On the Dock

“Many a man has left the dock before his ship came in.”

– Wilfred Peterson, American Author

Becoming wealthy has been, and remains, an aspiration for many. Unfortunately, many an immature person has been shipwrecked trying to make it rich quick. While money is not inherently bad, its influence and consequences can sometimes carry negative connotations when it is over-prioritized or mismanaged (such as when a large amount is received suddenly – especially at a young age). Stories of lottery winners, young athletes, and inheritors that have squandered wealth are not rare. In contrast, those who work hard to earn their money, are disciplined in spending less than they make, invest and save for the long run, and are generous towards those in need, often have lasting wealth. When managed appropriately, money can make a meaningful difference to a family’s quality of life. It can also bless them and others when charitable gifts are made. Regency celebrates that, collectively, its clients recently surpassed $11 million in contributions to donor advised funds1. Many of them have found that “giving while you are living” is great! Financial resources can last if well cared for but sharing the wealth and investing in relational and spiritual wealth can have great lasting impacts.

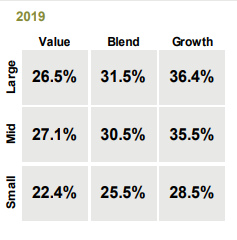

Speaking of gifts, the stock market acted like the gift that kept on giving in 2019. After a turbulent fourth quarter in 2018, stocks rallied hard amidst ever present headlines on trade deal progress, or lack thereof, recession fears, Brexit uncertainties, and impeachment. For all of 2019, the S&P 500 Index returned 28.9% (31.5% with dividends). Growth stocks fared best in 2019 with mid-cap stocks performing well as reflected in Figure One.

Figure One: U.S. Equities Returns/Style

Even bonds, as measured by the Bloomberg Barclays U.S. Aggregate Bond Total Return Index, returned a generous 8.7% for the year. These rates of return will likely be difficult to replicate in 2020 but the long-feared market pullback may yet be averted even in an election year, barring adverse geo-political developments. The S&P 500 Index historically has risen 75-80% of the time2 the year following a 20%+ annual return. No guarantees that history will repeat but in a low rate environment stocks may benefit from increased government spending (typical in election years) and cash still on the sidelines…

Economic and Earnings Fundamentals

Global growth slowed in 2019 but remained positive. U.S. real GDP expanded at 3.1%, 2.0%, and 2.1% in the first three quarters of the year and most likely will be positive in the quarter just ended December 31st. Will it be higher or lower in 2020? Some will argue that the 0.75% rate cut by the Federal Reserve will spur economic activity higher. Others expect slower growth because increasing debt by government, companies, and consumers might render them overextended. Then there is the upcoming election that may increase uncertainty and market volatility. Furthermore, overseas economic growth is, in many cases, weaker than ours. As always, risks abound but on balance our perspective remains constructive.

One weakness we noted in 2019 was that the manufacturing sector (Purchasing Managers Index, PMI) had dropped into contraction. The U.S. measure fell further in December to 47.2 (anything under 50 is contractionary), its eighth decline in nine months. PMIs in Europe also weakened to 46.3 but China’s rebounded to neutral territory (50.2). However, consumer spending, unemployment, real estate, and interest rates remain favorable in the U.S. and rates are accommodative globally. The Federal Reserve plans to be on the sidelines ahead of 2020’s elections. Retail sales continue to post 3%+ annual rates. Job creation remains positive and jobless claims subdued leading to a U.S. unemployment rate of 3.5%. Real estate prices for single family homes rose 2.2% annually in October as per S&P CoreLogic Case Schiller’s index of 20 major cities. Student loans, sub-prime auto challenges, and ample consumer lending continue to be concerning but there is little else to point to that poses near term risk to the current expansion. The House’s impeachment investigations of President Trump were juxtaposed by a successful Phase One trade agreement with China announced in December and expected to be signed on January 15th. In response, investors bought stocks steadily into year end, 2019.

