Fear

“The greater the obstacle, the more glory in overcoming it.”

– Jean Baptiste Poquelin “Moliere”

As we end another year that had plenty of negative news headlines (obstacles) and look ahead to 2024, we feel compelled to address an important topic in our culture: FEAR. Along with intense geo-political developments and cultural divisiveness that seems to permeate our globe, the media continues to feed this basic human emotion of being afraid. There is no lack of podcasts, Tweets, headlines, studies, warnings, and forecasts (sometimes cloaked as prophesies) by charlatan hawkers, often about a doomsday or reckoning heading our way: “Guaranteed!” Or is it? Let’s calm down and look behind the curtain of those crying “wolf”! We posit that most, if not all, of those who are ultra bearish are either selling a book, a subscription to a newsletter/research product, crypto, or precious metals. Are they ever objective and not trying to cash in on the fear that they engender and fan? We all know that economies and markets are cyclical. Don’t we? We are all looking to be good stewards of our wealth and so we need to stick to basic investment principles without being distracted by hype, hyperbole, or fear.

Fundamentals

That is not to say that all is rosy with the world. Our government finances seem undisciplined. Wars in Ukraine and Israel are ongoing. Climate change and social challenges continue. 2024 is a Presidential election year. At least Covid seems to be in our rear-view mirror, but it left a lot of pain and distortions in its wake. Some (much?) of the last two TRILLION dollars in aid to shore up our economy may have been superfluous and contributed to inflation’s 2022 spike. While the U.S. was not alone in fighting COVID, we were relatively aggressive in financing economic stability.

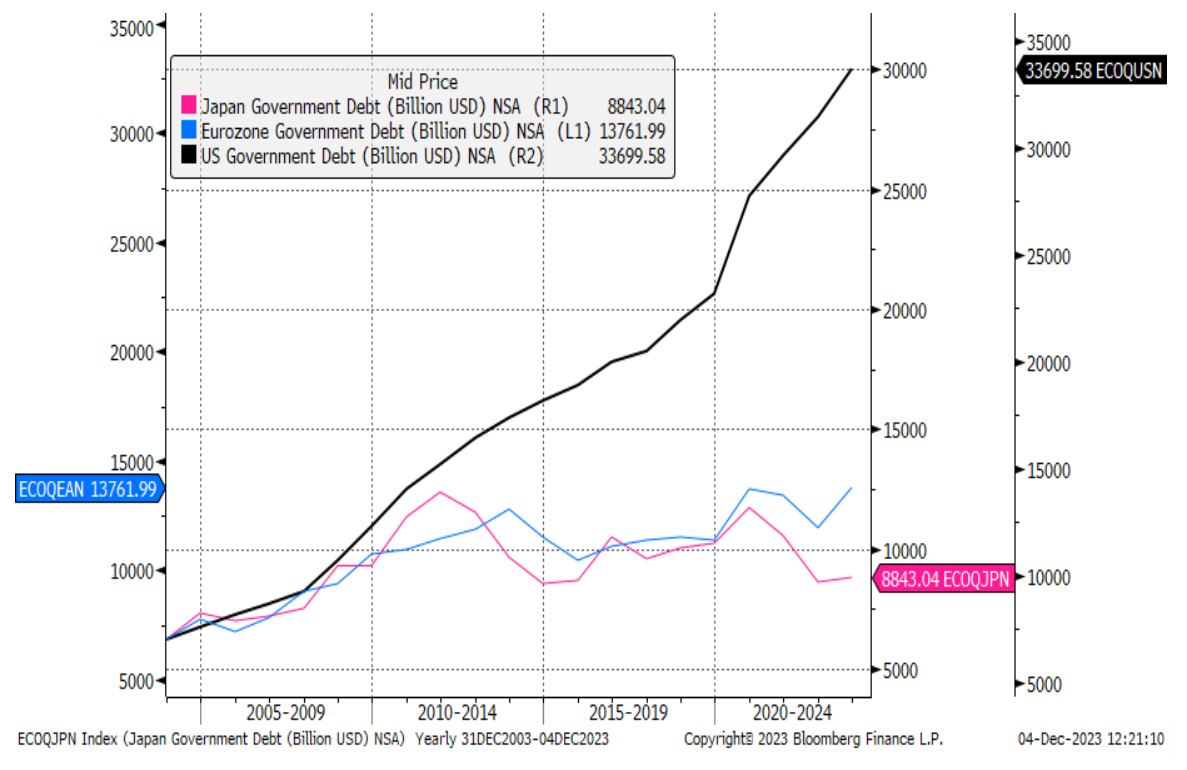

Figure One: Relative growth of Debt

Source: RWM, Bloomberg L.P.

