Healthy Perspective

“For time is the longest distance between two places.”

– Tennessee Williams, Author

Pandemic contagion and lockdowns came quickly in mid-February creating unprecedented global uncertainty over personal and economic health. Governments, citizens, companies, and investors wrestled to analyze and strategize over mitigation strategies and pondered the length and depth of the COVID-19 virus’ impact. OPEC piled on by increasing oil supply, halving crude oil market prices. Equity markets dropped 30% or more and credit markets melted as investors responded to the widespread uncertainties by selling just about every asset class that they could raise cash with before buyers appeared at month end. March was a long month. The distance between the onset of COVID-19 and its demise will feel very long – regardless of the actual day count. Resources dedicated to arresting this challenge are massive and we join all of our clients and friends in hoping for success.

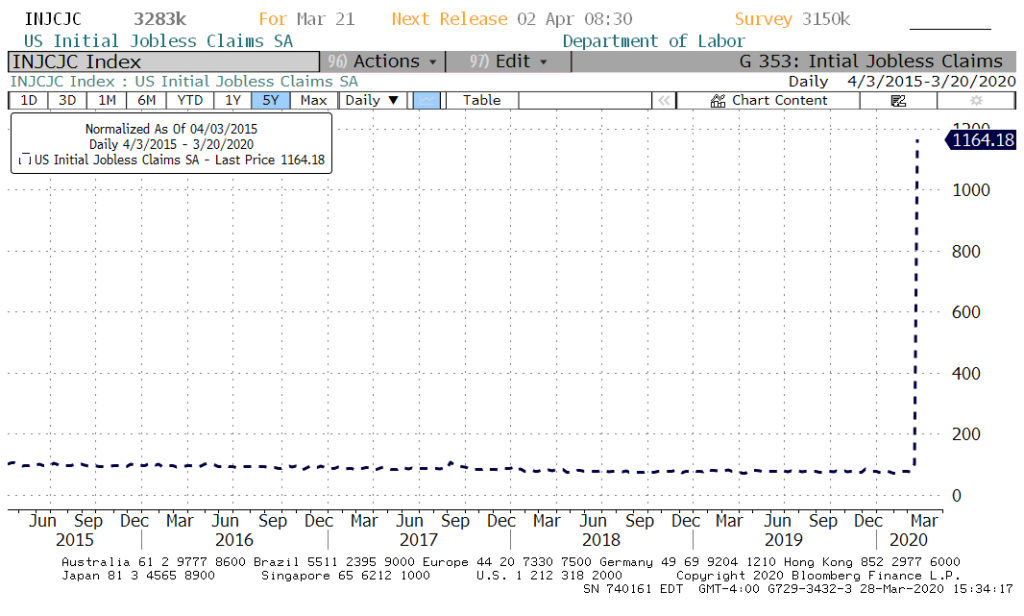

Before we are victorious against the virus, we are bracing for continued adverse news as it may infect friends, neighbors, colleagues or loved ones. It has already infected over three quarters of a million people and caused over 40,000 deaths globally. In the U.S. it is still spreading and has already surpassed 180,000 cases and over 3,500 deaths. U.S. unemployment claims surged to 3.28 million for the week ended March 21st, as shown in Figure One, and will likely continue to climb.

Figure One: Jobless Claims

Fortunately, governments are responding reasonably quickly and forcefully; the Federal Reserve Bank (FED) lowered its official discount rate to 0-0.25% from 2-2.25% in March launching massive liquidity programs to ease frozen credit markets, and the Senate passed three support bills including a $2.2 TRILLION bill to ameliorate short term employment, corporate, small business challenges, and aiding other economically critical sectors. Will it be enough? Time will tell but there is a “whatever it takes” mentality akin to war times. Central banks around the world have also acted and Europe has agreed to allow fiscal deficits ahead of a likely global recession that may be record breaking in scope but hopefully not in duration. The faster the virus ebbs the quicker economic activity can resume. The eventual rebound could be sharp and arrive this fall but it could also be delayed until late 2020 or early 2021 and be a more gradual recovery from a lower low.

