stunning rebound in the first quarter, the latest three months of 2019 were like riding a raft through the rapids. The S&P 500 Index (SPX) returned 3.9% in April before a choppy investment ride in May when the SPX dropped 6.6% after a lack of progress in U.S.- China trade negotiations. The ride shifted again in June with the index rising 6.9%. For the quarter ended June 30th the SPX returned 3.8% and is now up 17.3% year-to-date. Meanwhile, the Federal Reserve drained yields as they shifted to “Dovish Mode”. Ten-year U.S. Treasury bond yields settled at 2.0% at June 30th, down half of one percent for the quarter!

Overseas, European developed stock markets outperformed U.S. counterparts in the quarter, with the notable exception of the Brexit challenged U.K. China and emerging market equity indices lagged. Measures of manufacturing activity are showing contraction in Europe and China but overall sales and consumer spending are growing.

Economic and Earnings Fundamentals

As the quarter ended, G-20 meetings were taking place in Japan with side meetings trying to re-ignite cooperative efforts to forestall further U.S. tariffs on imported Chinese goods. Tensions eased as a truce emerged with both countries agreeing to continue trade negotiations, and delay any additional tariffs.

Meanwhile, central bankers are close to commissioning a global search party for inflation that remains surprisingly and stubbornly low after numerous years of highly accommodative/loose monetary policies. The Federal Reserve (FED) changed its “patient” posture in June and seems to be signaling a rate cut(s) in the second half of this year. The Bank of Japan and European Central Bank recently made strong assurances that they will do all they can to boost economic growth through low rates and asset purchases, if needed. There is now more than $10 trillion of sovereign debt sporting NEGATIVE yields. Yes, (some) investors are willing to buy bonds and get LESS principal back when these bonds mature! A true conundrum, head scratcher, puzzle, but undoubtedly mirroring investor confusion and lack of confidence. Reflecting this, Gold rebounded 8.4% in the latest quarter to $1,413/oz. We continue to view the chances of a U.S. recession before mid-2020 as low while the chance of a rebound in inflation as a possible outlier relative to market expectations.

As we noted recently, weakening economic growth trends never instill confidence but recent strength hasn’t either. GDP (Gross Domestic Product) growth expanded to an unsupportable 3.1% in the first quarter of 2019 (revised down from a 3.4% initial estimate) and is expected by economists to be closer to 2.5% or less for the rest of this year.

Stock and bond valuations

Slower revenue and earnings growth this year for larger companies in the U.S. is expected to parallel lower economic growth. Recent sharp declines in interest rates are serving to undergird valuations as higher earnings multiples tend to go along with cheap money.

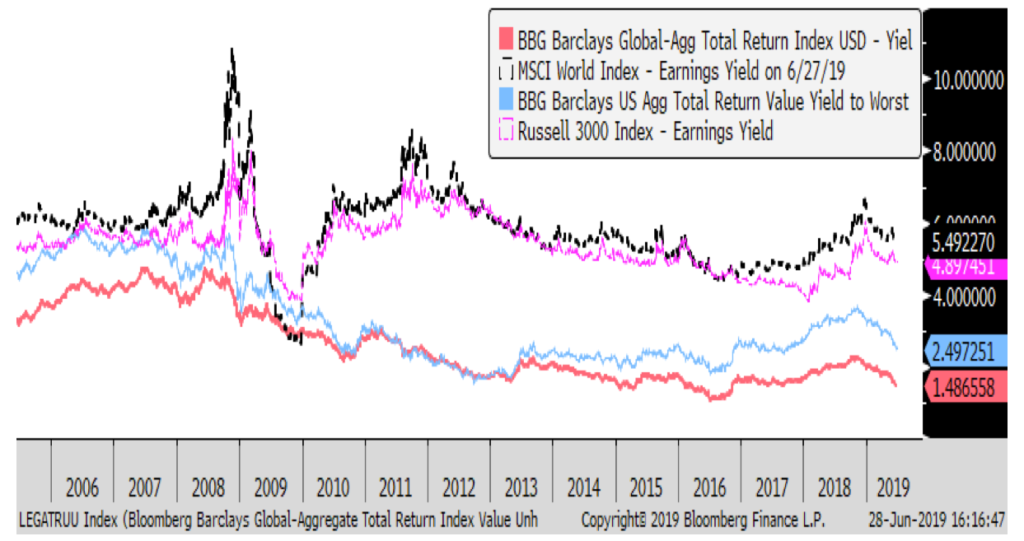

Figure One: Global rates down, Stock earnings yield rise

Figure one highlights the expanding differential in earnings yields both globally (MSCI World Index) and in the U.S. (Russell 3000 Index) relative to U.S. and global bond yields. This chart shows how bonds are offering less yield while stocks are maintaining higher than average earnings power.

