Recession Ahead?

“The measure of who we are is what we do with what we have.”

– Vince Lombardi

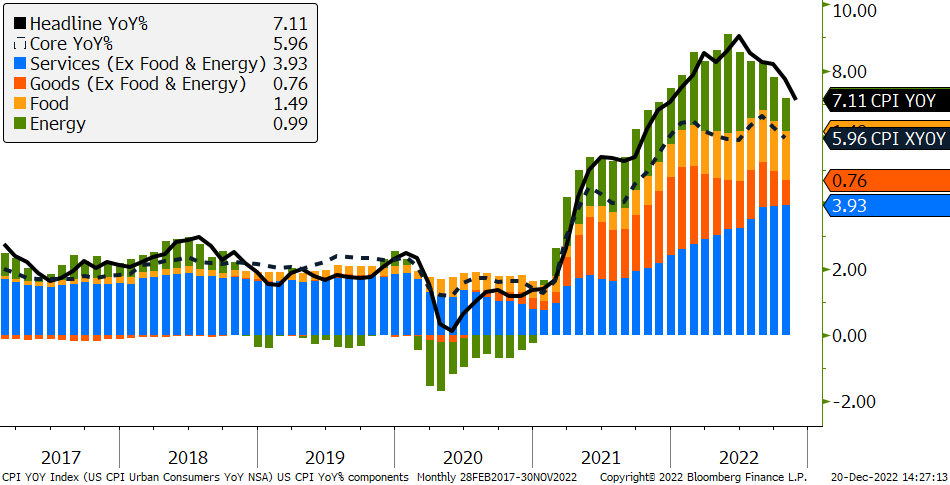

Happy New Year! After 2022’s hard landing in stock and bond markets we can now look to see how soft or hard the economy lands as it approaches a possible, much-anticipated recession1. 2022 was unkind to investors as most Central Banks (CB) moved to drain liquidity and raise interest rates to fight inflation amidst fiscal largess that might run at cross purposes. Domestically, our government enacted trillions of dollars in stimulus bills in 2022. Western European governments also worked to soften higher food and energy costs that resulted from the Russia/Ukraine war and Asian governments addressed other issues. Material increases in government spending may soften weakening economies but may also make it harder to tame inflation. The good news is that inflationary pressures seemed to peak last summer as shown in Figure One, below. The unwelcome news is that U.S. inflation is still well above the FED’s 2% goal.

