Dis-communicablelization

“Enthusiasm is the most important thing in life.”

– Tennessee Williams

Vaccines against COVID-19, developed in record time will be administered to many in 2021 in the hopes of achieving herd immunity. The process, termed by us as dis-communicablelization (DC) may seem trite to some but most will welcome the process, if not embrace the sentiment. Good riddance virus! Our sincere condolences to all who have lost a loved one to this terrible virus and our profound gratitude to the first responders and health care workers who stepped up courageously to help others. If we all learned something in 2020, it is how little in life we control. Like us, many of you have undoubtedly gained in appreciating the relationships in our lives that enrich us, support us, and allow us to collectively live life. May we never lose sight of these and other blessings and may we all thrive in 2021. We thank our valued clients for their oft-voiced appreciation for our team’s efforts on their behalf in a very challenging year.

Markets

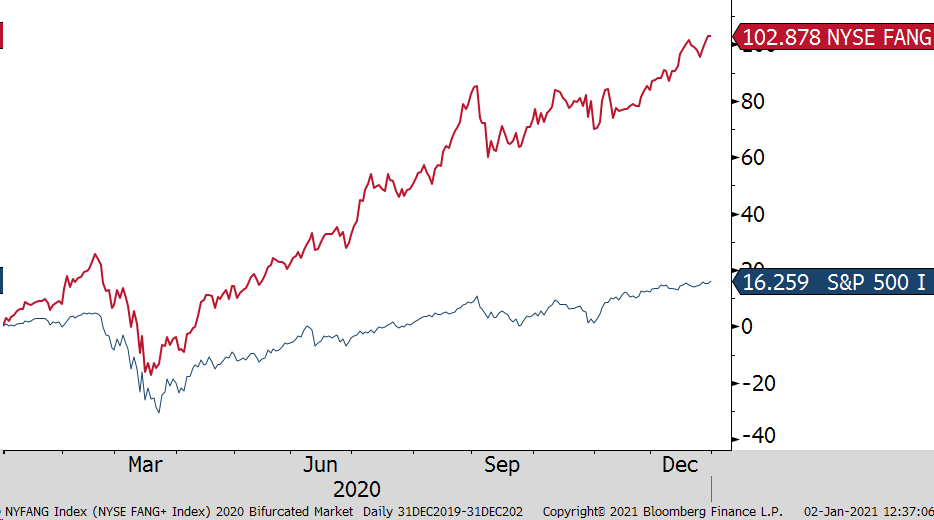

U.S. and global stock markets rose steadily after the pandemic induced sell off in March. Markets dropped over 30% from their peak in record time (S&P 500 dropped 34% in less than four weeks) before stabilizing and recovering. The steepness of the sell-off and the unusually high uncertainties tested us all. Dramatic government intervention to bridge income, extend loans, and liquify credit were timely and significant. By early September, some major indices had recovered much if not all of their losses before steaming ahead to close the year at near record highs. After a robust 2019, the S&P 500 Index rose 16.3% in 2020. But not all sectors participated equally in the rebound. The Dow Jones Industrial Average rose “just” 7.3%. In fact, energy (-37%), financials (-4%), real estate (-5%), and utilities (-3%) were down on the year. 2020 S&P 500 Index gains were led by info tech (+42%), consumer discretionary (+32%), commercial services (+22%), and materials (+18%). Reflecting the cap weighted nature of the index, a handful of tech and communication firms drove the S&P 500 Index’s rise. We published the chart below, Figure one, last quarter and have updated it to highlight the dramatically superior results of the NYFANG Index1 in 2020.

