Tapering

“Live as if you were to die tomorrow. Learn as if

you were to live forever” – Mahatma Gandhi

Tapering was the term bandied about most frequently in the second quarter – Encarta defines the transitive verb, taper – to become smaller in size or amount, or less important, especially gradually. The Federal Reserve Bank (FED) has been pursuing an aggressive monetary stimulus program by buying U.S. treasuries and mortgage backed securities in the open market to increase liquidity and lower interest rates ($85 billion per month!). This has been referred to as QE3 (3rd iteration of quantitative easing). These temporary efforts may taper later this year and bond purchases could end as early as mid 2014, as per FED Chief Bernanke, when unemployment is below 7.0%. Official lending rates of 0-0.25% would not be increased until the unemployment rate drops below 6.5% – possibly in 2015. The challenge for the FED is multi faceted – how to transition its monetary policy to normalcy without dislocating bond and equity markets. The bond market will no longer have an uneconomic buyer (the FED that has been buying treasury notes at unattractive levels where long term investors would not buy) and interest rates will likely rise to attract new investors. One consequence of ending this extraordinary monetary easing will be for investors to recalibrate their demand for bonds, dividend paying stocks, and alternative income products. As (higher) treasury bond yields again become reasonable alternatives with lower relative risk, credit sensitive bonds will be re-priced lower as investors demand higher yields to take on the added default risk. Hence the increasing speculation of when and how the FED will taper its current program.

A necessary pullback

This concern rose concurrently with mixed first quarter earnings releases that were consistent with weak, but positive economic growth. Although the S&P 500’s first quarter’s earnings growth was anemic, corporate cash levels are close to record highs and the recent refinancing of corporate balance sheets provides a sizeable cushion to EPS. While not as cheap as seven months ago, stocks remain attractive. International stocks are cheaper but challenged by weaker Global growth rates and elusive confidence. Debt financed government deficits continue to restrict more productive private sector alternatives.

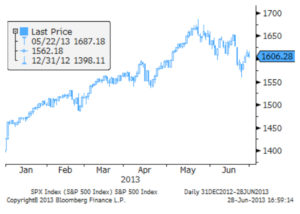

Most international stock markets dropped in the second quarter. The S&P 500 returned a respectable 2.9% in the just ended quarter but it and US Treasury bonds declined in May and June. Let’s face it – it was an impressive run-up for stocks prior to this pull back. The S&P 500 rose to 1669, up 19.4% from 12/31/2012 to 5/21/2013 before shedding almost 4 % to 1606 at 6/28/2013.

Figure 1: S&P 500 2013 YTD

U.S. equity performance varied widely as shown In Figure 2. Investors sold the high dividend yielding utility sector in favor of financials and consumer discretionary firms in the quarter. Aggregate valuations remain reasonable with Price/Earnings of roughly 14x forward earnings estimates. Dividend yields remain over two percent.

Figure 2: S&P 500 Sector Returns 2013 Second Quarter

Bond Yields are finally moving higher

Before this latest quarter the bond market was skeumorphic (a technology term where virtual things look like real things). Many investors extrapolated artificially low interest rates as if they would remain there for another few years before smoothly rising to realistic levels. Alas, market reality tends to be abrupt during transitions and we have just witnessed the first of a series of adjustments toward higher interest rates that likely lie ahead. The Barclays Capital U.S. Aggregate Credit Index lost 2.3% while the Barclays Capital Municipal Bond Index lost 3.0% in the quarter. As shown in Figure 3, the ten year US Treasury yield spiked in June as markets reacted to Fed tapering fears. Although we highlighted this risk in our April missive, we were surprised by the magnitude and movement of yields in June.

Figure 3: S&P 500 Earnings Yield vs. 10 yrTsy

The severity of this market reaction reflects limited liquidity and excessive leverage in credit markets. The selloff seems overdone but we continue to expect gradual upward pressure on rates as the economy continues to mend and Fed tapering begins. Mortgage rates rose about 1/2% and will rise proportionately but should not yet impede the housing sector’s rebound.

How much higher and how fast will interest rates rise? We don’t know – but we are not alone. Uncertainty continues to lead some households to under-employ savings and carry inordinately high cash reserves earning close to zero. That purchasing power eroding strategy will also work if stocks drop meaningfully, interest rates spike up, and cash is then deployed at just the right time. We don’t foresee either and there is always the possibility that a geopolitical event occurs drawing investors to the US as a safe haven. Our base case remains that the US economy continues to march along at a 2-2.5% growth rate this year and 2.5-3% next year. This should allow unemployment to recede towards 7% or lower allowing the Fed to end QE3. We are therefore carrying a mix of shorter duration bond exposures and starting to hedge portfolios by shorting long duration treasuries. Some investors will be tossed about as rates rise. Others, including our clients, are better positioned. Please call us if you would like to discuss further.

Chances are we are not going to die tomorrow but we know that none of us will live forever (in this life anyway). But we can always learn and look ahead. We can also look beyond ourselves. We applaud our clients philanthropic ways and encourage all to continue showing gratitude for what we have by sharing with those that are less fortunate.

Thank you for your continued invitation to be an integral part of your financial team.

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®,CMFC

Timothy G. Parker, CFA

Click to Download a PDF of this newsletter

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.