Trump Bump

“Everything you’ve always wanted is on the other side of fear.”

– George Addair

Stocks rose and bonds fell after Donald Trump’s November 8th presidential victory. What seemed like a fear trade as results were announced turned into a stock melt up as hope for growth was embraced. Republican control of the Federal government may increase the odds of business friendly legislation that should lift the economy. Fiscal stimulus may expand both the economy and inflation; consequently bond yields rose significantly (and bond prices fell) after the election.

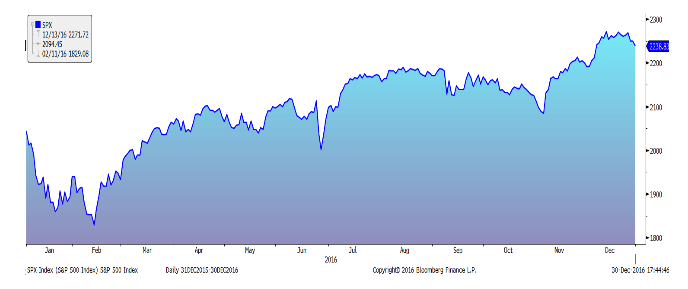

The S&P 500 index rose 9.5% in 2016 but had to climb out of a deep hole early in the year. Recall that the index dropped 9% in the first three weeks of 2016! China was the worry then, followed by Brexit in June, and pre-election jitters in October (-1.94%), before the Trump bump to record highs in November (+3.4%) and December (+1.8%).

Figure One: S&P 500, 12/31/2015-12/30/2016

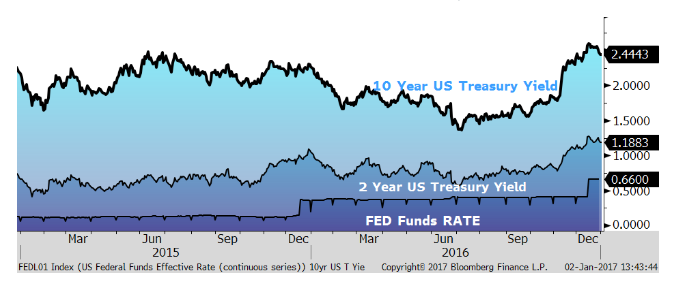

Stocks in developed markets rallied while emerging markets weakened in the fourth quarter as the US Dollar strengthened and investors worried that a Trump regime might impede free trade. Bond investors felt the burn as markets worried that higher fiscal deficits under a Trump administration could spur inflation higher. While the yield on the ten year U.S. treasury was only up 0.17% for the year, they rose dramatically from their mid-year lows of 1.36% ending the year at 2.44% (after peaking at 2.62%). West Texas Intermediate oil rallied 45% in 2016 to end at $53.72/barrel. Gold rose 8.2% for the year ending at $1,151.70 an ounce (but well off its mid-year highs).

US investment grade bonds, as measured by the Barclays Aggregate U.S. Bond Index, dropped 3.4% in the fourth quarter giving up more than half of their nine month gains. For the year, this index rose 2.4% and now yields 2.65%; 65 basis points more than three months ago! International sovereign bond rates remain unattractive and have also seen higher volatility. German ten year Bund yields rose 44 basis points in the fourth quarter to end the year at 0.32%, up from September 30th’s minus 0.12%. As expected, the Federal Reserve raised its Fed Funds rate by 0.25% in December, a year after its last raise.

Figure Two: U.S. Treasury 2 and 10 year yields, US Fed

Yields rose but the curve “slope” remains steep as shown in Figure two above. Typically, yield curves are upward trending with longer term yields being higher than shorter term ones. They tend to flatten during early stages of recession.

Economic Fundamentals

Growth rebounded strongly in the third quarter (GDP +3.4%) from a very weak 1% first half rate. Domestically, employment and housing remain steady. Unemployment dropped to 4.6% while average home prices rose 5%+ this year.

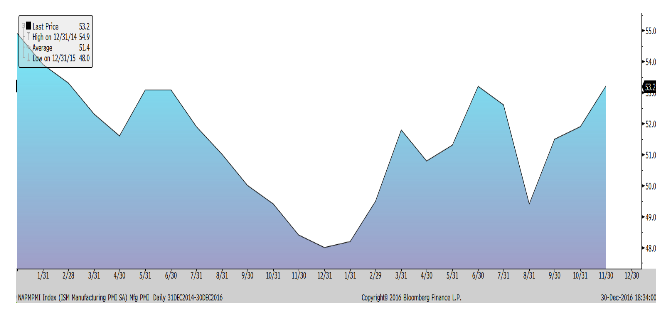

Figure Three: U.S. ISM Manufacturing PMI

Manufacturing and service sectors are both reflecting economic optimism. Manufacturing production rebounded in the fall, exceeding expectations with its 54.7 December tally but may slow in early 2017 reflecting the US dollar’s strength. Non-manufacturing (service sector) is also doing well recording its 82nd consecutive monthly advance in November. Overseas, it is a mixed picture with Western Europe struggling (GDP +1.7%), Asia stabilizing (+5.95% GDP growth, Ex-Japan; Japan +0.3%), India is expanding @ 7%+ but Argentina is contracting: oil producing countries are rebounding. Forthcoming elections that could shift eco-politics inward: Netherlands has a General election in March, France holds a Presidential election in April/May and Germany has a General election in September. A wave of right wing, protectionist sentiment, if it transpires, could be anti-growth.

Stock and Bond Valuations are high

Price/earnings multiples for the S&P 500 Index are 21 times (x) trailing earnings and 17.6x next twelve months’ estimated earnings –above long term averages but not yet egregious. Bond yields are up but remain relatively low posing risk to investors that reach for yield.

U.S. Government issues

Clouds remain on the horizon even as optimists party on. The cost of U.S. regulation is strangling small and mid-sized businesses. We spend upwards of 38% of GDP on (big) government, almost twice pre-WWII rates. Entitlements (Social Security and Medicaid) need to be amended as their current benefits are unsustainable. Our fiscal deficit is growing and its debt is myopically short funded (over half is due within five years). As seen in Figure Four, the Federal government has twice as much debt to refinance in the next five years than we had in 2009 (bottom panel)!

Figure Four: U.S. Government Debt Maturities 2016 vs. 2008

The incoming Trump administration has been relatively silent on these issues but has extolled its preferences for simpler and lower corporate and individual taxes, allowing overseas corporate cash to be repatriated at lower tax rates, less red-tape and more efficient government programs. It has also suggested taxing interest and dividend income at lower rates. While many details and negotiations lay ahead, many of these moves, if enacted, would likely be constructive to employment, productivity, and investment activity.

Outlook

How much of these domestic pro-growth expectations are already captured in the capital markets is impossible to ascertain as we begin 2017. The transition to higher interest rates has begun but yields should, in our opinion, gradually drift upwards for the next couple of years.

Thank you for allowing us, your Regency team, the privilege of helping you achieve your financial goals. Please call us with any questions.

Happy New Year!

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, CFP®, AAMS®

Click here to download a printable version of this newsletter

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.