Correction!

“Kindness is always fashionable.”

– Edith Huddleston Barr

In sharp contrast to the stock market’s stability in 2017, volatility was abnormally high in the quarter ended December 31, 2018 (4Q18). The S&P 500 Index dropped 14% in 4Q18 and lost 6.2% for all of 2018. It had lost 19% in December through Christmas before having its best one-day rally in many years on 12/26; +4.9% (was Santa late?). As stocks dropped many investors responded, on balance, with classic behavioral biases: herding, ambiguity, and myopic loss aversion. Given the alarming price drops and volatility, who can blame them? Some investors exhibited herding bias; following the crowd instead of making decisions independently. As money flowed out of the stock market, they sold into the negative momentum. Others followed ambiguity aversion; a tendency to avoid the unknown. Many expressed a myopic loss aversion; experiencing more sensitivity to losses than gains. None of these reactions have historically served investors well as a move to cash almost insures missing a significant portion of the eventual stock market recovery. This is a major reason why we at Regency spend so much time establishing risk parameters that fit our clients. Each client has a 20% range of minimum/maximum equity exposures commensurate with the volatility that we collectively agree they can tolerate. We all know that we can’t control near term market movements, but we can control the risk we take and the lifestyles we pursue (and then only partly as life is full of surprises). Establishing long term financial goals with thorough financial planning and pursuing them with customized, diversified portfolios reflecting each client’s risk profile, is preferable to succumbing to emotional responses during periodic market downdrafts. Those that are properly positioned can ride out the turmoil and achieve their financial goals. Those who are not will too often sell at the wrong time, lock in low yields in cash or “guaranteed” products and may well be worse off in the long run. Please call us if you have any concerns about this.

Summary

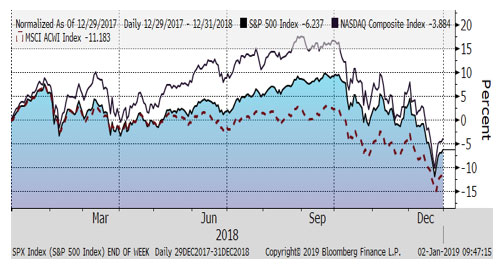

Some concerns that shaped the sharp selling included the potential of a government shutdown, fears of recession, prospects for higher interest rates, and tariff uncertainties. Weakness in stocks was most severe in the U.S. markets but was also evident overseas as most developed markets dropped 4-10% in the fourth quarter, 2018.

Figure One: No place to hide

2018 was only the second year of negative returns in the last six for U.S. stocks but the fourth quarter drop was noteworthy. U.S. economic indicators remain positive, but weakening, stoking fears that the Federal Reserve would raise interest rates too much and propel the economy into recession. Global economic trends have been weaker and mixed during a period of continued tariff uncertainties, adding to the angst. Of these, the one that carries the most valid concern is the reduction of liquidity by central bankers following a decade of unprecedented low interest rates and quantitative easing. The transition from low interest rates increases the cost of capital and the volatility of asset prices until uncertainties in both financial and economic matters are clarified. While the weaning from excessive monetary liquidity may be necessary, it has not been heretofore experienced to this degree, so its impact is unknown. While attention to current and forward fundamentals should help, we suspect that the ties between economics and markets will continue to be messy. In times where returns diverge, investors should focus on the long term as diversification can lower risks and should eventually pay off. For example, valuations as measured by price/earnings multiples have widened for European companies relative to U.S. based ones, as shown in Figure Two, and would deliver better returns if they trend back to historical averages.

Figure Two: European vs. US Stock multiples

Bond markets also had a volatile 2018 with the ten-year Treasury note’s yield reaching 3.24% mid-year before ending 2018 at 2.68%, 27 basis points above where it started. The popular Bloomberg Barclays U.S. Aggregate Bond Index was down in six of the twelve months and its total return was 0.01% for the year.

Economic and Earnings Fundamentals

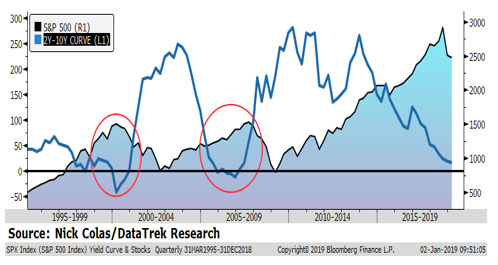

Third quarter U.S. GDP (Gross Domestic Product) grew a still strong 3.4% and the fourth quarter ended 12/31 is anticipated to exceed 2.5% reflecting low unemployment and steady consumer spending growth. Companies in the S&P 500 Index posted impressive earnings growth in the first three quarters of 2018 from the prior year’s. Revenue growth over the comparable period was 8% with 10% plus growth in sales for Energy, Materials, Information Technology, Communication Services, and Real Estate sectors. Earnings growth surpassed 25% in the first half of 2018. 2019 earnings growth will likely moderate in the absence of another corporate tax cut but should grow commensurate with economic expansion. The next recession doesn’t appear to us to be imminent but when it arrives it will temporarily slow earnings growth. One closely watched indicator of possible recession, the yield curve differential between two and ten-year Treasury notes, while still positive, has narrowed. Stock prices have typically risen for months after this yield curve flattens (reaches zero) or inverts (two-year yields exceed that of ten-year bonds).

Figure Three: Curve inversion and S&P 500 Index

Bond markets will continue to be sensitive to fundamental economic and investment market developments as the Federal Reserve still favors moderate (two?) interest rate increases for 2019.

Outlook

The U.S. political landscape is poised for confrontations and little actual policy progress. Europeans will live through Brexit and, twenty years into their single currency experiment, continue to discern how deep their common interest will be over the next decade. China’s growth may stabilize if tariff agreements are reached or continue to decelerate if they don’t. Our focus remains of diligently analyzing the corrective forces at work and how they might influence your investments. Let’s hope that kindness remains in fashion in 2019. Happy New Year!

________________________________________

Thank you for your continued trust in the Regency team. We are committed to working with you over the long term to help you reach your financial goals through constructive and impactful collaboration. Please call us to share any thoughts, concerns, and insights or to learn more about our wealth management process.

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan Kabot, CFP®, AAMS®

Click here to download a printable PDF

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.