Prices, Patience, Progress

“Price is what you pay, value is what you get.”

– Benjamin Graham

Prices, economies, and emotions exhibited memorable volatility over the last twelve months amidst the COVID-19 crisis. The challenges tested all of our fortitude and patience but hope and progress is tangible. Many have mourned unexpected loss of loved ones and perhaps many more have reassessed their mortality and priorities. Together we look forward to a brighter future.

As your financial team, Regency continues to patiently pursue delivering long term value through diversified portfolios, disciplined investment oversight, and thorough financial planning.

Fundamentals and Markets

Historic monetary and fiscal stimulus continues as governments address severe economic pressures from pandemic disruptions. Low interest rates and printing (borrowing) money to supplement temporary, but severe, income declines continue. The recent $1.9 trillion relief package, enacted by the Biden administration in March, brings cumulative COVID-19 fiscal relief to over $5 trillion! In the short run, this stimulus is constructive for income, economic activity, jobs, and corporate profits. In the longer term, it creates a challenge as it represents over 30% of our economy, as measured by GDP. High debt levels carry consequences: U.S. debt to GDP is approaching 120%, having doubled over the last fifteen years. While our nation’s debt/GDP is still half of Japan’s, it is about twice Germany’s and higher than Greece, France and most developed countries. At some point, this will translate to a weaker U.S. dollar and that typically influences inflation upwards. The Federal Reserve anticipates a temporary inflation bounce this year and moderation next year but there is a risk that they could be surprised by the degree and tenure of it. It will take several months to ascertain if the rise is temporary (as the Federal Reserve Bank expects) or stickier and higher for longer (this may prompt the Fed to consider raising its discount rate before 2023).

Effective COVID-19 vaccines and expectations of soon reaching herd immunity to the virus have fueled hope of resumptive, accelerated economic activity. In the quarter ended 3/31/2021, the S&P 500 rose 5.8%, European developed equity markets rose around 5%, and Asian stock indices were mixed. After a strong 2020, bond markets tumbled with ten-year Treasury yields rising to 1.74% from 0.91% at 3/31/21 and 12/31/20, respectively, as investors factored high government borrowings and inflation risk. Consequently, the widely followed Barclays U.S. Aggregate Bond Index dropped 3.4% in the quarter just ended.

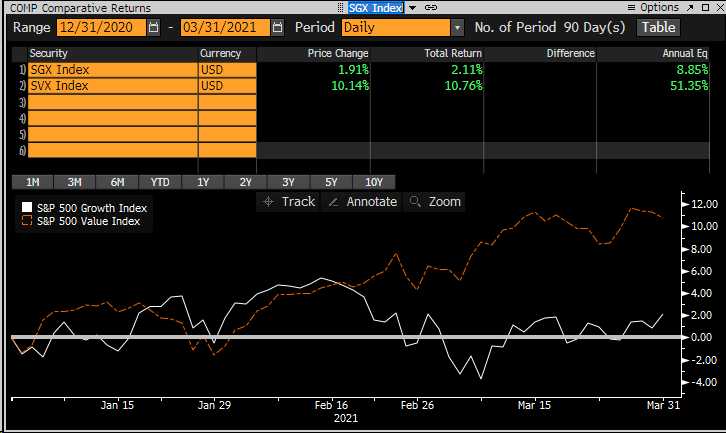

The multi-year outperformance of domestic growth stocks over value stocks may be over or at least on pause. Cyclical sectors may do better as we reopen in a post-vaccine world. Investors have started to reposition portfolios away from growth stocks towards cyclical and value plays. Figure One, highlights the shift in returns in 2021 with value stocks outpacing growth stocks by the largest margin in twenty years.

Figure One: S&P 500 Growth and Value Indices

The S&P 500 Value Index rose 11% in the first quarter 2021 while the S&P 500 Growth Index was up 2%. U.S. Mid-Cap and Small-Cap stocks did even better, rising 13% and 18%, respectively.

International stocks, long trailing US counterparts, are now more competitive. In part this reflects marginal weakness in the U.S. Dollar but also recognition of their lower relative valuations vs. U.S. stocks.

Investment Strategy

We entered 2021 with a neutral risk posture in our diversified stock portfolios and a marginally shorter duration (a measure of interest rate sensitivity) in bonds. Valuations are not cheap in either stocks or bonds in the aggregate. However, we still find relative value in the stocks of a number of companies with solid balance sheets, superior cash flows, and low leverage. International developed markets appear relatively attractive, so we have modestly increased allocations there. Bonds still offer little value in our opinion, so we are maintaining a lower sensitivity to interest rates and resisting the temptation to reach for yield in a low-rate environment. Investment grade U.S. bonds are collectively yielding an average of just 1.6% as measured by the Bloomberg Barclays U.S. Aggregate Bond Index.

Economy

We expect above average economic growth in 2021 as vaccinations allow us to resume a more normal environment. Retail sales, housing, manufacturing activity, and employment should continue to grow as companies seek to meet pent-up demand. Unprecedented government income and liquidity programs have helped bridge the gap back to normalcy. How we unwind that aid without hurting industry, labor, and entrepreneurship will be fascinating and likely require higher taxes to contain growing government deficits.

Outlook

Anytime markets are at or near record highs investors fret about the correction. It would not be surprising to see both recovering earnings and multiple contraction1 this year. Should interest rates, as measured by the U.S. ten-year treasury yield, rise to 2.5% or more, some investors may reduce their stocks and increase their bond allocations. Higher corporate taxes (President Biden has proposed increasing them to 28% from 21%) will pinch corporate earnings in 2022 and possible increases in individual tax rates may reduce spending.

We remain attentive to identifying investment risks and opportunities as we seek to add value. Thank you for your continued partnership and for allowing us to share in, and contribute to, your financial progress.

Your Regency team remains available for in person meetings, telephone and/or video calls to discuss any issues and questions.

Click here to download printable version of this newsletter.

[1] Stock price multiples defined as price/earnings

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.