Drachmatic

“…legacy planning is not about leaving a legacy, but about living our legacy.” – Dr. Richard Orlando, LEGACY

Negotiations between the leftist Greek government and European finance ministers broke down in late June prompting a missed payment to the IMF on June 30th. Elected on a platform to end austerity, the Greek administration is at obvious odds with creditors who require prudent fiscal plans. Greek’s voted NO to a July 5th referendum on additional austerity. Considering Greece’s small economy and that asset managers and mutual funds own just 1.6% of its Euro 299 billion of sovereign debt, it gathered disproportionate media attention and market reaction. Ironically, a Greek default makes Germany both weaker and stronger as they are the largest indirect creditor but also should benefit if Greece exits the Euro as the remaining membership would, by definition, be stronger. How the last act of this five year Greek tragedy plays out will be interesting but appeared to be a convenient excuse for market volatility as capital market participants repositioned portfolios into month-end.

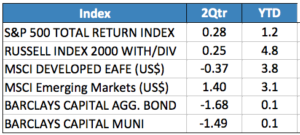

U.S. stock indices were mixed in the quarter ended June 30, European markets were weaker, and bond yields, while volatile, rose. As shown in Table One, small stocks continue to lead year to date returns. Bond indices dropped in the latest quarter as economic indicators are pointing to higher official US rates this year.

Table One: 2015 Index Returns

European stock markets were mixed in the quarter after falling in June but remained well ahead of the S&P 500 year to date. The strongest equity markets were in Asia (led by Japan and China) but these too weakened in late June.

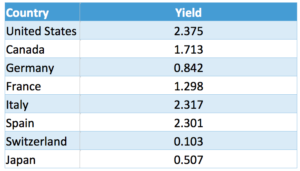

Figure One: Global Bond Yields, 7/02/2015

Global bonds sold off across most of the world until late June when Greek headlines caused investors to buy quality bonds. Nevertheless, the U.S. ten year bond yield ended 6/30th at 2.35%, up 43 basis points (0.43%) in the quarter (after shedding 15 bps in the last few days of June) resulting in a -1.68% return for the quarter. German ten year Bund yields climbed 58 bps to yield 0.76% at June’s end; a 6.0% price decline for the quarter. German two and three year bonds continue to sport modest negative yields signaling continued Euro concerns. Puerto Rico added to bond holder concerns as it acknowledged that it is unlikely to be able to repay its $70 billion+ debt on a timely basis. The island has long been a problem credit.

Fundamentals

U.S. economic data rebounded in Spring after weak consumption. The reticence to spend may reflect counterproductive U.S. rate policy. Rates have been too low for too long and don’t allow retirees or pre-retirees to safely keep up with inflation so they are reluctant to spend. However, lower unemployment rates and stronger housing sales should boost spending during the second half of this year and the Federal Reserve has signaled its intention to begin raising rates as early as September.

Curiously, the U.S. Dollar weakened in the second quarter relative to the EURO is spite of the Greek situation. This will be a modest positive for U.S. large cap, multinational companies’ earnings in the near term.

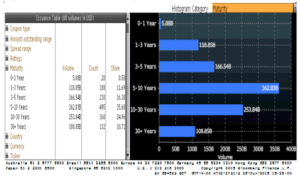

First quarter 2015 U.S. corporate earnings growth was weak but is likely to rebound in the remaining quarters of 2015. Corporate America has refinanced their balance sheets at record low interest rates and extended debt maturities thereby significantly decreasing their financial risk. Figure two shows the year to date maturity profile of new corporate issuance.

Figure Two: U.S. Companies New Issues 2015

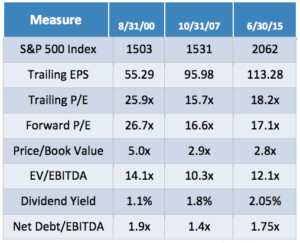

Valuations

U.S. stocks traded near record market levels before weakening at month end. The second quarter, 2015 marginal gain in the S&P extended a string of consecutive quarters of gains to ten (source: BTN Research). This index also posted ten all-time closing highs this year garnering much media and analyst speculation about an overdue “correction”. While the S&P 500 Index is not cheap, it is not yet trading at unreasonable levels and, in our opinion, U.S. stocks continue to offer relatively good alternatives to unattractive bond yields. The typical valuation metrics, as shown in Table Two, fail to capture the aforementioned superior balance sheet and cash flow flexibility that corporations have locked in by taking advantage of historically low interest rates. We view this as lowering financial uncertainty and postulate that the market has largely underestimated its import.

Table Two: S&P 500 Index vs. recent peaks

Outlook

The U.S. economic expansion should continue in the second half of 2015 and European growth is likely to improve post Greece’s travails. After a brief pullback, we anticipate equities to rebound as growth resumes.

Thank you for allowing us to help steer your finances clear of the ”potholes” so that you can grow and spread the wealth.

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, AAMS®

Click here to download a pdf of this newsletter

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.