Combining the efforts of two local firms, transitioning custodians for legacy Regency clients and introducing the respective partners to each firm’s clients – all during the year end period – was exciting, challenging and progressive. We are optimistic that, God willing, this new partnership will be rewarding for all parties involved: clients, staff, and our communities. We are grateful and appreciative for those who have enabled our progress and pledge you our continued efforts to maintain your trust. We thank you for your business and are excited that we will share this journey together.

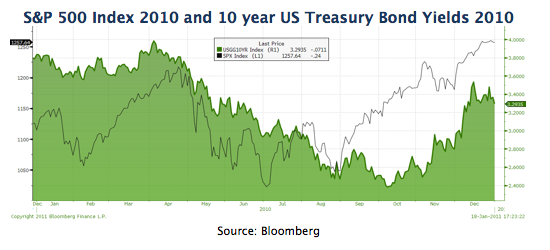

4Q Reversal After three quarters of sharp volatility, stock markets globally had impressive runs in the quarter just ended December 31st, 2010. In US $ terms, stock markets in Germany and Japan joined the US stock markets in rising 9-12%. For the year, investors (both equity and bonds) rode a wild rollercoaster as shown in Figure 1.

Figure 1: Rollercoaster without seatbelts

Progress was evident in the economy and financial markets in 2010. Although most developed economies continue to face challenges (increasingly, we tire of “experts” that unequivocally surmise that one crisis or another is certain to derail our economy, country, or globe) most are also showing progress. To say that the investment climate has been difficult over the last two years would be an understatement but it would also fail to capture the opportunities that market dislocations presented. Contrary to the media “chicken-littles”, U.S. GDP growth has been positive for five straight quarters through 9/30/10 and looks to continue rising through 2011. Yes, the lagging indicators remain weak; unemployment remains very high (and is likely to continue near current levels for much of the year) and real estate is still floundering, but two years of fiscal and monetary stimulus is starting to matter. Our base case scenario continues to be for modest (but accelerating) economic growth and positive though moderate equity returns. Under this scenario, longer term bonds would have low or negative nominal returns until things get closer to normal (2012-2013?). Stocks, while up 10% in the last quarter, still appear attractive. Even if we marginalize the 8-10% revenue and strong earnings growth of the S&P 500 in 2010 (recall that 2009 earnings were weaker and thereby comparables in 2011 will be harder to beat), we see value in its collective forward P/E (price/earnings) ratio of 14.7 times. When we consider the lack of alternatives like bank CDs with “no” risk (they do have inflation risk) and bonds with low yields and significant interest rate risk, the dividend yields on blue chip stocks with strong market positions, REITs, MLPs, and preferred stocks all look more appealing. Obviously the suitability of these to each client’s risk profiles needs to be considered as do global alternatives but by and large opportunities remain for 2011.

Earnings and valuation remain attractive. Third quarter earnings for S&P500 companies again beat Wall Street’s expectations. Similar to earlier 2010 quarters, positive earnings surprises posted by this group were ahead of negative ones by 3.5:11. In other words, for every company that reported weaker than expected earnings, 3 1/2 companies reported stronger than expected results. As we noted in our October letter, the rebound in stock prices could well reflect expectations for continued earnings growth in 2011. Volatility in stock prices will likely continue this year but equity valuations remain reasonable: S&P 500 Index’s forward P/Es, at 14.7x2, below historical averages of 15-17x; the earnings yield (Dividend/Price) for S&P 500 index, at 6.35% is significantly higher than usual compared with the yield on the ten year US Treasury as shown below.

Figure 2: Equities’ earnings “yield” has widened relative to bond yields

Progress. As we have said before, the only sure way to get rich is to spend less than you make and save/invest the difference. How one invests can and does make a big difference but how generous we are to others is also important. A friend reminded us last month of the following quote by Winston Churchill, “We make a living by what we make, but we make a life by what we give.” As always we will endeavor to deliver competitive returns with below average risk, thus being effective stewards of your money. As our business prospers we will also seek to be philanthropically generous. Thank you for your continued trust in Regency Wealth Management. Here’s hoping that we all continue to make real progress in enriching our world in 2011.

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Sources: 1,2 Bloomberg, L.P.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.