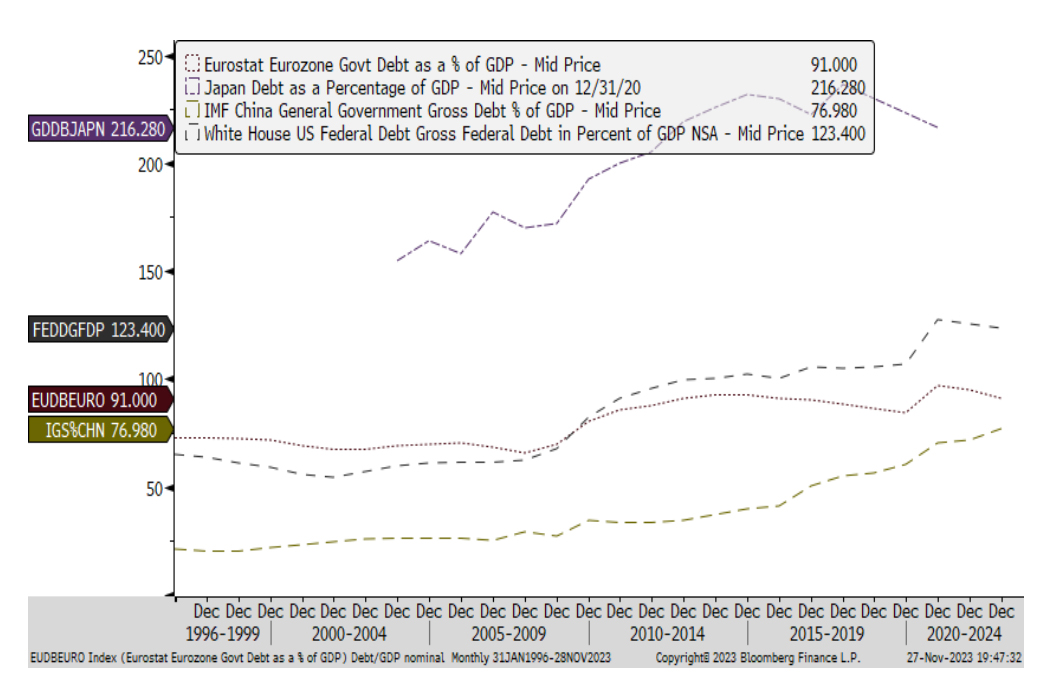

Figure one depicts the relative growth in Debt ratios for the U.S., Eurozone, and Japan. The lower two lines are Europe and Japan. Our debt (top line) expanded faster than most. It now represents 121% of our GDP (Gross Domestic Product).1 That is higher than the Eurozone and China’s debt/GDP ratios but much lower than Japan’s, as depicted in Figure Two.

Figure Two: % Debt/GDP

Source: RWM, Bloomberg L.P.

Markets

In spite of our government’s fiscal miscues, the S&P 500 Index rose an impressive 24% in 2023 as a handful of Information Technology stocks skewed results. The tech-heavy NASDAQ was on fire growing 43%! Broad gains were recorded internationally in most developed markets. Bond yields remained volatile, but the Bloomberg U.S. Aggregate Index returned 5% for the year. It starts 2024 with a 4.5% yield and is likely to have another positive return in 2024. Gold rose a modest 13% in 2023. Crude Oil (WTI Cushing Crude) dropped 10.7%.

Valuations

Neither stocks nor bonds carry compelling valuations as we start the new year. U.S. stocks (as measured by the S&P 500) are trading at an average price/earnings (P/E) of 22 times. P/Es are closer to historical averages when adjusted for the higher priced and faster growing leaders. The S&P 500 Information Technology Sector and Software firms trade at 34-35X trailing P/E. In contrast the average P/E of Regency’s individual stock buy list is 19.4X.

Outlook and Investment Strategy

Is a downturn in our economy overdue? Perhaps. Does a recession equate to investment losses? Sometimes. Historically, markets have always recovered from corrections. Will the U.S. Government default on its debt? Highly unlikely! Does our increasing government debt have potential negative consequences? Probably, if unchecked. However, there are reasons that America is the largest economy in the world including open capital flows, a robust legal system, regulation, and governmental checks and balances. Next time you read an ultra-bearish commentary that exaggerates our country’s high debt, government disfunction, or impending bank failures, take a deep breath and remember that they may be trying to scare you into buying gold or silver (or a newsletter or book) so that they can increase their revenues.

Remember time-tested investment basics including portfolio diversification, balance, and patience. Analysis of management, cash flows, leverage, competitive advantage, technology and regulatory risks always matter in the long run. Basic bond math and a bond’s risk analysis also matter. When markets drop (and they do), money doesn’t evaporate, it changes its address, moving from those who sell out of fear to those who see an opportunity and buy. Seldom does a stalwart company that is not dishonest implode overnight. If a leading company’s fundamentals are intact and the stock falls sharply on actual or potential earnings shortfalls, its stock price often overshoots, and its valuation drops to a more attractive price. Careful analysis is, of course, needed to inspect the investment’s risk/reward and valuation relative to sustainable earnings and cash flow. That is not to say that economic cycles or government policies are unimportant. They are, but they must be objectively analyzed and reviewed in context of consensus expectations, valuations, and underlying fundamentals.

Obstacles will likely be with us in 2024. The highly expected recession may yet arrive. The FED may lower interest rates, but we suspect that it will not cut rates as early or as deeply as the consensus expects.

Be cautious and skeptical of those peddling doomsday. We will be. Do not succumb to fear. We won’t as we look to navigate market, economic, and political challenges.

Thank you for allowing us to be on your financial team and for referring us to those you care about most.

Click here to download printable version of this newsletter.

1 A comprehensive measure of U.S. economic activity. GDP measures the value of the final goods and services produced in the United States- Bureau of Economic Analysis. www.bea.gov.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.