Risks

“If no one ever took risks, Michelangelo would have painted the Sistine floor.” – Neil Simon

Risks abound in securities markets and the current environment is no exception. As we enter the second half of 2014, troublesome headlines include Jihad in the Middle East, continued unrest in the Ukraine, and uneven refereeing in the World Cup.

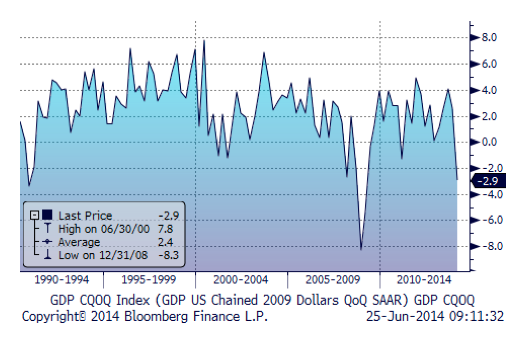

Revenues and earnings of S&P 500 companies rose at a reasonable rate in the first quarter overcoming the weak, apparently weather-dampened, GDP contraction of 2.9%. Employment creation picked up reducing the unemployment rate to 6.3%.

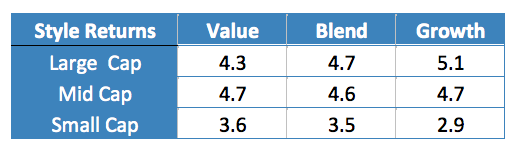

Stocks staged a solid recovery amidst soft economic data and unsettled geopolitics, (climbing the proverbial “wall of worry”) and reached record highs in June. The S&P 500 Index traded in a 150+ point range in the latest quarter. For the quarter, mid and large cap U.S. stocks outpaced smaller firms as shown in Table One.

Table 1: U.S. Style Returns 2Q2014, MSCI

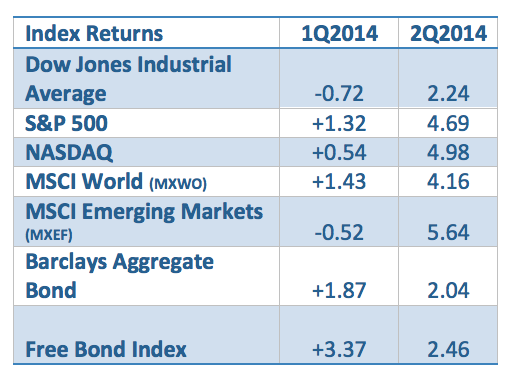

The S&P 500 Index climbed 4.7% in the second quarter while the DJIA rose 2.2%. Volatility was subdued in spite of continued uncertainty in Eastern Europe and the Middle East. The MSCI World Index (measuring developed markets) returned 4.2% this quarter (the UK’s FTSE Index +4.6%, German DAX Index +1.7%, Spain’s IBEX 35 Index +5%) measured in U.S. dollars. Asian stocks also rose with the Nikkei up 4% and the ASX 200 up 2%. Emerging markets also rebounded rising 5.6% as measured by the MSCI Emerging Markets Index.

Table 2: First Half 2014 Returns

Weather induced paralysis likely helped drop GDP to its weakest reading since 2009 as shown in Figure 1 below. Our earlier expectation of a 2.5-3.0% GDP growth in the U.S. for 2014 is looking aggressive but we think 2.5-2.8% is still achievable as consumer and business spending likely accelerated in the second quarter ended June 30th.

Figure 1: GDP dropped in First Quarter, 2014

New job creation is helping reduce unemployment and it could well approach 6% by year-end. Job growth is unlikely to pressure wage gains and feed inflation until it approaches 5%, possibly by early 2016

Bonds rally again

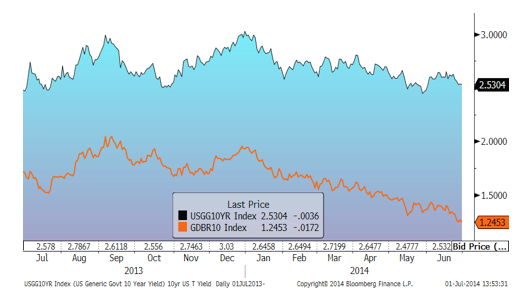

The first quarter’s flight to quality rally continued into the second quarter. The ten year US Treasury bond’s yield dropped as low as 2.41% before rising to 2.65% and then falling back to 2.53% at quarter end. Mohamed El-Erian, Allianz’s Chief Economic Adviser (and ex-PIMCO co-CIO) pointed to both behavioral finance and institutional considerations – “investors have yet to see sustained pain from lower bond prices…no urgency in shedding bonds. In fact, higher prices have attracted investors who chase after past performance. Some investors are also hesitant to buy stocks at record prices.” El-Erian also noted that some institutions with large pension liabilities are matching those liabilities with long term bonds and bond traders are short the market. Municipal bonds also rallied this past quarter but longer maturities also remain vulnerable to losses once rates rise.

Figure 2 : 10 year US (top) vs. German Bonds

As seen in figure 2, low rates in Germany heighten foreign investor appetite for U.S. government’s higher yielding bonds. While US bond’s relative yields are boosting prices in the short term, the risk/reward in bonds remains unappealing to us. Returns are limited if things go right and the losses might well be significant when rates rise. We continue to favor shorter bond maturities complemented with higher yielding sectors (corporates, high yield loans & bonds, and preferred stocks).

Outlook

Full year returns for domestic stocks are less likely to exceed 10% unless underlying economic activity picks up materially. If it does, multiple expansion to 19x+ price/earnings (P/E) for the S&P 500 is possible. If it doesn’t, the current 18x P/E will be hard to maintain. Ahead of mid-term U.S. Congressional elections, we don’t expect any meaningful legislative progress.

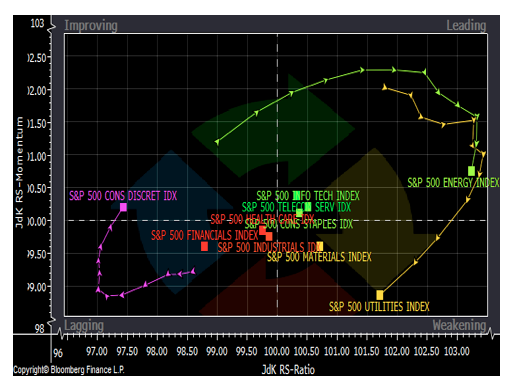

Figure 3 : S&P 500 Sector Momentum and Relative Strength, twelve weeks ended 6/30/14

Figure 3 graphs industry sectors by relative momentum and relative price strength for the S&P 500 Index. Energy is the only one showing both strong relative momentum and relative price trends over the last twelve weeks. Utilities have done well but their momentum is weakening while consumer discretionary companies have lagged yet are gaining momentum. The lack of sectors with both improving momentum and improving relative strength may be a signal for near term caution. Call us with any questions.

Thank you for allowing us to be on your team as we navigate risks together to paint a better financial picture

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, AAMS®

Click here to download a pdf of this newsletter

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.