Artificial Intelligence (AI)

“There are always flowers for those who want to see them.”

– Henri Matisse

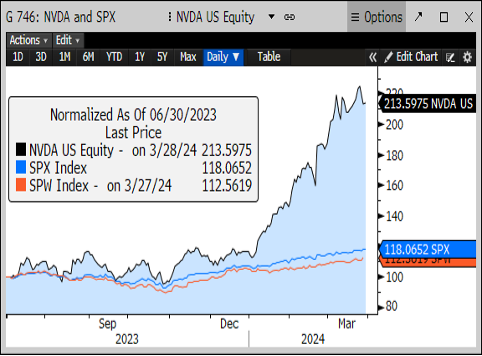

AI (Artificial Intelligence) has been the rage for over a year now. Computer systems that can quickly process vast amounts of data, interpret patterns, and extrapolate it to improve processes and predict outcomes hold much promise. Applications across industries could provide significant productivity gains and may improve our individual and collective quality of life. They require dramatic volumes of computing power and have initially boosted the revenues of semi-conductor chip producers, especially the leader in the field, Nvidia (NVDA). Sensing transformative technological breakthroughs, investors have bid up NVDA and related stocks, driving many market indicators to record highs as shown in Figure One.

Figure One: NVDA stock vs. S&P 500 Total Return Index and equally weighted S&P 500 Index

Source: RWM, Bloomberg L.P.

Many investors, particularly risk averse ones, have missed this rally. We continue to caution investors not to chase high valuations at this early phase of AI’s development. While NVDA is clearly the early leader in AI, earnings forecasts of a four-fold increase over the next four quarters create heady expectations, reflected in its 75 times (x) and 37x trailing and forward price-to-earnings ratio (P/E), respectively. The eventual winners and best AI related investments may not be clear for several years.

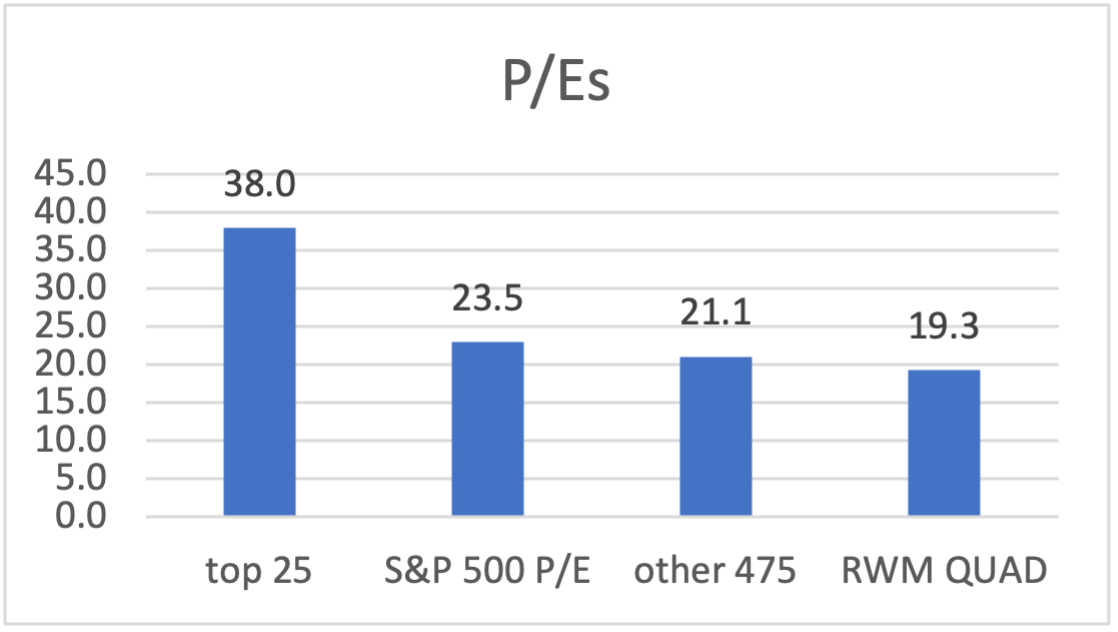

Markets

U.S. stocks (as measured by the S&P 500) are trading at an average P/E of 23.5x as shown in Figure Two. P/Es are still above historical averages when adjusted for the higher priced and fastest growing leaders. The S&P 500 Information Technology Sector and Software firms trade at 38x trailing P/E. In contrast the average P/E of Regency’s individual stock buy list is 19.3x as shown in Figure Two.

Figure Two: S&P 500 Total Return Index P/E

Source: RWM, Bloomberg L.P.

International developed market stocks continue to offer a 20% or greater discount to U.S. stocks and twice the dividend yield. U.S. bonds remain competitive with stocks, offering close to a five percent yield as of March 31st. The FED has reiterated its expectations that rates are likely to move lower when inflation resumes a downward trend. It may cut rates as early as June and lower them once or twice more before the end of 2024.

Fundamentals

Low unemployment rates, stable residential real estate markets, and higher stock markets are contributing to extending a robust economic cycle. While both consumer and commercial delinquencies are trending up, most measures remain below pre-pandemic levels. Office property values are lower, and many businesses must refinance maturing debt at higher levels (zero to two percent interest rates are long gone). Still, most sizeable businesses are reporting improving earnings gains with relatively high margins.

Outlook and Investment Strategy

Spring is here and flowers are blooming for us to enjoy – you just need to know where to look and who wants to see them. Others will focus on the rain clouds and occasional severe storms.

We remain cautiously optimistic that the recent rally will continue to expand and that interest rates are more likely to drop than rise later this year. In a presidential election year, turbulence and volatility are to be expected so we espouse discipline and the avoidance of both greed and fear.

Thank you for allowing us to be on your financial team and for referring us to those you care about most. Don’t forget to smell the flowers!

Click here to download printable version of this newsletter.

1 “Magnificent Seven” is composed of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.