Figure One: Bifurcated Market

These stocks did very well while much of the rest of the index was down as investors expressed their desire to own shares in tech and communication firms that are well positioned to grow revenues and earnings in a low interest rate, lower growth world that is voraciously consuming high-tech solutions. Overall, domestic growth stocks outperformed value stocks again and in 2020 they did so by the widest margin in 20 years! International stocks were also volatile this year but many of their returns were competitive and many outperformed their U.S. counterparts in the fourth quarter ended 12/31/2020 – a sharp reversal to recent years of underperformance. In part this reflected marginal weakness in the U.S. Dollar but also recognition of their lower relative valuations vs. U.S. stocks. Least we neglect the volatility experienced in the bond, oil, and other markets in 2020, they too had their challenging times. While official interest rates dropped near zero last Spring, both investment grade and high yield markets dropped over 10%, oil dropped in March as Saudi Arabia and Russia battled over supply terms, and gold rose steadily through September before hibernating last quarter. Bonds now offer little value as we enter 2021 (some say they offer “return free risk”). Investment grade U.S. bonds are collectively yielding an average of just 1.1% as measured by the Bloomberg Barclays U.S. Aggregate Bond Index after returning a strong 7.4% in 2020.

Investment Strategy

After pursuing relatively conservative strategies in 2020 with our fully discretionary portfolios (including a modest hedged equity component and a position in gold) we enter 2021 with a neutral risk posture in our diversified stock portfolios and a marginally shorter duration (a measure of interest rate sensitivity) in bonds. The pandemic has possibly accelerated some technologically driven trends and our research has uncovered some investment opportunities that may participate in a new normal. Last summer we inaugurated a position in an innovation ETF to capture some exposure to companies with leading technologies across tech, bio-genomics, robotics, energy storage, and fintech. We have added modestly to this position and see it as complementary to our portfolio of good companies with solid cash flows and strong balance sheets. Our investment committee continues to recommend diversified sector and company exposures that are periodically rebalanced. In the near term, we enter 2021 with a neutral risk posture relative to the range including a modest hedge in stock portfolios that would cushion some downside should markets drop. Bond positions continue to be defensive but less than in September.

Economy

The surprise, COVID-19 driven, global recession was steep but brief. Global economic output is estimated by The Economist to “be at least 7% lower that it would otherwise have been, the biggest slump since the second world war”2. After the third quarter’s GDP bounce of 33.1% following second quarter’s 31.4% drop (both rates are annualized), we expect above average growth in 2021 as vaccinations allow us to resume a more normal environment. Employment and wages should continue to grow as companies seek to meet pent-up demand. The demand rebound and inventory rebuilding is anticipated to expand in the near term – assuming the virus crests and vaccines are administered successfully. Unemployment surged to 14.7% in April but surprisingly fell meaningfully to 6.7% in November as businesses resumed operating. Manufacturing activity has also rebounded and may accelerate by mid-year 2021. Unprece-dented government income and liquidity programs are helping bridge the gap back to normalcy. How we unwind that aid without hurting industry, labor, and entrepreneurship will be fascinating and likely require higher taxes to contain growing government deficits.

Outlook

While no one can predict future market returns, high stock valuations are likely to be already discounting some of the expected good economic and earnings growth news that may lie ahead. It would not be surprising to see both recovering earnings and multiple contraction3 in the future. Low interest rates should continue to support how much investors are willing to pay for the expected future earnings streams. Inflation developments will also play an important role as it affects rates, wages, and currency values.

Your Regency team remains available for telephone and video calls to discuss any issues and questions and eagerly await seeing you in person as conditions allow. We hope that you enjoyed the recent holidays and that you are able to keep a constructive and enthusiastic outlook for 2021. Thank you for your continued confidence and trust. Stay safe and healthy!

Click here to download printable version of this newsletter.

[1] NYFANG+ Index is an equal-dollar weighted index composed of high-quality tech and tech-enabled firms; Apple, Amazon, Alibaba, Baidu, Facebook, Netflix, Google, Netflix, Nvdia, Tesla, and Twitter.

[2] The Economist, December 19th 2020-January 1st, 2021, The plague year

[3] Stock price multiples defined as price/earnings

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.