Growing Pains

“The human being is born with an incurable capacity for making the best of things.”

– Helen Keller

Happy New Year! Two years, and counting, of dealing with COVID-19 and its variants! Many have struggled with the virus and related challenges. As the quote from Hellen Keller reminds us, we are all born with a capacity to make the best of things. We all hope and pray that 2022 will be a better year for local and global health issues as the virus turns endemic.

Equity investors made the best of it in 2021 as they rewarded the robust earnings posted by most S&P 500 companies by bidding up prices, underpinning confidence in an otherwise strepitous year. Continued low interest rates also helped draw in equity buyers. Consequently, equity markets rebounded to record highs in 2021. Both stocks and bonds were sensitive to any renewed fears of delayed normalcy from COVID variants, but pullbacks were limited. The S&P 500 Index rose in nine of the twelve months while the Bloomberg U.S. Aggregate Bond Index dropped in seven months as inflation rose and the Fed signaled it was likely to end ultra-accommodative policies in 2022. For the year, these indices rose 26.4% and fell 1.54%, respectively.

Fundamentals and Markets

Job growth seems sustainable, real estate is strong, and interest rates are low. Large publicly traded companies are enjoying near record profit margins. Stock valuations are above average but still reasonable relative to expected earnings. In contrast, bond prices look very rich.

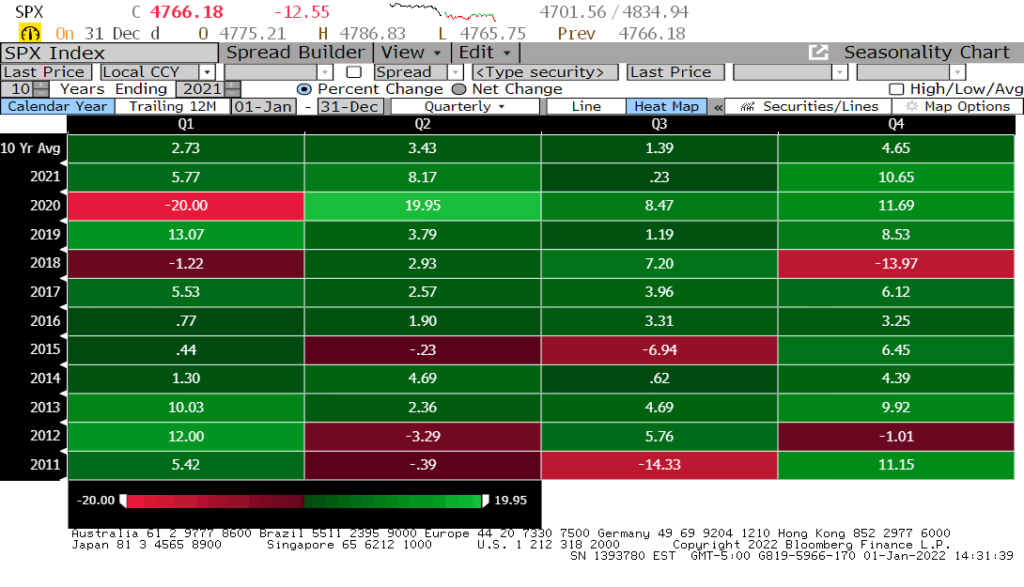

As reflected in Figure One, U.S. stocks, as measured by the S&P 500 Index, rose every quarter last year and extended the consecutive quarterly gain streak to seven.

Figure One: S&P 500 Index quarterly returns

Note that the average annual return for the last three years was an impressive 24%! The last decade’s average was 12.2%, and that was well above the 6.9% twenty-year average. What will 2022 be? We suspect returns will moderate but don’t foresee a recession before late 2023 or 2024.

