Look Out Below

“It is not prudent to sacrifice principle for the sake of yield” – Anonymous

Muni bonds can be hazardous to your financial health. After providing good income and even better total returns, intermediate and long maturity municipal bond investors are at risk to losing value. Almost $2 trillion of municipal bonds are directly owned by individual investors today. The income from these bonds has been exempt from Federal taxes.

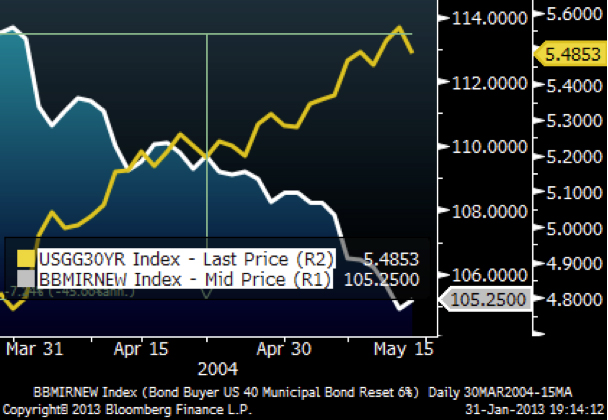

Figure 1: Bond Buyer US 40 Municipal Bond Reset 6%

What’s not to love? Plenty, in our opinion as we look into likely scenarios in the future and foresee a major financial accident in the making. No, we don’t mean a recession or global systemic meltdown a la 2008. Rather it is the value destruction that will result from rising interest rates on what is supposed to be the safe part of one’s investment portfolio – bonds. Interest rates are near historic lows and the majority of municipal bond maturities are long (an estimated ¾ of municipal bonds mature in seven or more years and $500 billion mature in 15 years or more) . The good news is that investors are enjoying decent yields in an environment of financially depressed alternatives (CD are now being described Certificates of Depression reflecting their paltry yields).

The bad news will be painful as the interest rate risks inherent in high priced, long maturity bonds is startlingly huge.

Enduring the details

At Regency, we have been warning clients about the high negative skew in bond returns at the current interest rate levels. Think of it this way; how much would you pay someone who has a CD earning 1% for five years when newly issued CDs reach 5% again? Obviously a lot less. The sensitivity of the bond’s price move is measured by its duration (the volatility of its price to changes in rates). Bond prices move inversely to interest rates. So higher interest rates lead to lower bond prices. This sensitivity to higher interest rates is worse this time around as many bonds carry “call” features. Many longer maturity bonds are callable – that means that the issuer can redeem the bonds after set dates and at set prices. When rates are low, investors price bonds to their call date/price since they are likely to be retired at the specified call date and price (the issuer would sell new bonds in the market at low rates to pay off the old ones). But if interest rates climb, bond investors then price these bonds to maturity as the issuer has no incentive to retire the bonds early. Thus the potential price movements are asymmetrical – prices move up less for callable bonds as rates drop and prices drop more for them as rates rise.

It gets worse

There are two other headwinds to municipal bonds today as trading is less liquid and credit risk is higher. There is a wider “bid-ask” spread in the secondary trading market for municipal bonds (the “bid” is what someone is willing to pay, the “ask” is where someone is willing to sell the bonds). The average rating (a relative estimate about its default risk) on municipal bonds has also dropped (meaning that the estimated default risk has increased). Prior to 2008 about half of the municipal bonds issued carried bond insurance that raised their credit rating to AAA. Less than 5% of muni bonds issued last year were insured. All fine and good, you say, but what does it have to do with me? I like the income I am getting from these bonds and I am confident I will get my money back. While the income stream from these bonds is reasonable (especially after we tax effect them for not paying Federal taxes), your effective “yield” on these bonds is lower. These bonds are trading at a “premium”, much higher than their par value, so the current income represents a lower yield on their current market price than when you bought them. The market yield (or yield to maturity) is even lower as it factors in that the price of the bond will drop back to par as it nears maturity. Bond investors who hold these securities until they mature will get their initial investment back and the interest income in the interim but they will lose the premium that these bonds are currently trading at – guaranteed!

Time to act? What’s the hurry? Isn’t the Federal Reserve committed to keeping interest rates low until unemployment is below 6.5% (currently at 7.9%)? Yes, but as the biggest buyer of long dated U.S. Treasury bonds in the market, it will eventually not only stop buying them but may eventually sell them pushing down their price (and increasing their yield). The market will try to anticipate this and when market interest rates move up they may do so violently! Major financial transitions always end in tears. We think this is one financial accident that you can avoid and being too early is better than regretting inaction after it is too late.

Figure 2: 30 year US Treasury Yield vs. Bond Buyer US 40 Municipal Bond Index

The above chart depicts a five week rise in 2004 of the 30 year US Treasury bond yield of just 0.7% that resulted in a 7.2% loss in this index of 40 benchmark municipal bonds. A rise in the current 30 year bond yield from 3.2% to 6.2% would result in more than a 25% decline in this index! We agree that a rate spike is unlikely to happen in a few weeks but by the time rates start to normalize from their government induced abnormally low level it may be too late to avoid painful losses in those long term municipal bonds you love. The last time the Federal Reserve Bank raised official rates was in 2004-2005 when they boosted the discount rate from 1% to 5% in 18 months. Better to be early and protect principle than to chase a little yield at this juncture.

Call us if you would like to discuss this further!

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Click to download a PDF of this newsletter

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.