Stock and Bond Valuations

As equity markets rose to new highs, valuations of U.S. stock indices reached modestly overextended levels while bond yields remain well below historical norms.

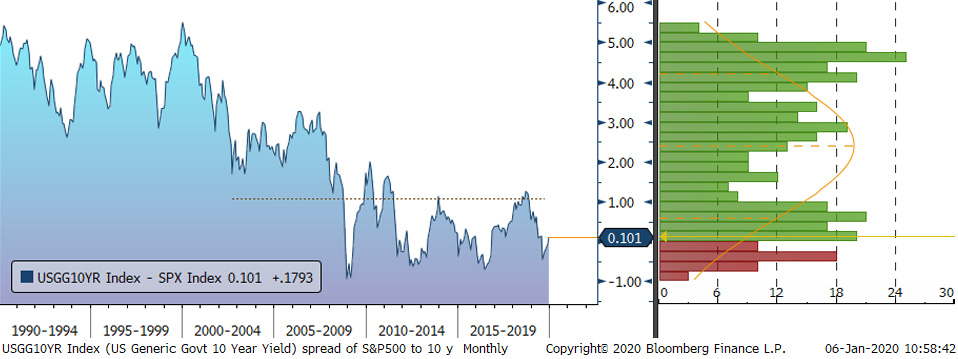

Figure Two: Stock & Bond Yield Differential

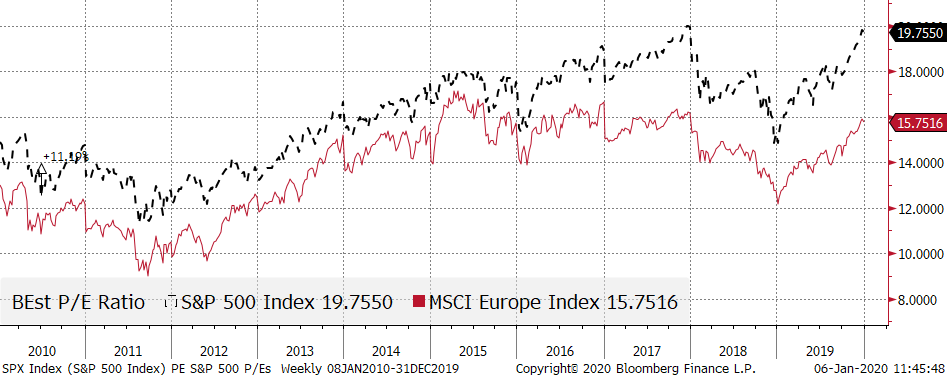

Figure Two reflects the unattractive differential between the S&P 500 Index’s dividend yield (1.82%) and the U.S. ten-year treasury note yield (1.92%). Why would investors lock in a ten-year bond yielding 1.92% when it is no better than inflation and little more than stocks? Stocks historically yield 1-4% less than ten-year treasuries (0.1% at year-end). That said, investors should not ignore the current relatively high stock market multiples. The U.S. stock market is not cheap (Figure Three) but, in our opinion, reasonably priced. Cheaper European valuations may narrow vs. U.S.

Figure Three: US vs. European Stocks Price/Earnings Ratios

Outlook

Modest economic growth in the U.S. and slower and mixed growth overseas will continue to be worrisome as recessions will return someday. Stocks, while not cheap, are less expensive than bonds leading us to keep our neutral equity risk budgets. Low yields continue to offer little reward for extending maturities so we are maintaining a conservative and limited exposure to interest rate sensitivity.

We commend all our clients for their hard work, disciplined lives, and their generous support of their communities. May we all leave our docks at the right time, board the right ship, building lasting legacies to all we come in contact with in this new year!

Click here to download printable version of this newsletter.

1Source: Fidelity Charitable allows Advisors like Regency Wealth Management to manage Donor Advised Funds exceeding $250,000.

2Source: J.P. Morgan

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.