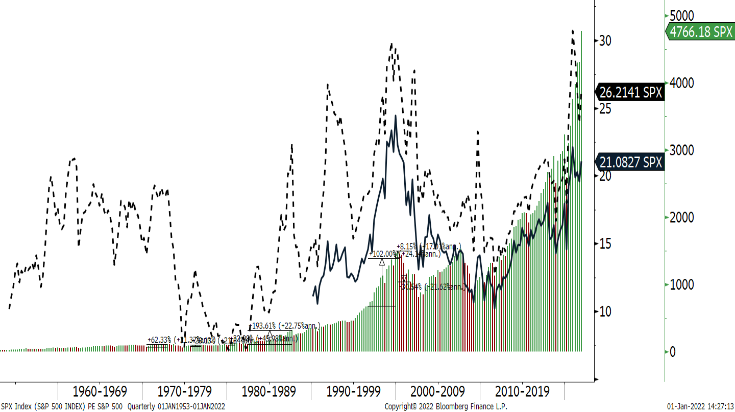

Figure Two: S&P 500 Index returns and P/Es (Price/Earnings) multiples

Valuations are not cheap with stocks trading at P/Es of 26.2 times trailing earnings (— dotted line) and 21.1x forward price/earnings (- dark line), as depicted in Figure Two. The U.S. equity markets, as measured by P/Es is less expensive than it was pre-pandemic reflecting robust earnings growth. Third quarter earnings growth was unsustainably 40% higher than 2020’s third quarter on the back of a 17% expansion in revenues.

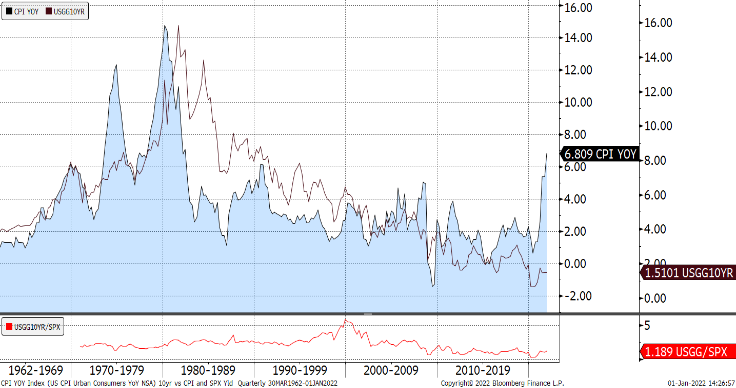

U.S. ten-year Treasury yields ended 2021 yielding 1.51%, three basis points lower from three months prior. Inflation, however, is running at an estimated 6.8% year-over-year rendering U.S. bonds unattractive (negative real yields across the maturity spectrum).

Figure Three: Ten Year Treasury bond yields vs CPI (Consumer Price Index) YOY (Year of Year)

In the quarter ended 12/31/2021, the S&P 500 rose 9.4%, European developed equity markets were up 2-8%, and Asian stock indices were mixed returning -5.5% in Japan and a +4.1% in Australia.

Investment Strategy

We modestly increased our risk posture last quarter and are keeping that profile in our diversified stock portfolios as we enter 2022. International developed markets equity returns have lagged U.S. counterparts reflecting lower inoculation rates and spreading COVID variants. Collectively, these stocks appear relatively attractive and should rally as their economies re-open. The potential for a weaker U.S. Dollar (given America’s higher absolute and relative debt levels) would also help international equity returns. Bonds still offer little value in our opinion, so we are maintaining a lower sensitivity to interest rates and resisting the temptation to reach for yield in a low-rate environment when the Federal Reserve anticipates raising rates in 2022 and 2023.

Outlook

The pace of economic growth is likely to have decelerated in the three months ended 12/31/2021 to about 3%. 2022 may be modestly better. Economic progress may accelerate as the world recovers from the recent Omicron variant wave.

Supply chain bottlenecks should ease by mid-year, and energy and transportation costs should moderate. Labor inflation may rise reflecting recent gains in unemployment as businesses try to fill vacancies. First time home buyers may find it harder to buy as they increasingly compete against commuters that are relocating into and working from suburbia. Fears of higher interest rates may bolster real estate prices further in the near term as buyers seek to lock in relatively low mortgage rates before they rise. Official interest rates would still be well below historical averages after the Fed raises them several times in 2022 signaling success in growing post pandemic demand. Investment grade U.S. bonds are collectively yielding just 1.75% as measured by the Bloomberg U.S. Aggregate Bond Index. After losing 1.54% in 2021, this prominent bond index may record a second consecutive loss, something it has not done in 20 years.

We now look to transition from “free” money to something closer to normalcy. These growing pains will benefit from our collective capacity for making the best of things. We look forward to successfully navigating this transition with you, our esteemed clients. Thank you for your continued trust in us.

Your Regency team remains available for in person meetings, phone, and/or video calls to discuss any issues or questions.

Click here to download printable version of this newsletter.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.