Transition

“Worry never robs tomorrow of its sorrow, it only saps today of its joy.”

– Leo Buscaglia

The light ahead at the end of the tunnel may not be an upcoming train but a fresh look at a much welcome transition from COVID challenges to an almost normal cyclicality. This transition began in a turbulent fashion even before encountering the late February “air pocket” from Russia’s ill-advised invasion of Ukraine. Our hearts go out to the many people and families seeking safety, shelter and peace following the invasion. Sanctions on Russia have quickly cut that country off from the global financial system, rendering it increasingly isolated, and its currency weaker (-13% vs the U.S. Dollar and -9% vs. Euro). NATO has thus far resisted calls for enforcing a no-fly zone fearing that it would escalate the conflict and possibly lead to WWIII. There is no quick fix to replacing Russian oil and gas, but efforts will be made in the short term (boosting production, importing Iranian oil?) and in the long term (investments expanding liquified natural gas capacity). Stocks had weakened prior to the war, then dropped further in early March before rallying on modest volume. Historically, stock prices have recovered losses from numerous geopolitical events in months rather than years. Markets may stay volatile in the short run as uncertainty remains elevated. The implications of these actions are significant: though Russia accounts for only 3% of global GDP, the expected spillover effects from energy and trade will continue to serve as economic headwinds in a post-COVID global recovery.

Oil and gas prices surged to almost $130/barrel before settling back to about $101/barrel (30+% higher than 12/2021); natural gas rose almost 60% to $5.6 MMBtu. Other commodity prices also rose including grains and precious metals. Although COVID is fading, some lockdowns were recently enacted in China, possibly exacerbating trade flow disruptions. Together, geopolitics and ongoing global supply-chain issues create a more uncertain investment landscape just as central banks in developed nations pivot towards transitioning from liberal monetary policies to tighter ones. The Federal Reserve (FED) raised rates by 25-basis points in March and plans several further rate hikes later this year, with the pace and scope depending on economic data. The European Central Bank may delay tighter monetary conditions to 2023 because of the energy shock’s impact on growth. U.S. GDP is estimated to decline by 0.1% for every $10/bbl increase in oil. Remaining risks to markets include the potential for further hostilities, inflation, and slower global economic growth.

Fundamentals and Markets

The good news is that stocks are cheaper now than they were prior to the pandemic as measured by price to earnings. Households and corporations used generous government stimulus and record low interest rates to strengthen their balance sheets. Employment is strong and real estate robust, establishing a solid backdrop for continued economic growth. While higher energy prices and rising interest rates will be headwinds, stock valuations are reasonable relative to expected earnings. In contrast, bond prices look very rich. Inflation remains high and a tight labor market remains a challenge.

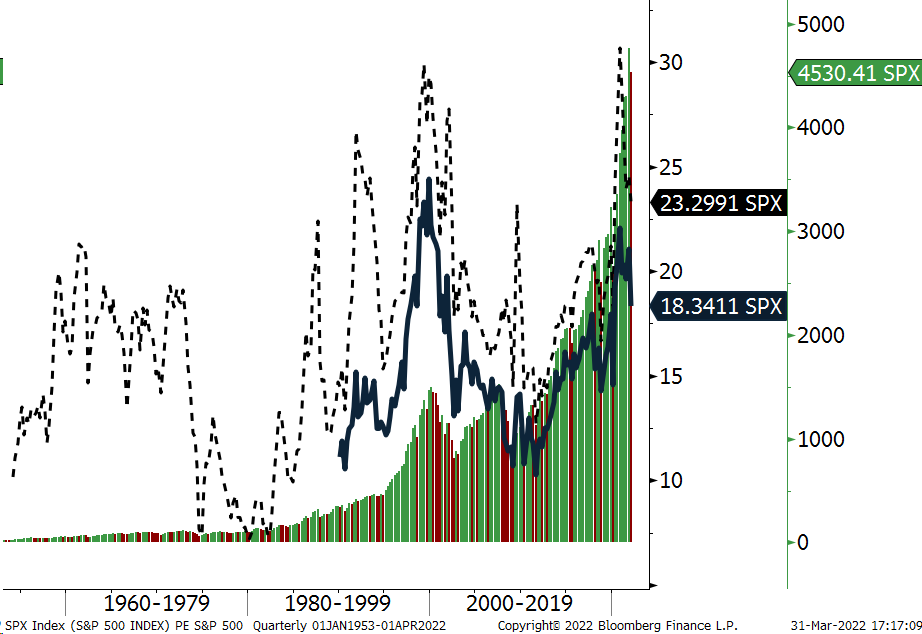

Valuations improved in the first quarter 2022 but are still not cheap with stocks trading at P/Es of 23.2 times trailing earnings (—dotted line) and 18.3 x forward price/earnings (- dark line), as depicted in Figure One. Fourth quarter 2021 earnings growth was unsustainably 30% higher than 2020’s fourth quarter on the back of a 16% expansion in revenues.

