Impact

“When you learn, teach. When you get, give.”

– Dr. Maya Angelou

Impact as in our contribution to society, should be a common goal. How do we use our God-given ability to make this a better world? Who poured wisdom into us? Who are we pouring into? Some things to ponder as we enter a new year.

Markets

Investors poured money into the U.S. stock markets in 2024 extending the 2023 rally. Technology stocks led the way boosted by impressive strides in Artificial Intelligence (AI). For the year, the three major U.S. indices, Dow Jones Industrial Average (DJIA), S&P 500, and NASDAQ Composite rose 13.8%, 23.5%, and 28.6% respectively. All Western European stock markets trailed the U.S. and only a couple of Asian stock markets rose as much as the DJIA. Bond market returns were mixed and subdued even as Central Banks lowered their official interest rates. The Bloomberg U.S. Aggregate Bond Index (AGG)1 rose just 1.3% for the year as investors considered a possible inflationary encore amid growing fiscal deficits in 2025 and beyond. For all of 2024, Crude Oil (WTI Cushing Crude) was up 1% while Gold rose 27.3%.

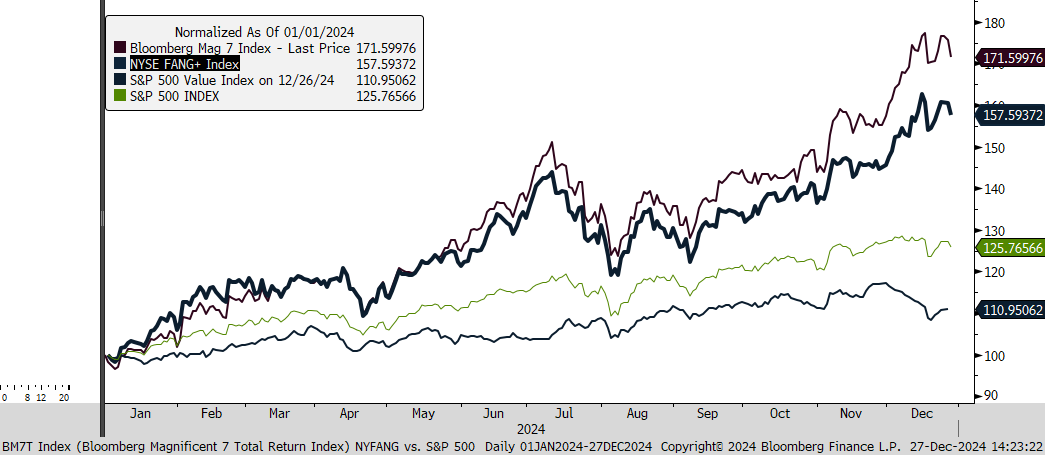

Arguably the most impactful group was the tech-heavy “Magnificent Seven” (Mag7)2 gaining headlines and heady returns. These stocks were up an average of 68% in 2024 as depicted in Figure One. Moreover, they are up 535% over the last five years. They also have valuations that anticipate significant continued earnings growth (an average of 37x forward Price/Earnings, 9x Price/Sales).

Figure One: Mag7 and NYFANG outpaced S&P 500 and S&P 500 Value indices

Source: RWM, Bloomberg L.P.

Investors are now left with a quandary. Should they chase these stocks hoping that they continue to outperform or take profits and rebalance their portfolios to more diversified realms? How about bonds? Glad you asked.

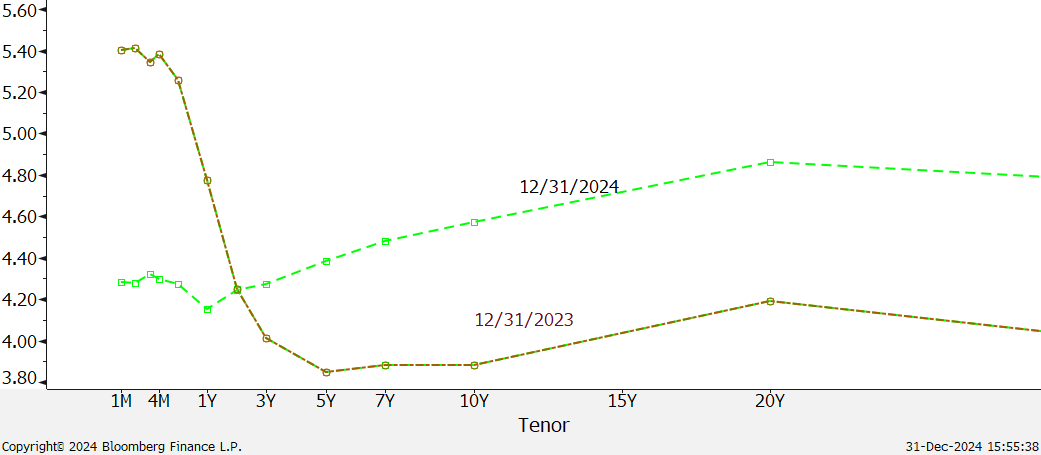

Figure Two: Year-end U.S. Yield Curves ‘23-‘24

Source: RWM, Bloomberg L.P.

Figure Two shows how the U.S. yield curve transitioned from inversion to a (modest) positively sloped one this past year. The Federal Reserve (FED) cut its discount rate 1% from September through December but signaled that further cuts in 2025 will remain data dependent and are anticipated to be less frequent. Although lower inflation rates allowed the FED to cut rates, inflation remained above the FED’s 2% annual target (CPI, Consumer Price Index, expanding at 2.75% annual rate in November). Unemployment, at 4.2%, is still low but up 0.8% from its lowest point. With a 4.9% yield, investment grade bonds are reasonable but not compelling in our view. We are neutral to the index’s interest rate sensitivity and expect the ten-year treasury yield (4.57% at Year End 2024) will continue to be volatile in 2025.

Fundamentals and Valuations

U.S. stocks (as measured by the S&P 500 Index) continue to trade at a significant premium to historical averages. In part, this reflects AI’s expected potential promising improved efficiencies across most industries. At 26x Price/Earnings, there is little room for disappointment regarding expected double-digit earnings growth in 2025.

Consumer confidence remains high, but consumer and commercial delinquencies are trending up. Lower interest rates allowed corporations to reduce debt levels and interest expense and are thus less vulnerable to lower economic growth. Housing remains moribund as first-time home buyers find higher prices and higher mortgage rates hard to digest.

Outlook and Investment Strategy

Investors anticipate that the FED will be successful in generating a soft landing where inflation is modest and economic growth remains positive. A surprise recession would likely be bullish for Treasury yields but bearish for stocks while higher inflation may hurt both stocks and bonds as interest rates would rise.

The Trump Administration is bound to have a significant impact globally over the next few years. Whether you voted for him or not, we all have a personal interest in its success or failures. Trump promised swift and broad policies that could improve economic competitiveness or experience unforeseen snags in trade, labor, and government funding. Geopolitical risk remains elevated and could affect energy prices, rates, and economic growth if they worsen. As always, prudent diversification and risk management are paramount.

As we look to 2025 and beyond, we encourage all of us to consider making a positive impact on our families, neighbors, friends, clients and colleagues so that we can constructively make a difference to all. Let us make good use of what we have learned and give freely in this new year.

Thank you for allowing us to be on your financial team and for referring us to those you care about most.

Click here to download printable version of this newsletter.

[1] The “AGG” is a commonly used measure of US$ investment grade government, mortgage, and corporate bonds.

[2] The Bloomberg Mag7 index (BM7T) tracks META, AAPL, GOOGL, AMZN, TSLA, NVDA, and MSFT.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.