Figure One: U.S. CPI YOY components

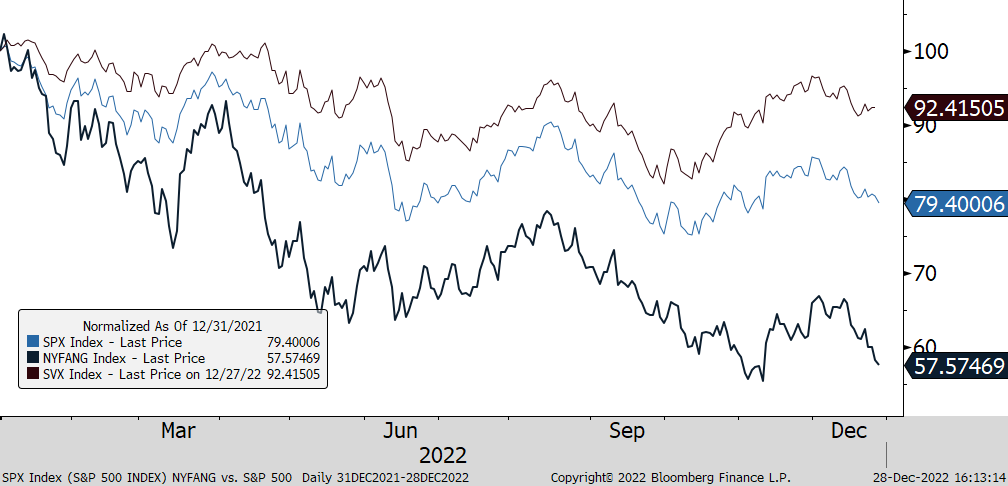

Investors expected the FED to raise rates modestly in 2022. Instead, the Fed Funds rate rose 4.5% in nine months! The speed and magnitude of rate hikes hurt both stock and bond markets. Stock prices reflect a company’s expected future earnings discounted by a risk-free rate and a variable premium (that reflects idiosyncratic factors) so the higher the discount rate, the lower a stock’s theoretical price. Bonds are simpler as bond prices move inversely to interest rates. Non-government bonds have additional risks (credit, repayment, and call features, etc.) so their price incorporates a premium spread over and above that of government debt. It is unusual for both stocks and bonds to lose value at the same time, but they did so in spades in 2022. For the year, S&P 500 Index dropped 19.7% while the Bloomberg US Agg Index lost 13%. The NYFANG Index2, representing ten high growth firms, bore more pain, dropping over 40% as shown below.

Figure Two: Value stocks beat Growth – NYFANG Index vs. S&P 500 Index and Value Index

Of note, most international developed markets, while down in 2022, lost less value that the S&P 500 Index did. Globally, investors fear a slower economic landscape that higher rates usually foretell, i.e., a recession. Fortunately, the U.S. enters this slowdown with strong employment and high liquidity. The strong labor picture, solid real estate markets, higher, but still moderate, interest rates, and strong banking, corporate and consumer balance sheets should help cushion the economic pain. The strong fundamental backdrop may also result in a shorter and shallower recession than average.

Valuation

Although stock markets are cheaper, they are still not “cheap” as indices are near historical averages. U.S. stocks as measured by the S&P 500 are trading at P/Es of 19 times trailing earnings and 17 times forward price/earnings as investors look through the near-term slowdown into recovery years.

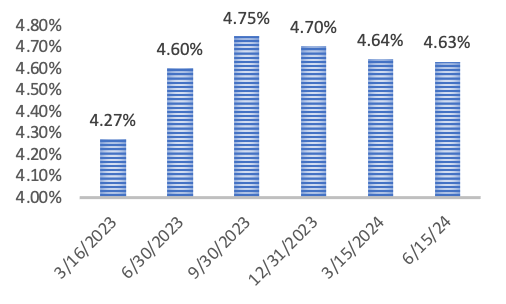

Figure Three: Comparison of 10-year Treasury Yields vs. Fed Funds rate

Bond investors expect the FED to have to lower rates in late 2023 as the economy slows as reflected by the large spread between the two-year note and the ten-year Treasury bond. The former represents value to us in an uncertain rate environment while the latter does not. The U.S. dollar strengthened materially against most major currencies in 2022 signaling varying levels of stress and low investor confidence abroad. Dollar strength may have precluded gold price returns from performing better in an otherwise higher inflationary environment. Modest dollar weakness could assist both gold and international equity returns in 2023.

Investment Strategy

While the next recession may be some quarters away, stocks can still record positive returns before and through the recession if inflation expectations moderate and earnings stabilize. The market may be pricing a more severe recession than we expect. We are therefore maintaining a neutral, diversified, and partly hedged risk allocation. Regency also de-risked fixed income exposures by reducing credit exposures and eliminating high yield positions. Importantly, the bond market selloff created an opportunity to take advantage of yields in the front end. We created a “mini-ladder” in most portfolios – allowing our clients to earn about 4.6% per annum over the next 18 months with no loss potential if they hold these to maturity.

Figure Four: U.S. Treasuries Mini-Ladder

Outlook

Major stock indices were not only down in 2022 but were very volatile, reflecting uncertainty over how the liquidity drain will affect economies. How quickly will inflation decline? Will excess fiscal stimuli contribute to higher interest rates for longer? Will the FED and other CB stop raising rates in early 2023 and start lowering them later in the year or will they have to resume hikes if inflation remains high? Uncertainty and volatility will continue until inflation declines materially.

In uncertain times, investors need to stay disciplined and focus on the long-term. Thank you for allowing our team to collaborate with you as we navigate through this cycle. Your Regency team remains available for in person meetings, telephone and/or video calls to discuss any issues and questions.

May 2023 be a better year, in every way, for all of us as we do well with what we have.

Click here to download printable version of this newsletter.

1 A recession is confirmed by NBER, the National Bureau of Economic Research as involving significant declines in economic activity spread across sectors and lasting more than a few months.

2 AAPL, AMD, AMZN, GOOGL, META, MSFT, NFLX, NVDA, SNOW, TSLA

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.