Figure One: S&P 500 Index returns and price/earnings multiples

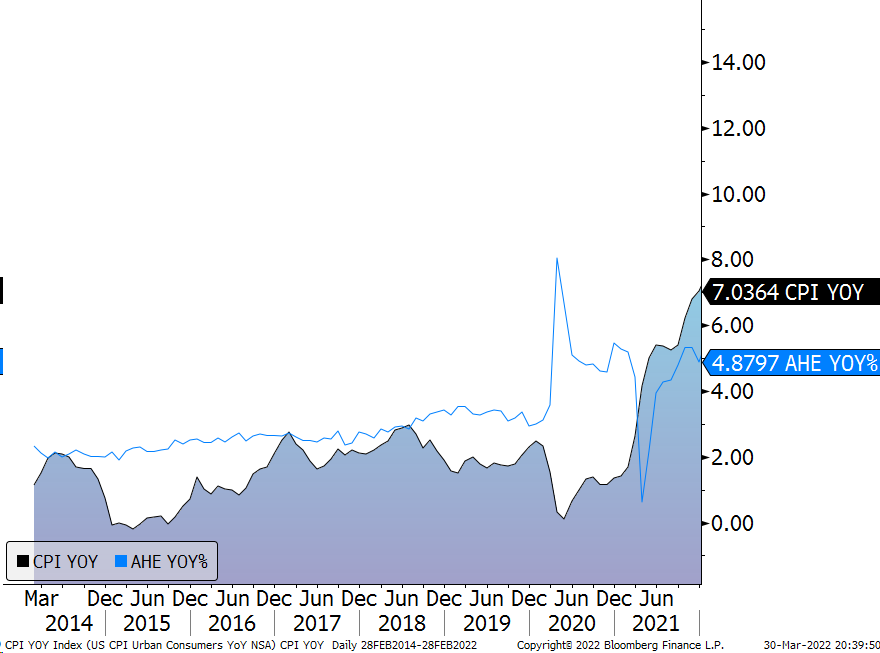

As depicted in Figure Two, inflation is running at 7% year-over-year and wages are up 4.9%.

Figure Two: US Consumer Price Index

U.S. ten-year Treasury yields ended March 2022 yielding 2.34%, 85 basis points higher than three months prior, and 16 basis points less than its mid-month high. Shorter rates rose at a faster rate and the difference between the two-year Treasury yields and the ten-year yield was effectively zero at March end. The five-year Treasury yields 2.43%, a so-called inversion, as it is higher than the longer-term bond. Yield inversions often portend that a recession is coming within 18 months. U.S. bond yields are likely to rise further as FED hikes progress.

Investment Strategy

While the next recession may be a year or two away, stocks can still record positive returns in the interim. We are therefore maintaining a neutral, and diversified, risk allocation. Historically, there have been very few asset classes that act as an effective hedge against geopolitical risk, although gold has been one of them (we have a modest allocation). We hold a small equity hedge in our portfolios providing modest downside protection in a risk-off environment. Our constructive expectations for international developed market stocks have been dampened as economic growth rates are now anticipated to be lower. Bonds still offer little value in our opinion, so we are maintaining a lower sensitivity to interest rates and resisting the temptation to reach for yield in a low-rate environment as the Federal Reserve anticipates raising rates into 2023.

Outlook

The pace of economic growth is likely to have decelerated in the three months ended 3/31/2022 but the rest of the year may be modestly better. Economic progress may accelerate as the world recovers from the recent COVID variants, partly offset by higher energy prices. Supply chain bottlenecks should ease by next year, and energy and transportation costs should moderate, especially if Ukraine is resolved and European nations normalize energy contracts with Russia. Labor inflation may rise reflecting recent gains in unemployment as businesses try to fill vacancies. Fears of higher interest rates may bolster real estate prices further in the near term as buyers seek to lock in relatively low mortgage rates before they rise further. Investment grade U.S. bonds are collectively yielding 2.9% as measured by the Bloomberg U.S. Aggregate Bond Index. After losing 1.54% in 2021, this prominent bond index is down 6% year to date and may record a second consecutive annual loss, something it has not done in 20 years.

Our thoughts and prayers for the brave people of Ukraine continue. We look towards peace and freedom for all with concern but also hope. Thank you for allowing us to assist you in looking forward to successfully achieving your financial goals. May tomorrow’s headlines not sap us of today’s joy.

Your Regency team remains available for in person meetings, telephone and/or video calls to discuss any issues and questions.

Click here to download printable version of this newsletter.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.