While some are concerned that companies are borrowing more, many miss the substantively lower aggregate costs of servicing that debt and growth in cash flows.

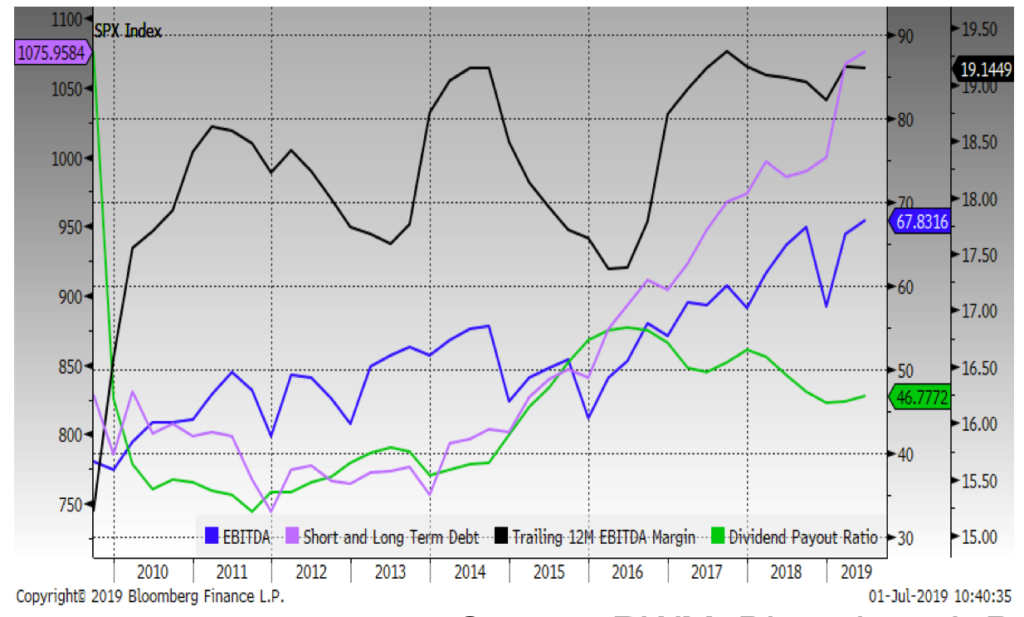

Figure Two: Leverage, Cash Flow, Margins, and Dividend Payout Ratio; S&P 500 Index

Source: RWM, Bloomberg L.P

Figure Two shows that companies in the S&P 500 Index have sharply higher short and long term debt (pink), accompanied by higher cash flow (blue) and healthy EBITDA margins (black) along with a moderating dividend payout ratios (green). We interpret this, in aggregate, to be a manageable financial position at what could be a late stage in this expansion cycle. Margins remain ample enough, on balance, to possibly absorb the lower demand that an eventual recession will bring without material collateral damage.

Outlook

Economic growth remains positive but mixed overseas and is expected to slow in the U.S. leading us to keep our neutral equity risk budgets. Low domestic yields, reflecting weaker rates and slower economic growth internationally offer little reward for extending maturities so we are maintaining a conservative and limited exposure to interest rate sensitivity.

The varied economic and corporate prognosis leave investors wondering if the rapids around the next bend will be category two or four. Will investors stay the course after this latest challenge or will they head to shore to dry out? Moves up and down through variable waters or volatile markets are part of the journey. Stock markets will rise and fall from one month (or bend) to the next but over time they historically have provided significant gains relative to inflation. The journey will likely encounter new challenges but together we hope to help you achieve your financial journey. We remind our clients and friends that time in the market usually beats trying to time the market. In the meantime, we can all do our part to improve our world.

The Regency team is happy to welcome our latest crew member, Christine Greco, Client Service Associate, who came aboard in early June. A Bergen County, New Jersey native, she brings her 19 years of experience and warm smile to our Ramsey office. Please welcome Christine!

Click here to download printable version of this newsletter.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.