Oil Slick

“There are two ways of spreading light: to be the candle or the mirror that reflects it.”

– Edit Wharton

Oil prices leaked massively in the last half of 2014 and for the year as supply growth greatly exceeded demand growth for the black gold and producers chose not to decrease production. Brent crude oil dropped almost 50% in the second half of the year. Consumers and heavy energy users (e.g. airlines) benefitted significantly from this trend. However, U.S. employment growth may moderate in the near term as energy firms and those supporting the U.S. exploration, transportation, and delivery of crude delay planned expansions. In sharp contrast to oil’s price swoon, the U.S. dollar rose over 10% versus the Euro and more than 18% versus the Japanese Yen. Meanwhile, the U.S. economy grew at an impressive annualized rate of 5% in the third quarter adding momentum to the second quarter’s 4.6% pace.

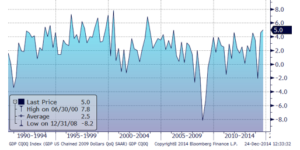

Figure One: U.S. GDP rebounds

Earnings and employment growth emboldened investors, propelling U.S. stock markets to record highs in late 2014. We caution that this progress has been an increasingly volatile one and we anticipate volatility may be even higher in 2015. The bond market was also volatile yet mostly kind to investors this past year. Contrary to consensus expectations (including ours), yields dropped instead of rising in 2014.

Third quarter revenues and earnings of S&P 500 companies rose versus the prior year’s by 3.9% and 9%, respectively. Obviously, growth was not uniform across sectors with Energy firms posting a 3.6% decline in sales in sharp contrast to Health Care’s 12.2% and Information Technology’s 7.2% growth in year over year quarterly sales.

Perhaps more importantly, corporate America has refinanced balance sheets at record low interest rates thereby decreasing financial risk to their operations to arguably unprecedented levels. In other words, one important risk has diminished. Together with an environment of continued low interest rates, we postulate that investors should be willing to pay up for this by way of higher price earnings multiples (a common gauge of valuations). The S&P 500 Price to earnings ratio, at less than 19 times (x) trailing earnings and less than 17x estimated earnings a year from now has room to expand to 20-21x before we would become worried about overly excessive valuations.

New jobs creation allowed the unemployment rate to drop to 5.8% in October and November. While still high, the progress remains directionally constructive. Continued job growth may begin to pressure wage gains when unemployment approaches 5%. In short, the economy is growing, gasoline prices are down, and unemployment is dropping, contributing to greater consumer spending and corporate earnings growth. However, a stronger U.S. Dollar will trim the pace of earnings growth in 2015. Conversely, a weaker EURO should help European corporations increase their foreign sales and earnings. Their ability to resume growth likely lies with how soon and how aggressive the European Central Bank enacts quantitative easing.

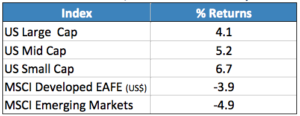

Table One: Fourth Quarter 2014 Returns, MSCI

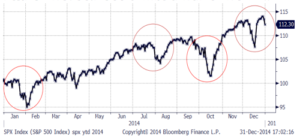

Returns from smaller U.S. companies’ stocks rebounded in the quarter (+6.7%) after languishing earlier in the year. International equities remained weak. All major European stock markets (measured in US Dollars) dropped again in the latest quarter. Asian stocks were mixed with the Hang Seng, New Zealand, and some Chinese markets up but Australia’s ASX 200 fell 5.5%. Most major international equity markets lost money in US Dollar terms for the full year 2014. Most non-Asian emerging markets also recorded negative average returns in 2014 (measured in USD). Consequently, diversification away from U.S. large cap stocks had a mixed impact on portfolio performance this past quarter as shown in Table One. The S&P 500 Index and the Dow Jones Industrial Average both rose 4.4% and 4.6%, respectively in the fourth quarter of 2014 but exhibited more volatility in three of the last six months than they had since January as shown in Figure two.

Figure Two : S&P 500 climbs a wall of worry…

Bonds rally again

Investors’ flight to quality rally continued in the fourth quarter largely driven by foreign demand for yield and the U.S. dollar. The EURO’s aforementioned weakness may reflect European investors buying U.S. government bonds. The U.S. ten year note’s yield fell to 2.06% in mid-December before closing the year at 2.17%, down from 2.39% at 9/30/14, well below the year end 2013’s 3.03% but off its intra-day low of 1.85% reached in late October. The end of the Federal Reserve’s quantitative easing in October did not negatively affect underlying market demand for treasuries and mortgages as low international bond rates have kept U.S. interest rates low longer than we had expected earlier this year. German 10 year BUND yields offered only 0.54% and Japan’s 10 year note just 0.31% at year-end 2014! Even Italy (1.86%) and Spain (1.58%) ten year notes were yielding less than the U.S. ten year treasury!

We continue to caution that the risk/reward in bonds remains unappealing to us. Returns are limited if things go right and the losses might well be significant when rates rise. Our portfolios will continue to favor shorter bond maturities complemented with credit sensitive sectors (corporates, high yield loans & bonds, and preferred stocks). We will decrease allocations to high yield if economic growth slows materially.

Outlook

We anticipate that U.S. economic growth will continue in 2015 and European economies stabilize but both of their stock markets are likely to show higher volatility. Interest rates should trend modestly higher. We are maintaining broadly diversified portfolios and are ever vigilant for developments. Hopefully we can shed some light on global markets in 2015 and help you grow and spread the wealth. Call us with any questions.

Thank you for allowing us to help light your paths through slippery times. May you have a happy and prosperous New Year.

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, AAMS®

Click here to down load a pdf of this newsletter

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.