Disciplined Investment Strategy

Many are guesstimating how high unemployment will get and how much economies will shrink in the second quarter with numbers as high as 30% and -30% annualized for each measure. These guesses are sometimes bandied about with conviction. We posit that the actual numbers will matter little until the cresting and abatement of the virus’ infection and mortality curves occur. If containment is successful and effective new drugs are discovered and administered sooner than later, recovery will obviously be quicker. Production will resume and pent up demand will increase making up for some, but not all, of lost sales. Meanwhile, the stock market gains of 2019 have been erased and valuations will be reduced to eventually create more bargains once this challenge passes. For now, we have raised a modest amount of cash, tactically lowered credit exposures, and overlaid portfolios with a buffered security (with some upside but less downside to the S&P500’s performance). Importantly, we keep owning a diversified number of stocks in companies with very solid cash flows and strong balance sheets. We hold some international equities with cheaper valuations and have kept our small gold position. Fixed income positions favor investment grade short and intermediate credit, municipal bonds, select preferred stocks, and short maturity Treasuries. We hold no international or emerging market bonds.

Bond market comments

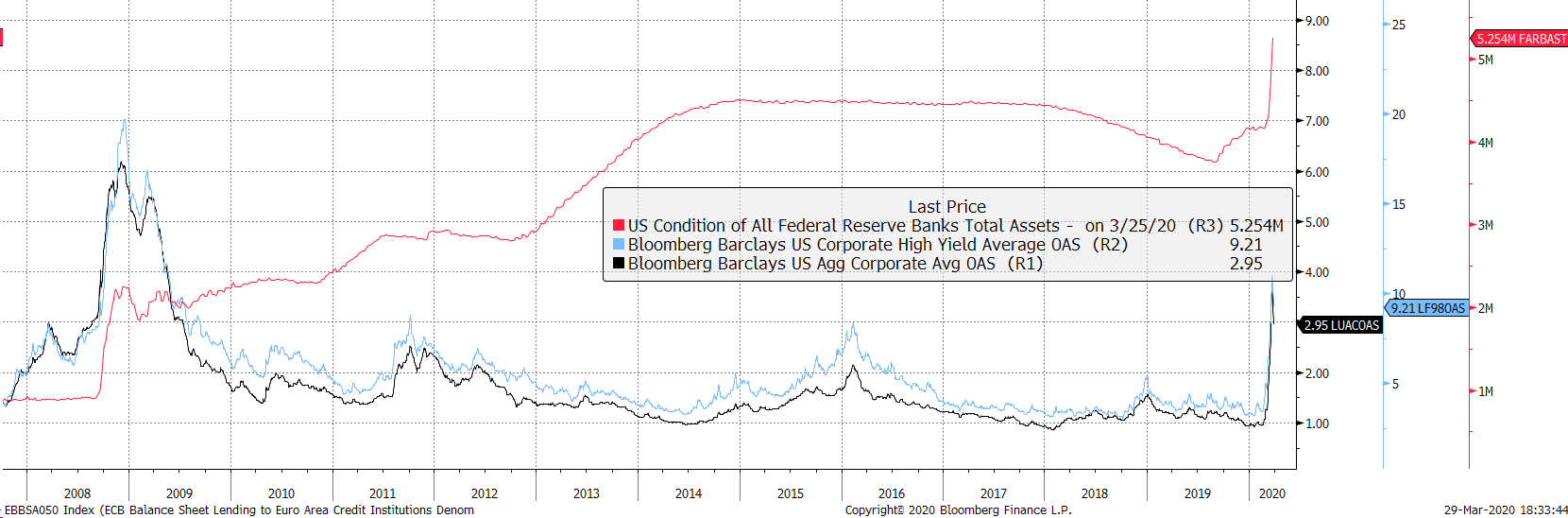

One important byproduct of an economic crash that is almost void of revenues is a liquidity crunch that could lead to solvency issues for those who have high indebtedness. The high yield bond market composed of companies with debt that is rated non-investment grade (typically because of balance sheet weakness – too much debt relative to revenues) dropped about 20% in mid-March before partly recovering at month end. Even the stronger investment grade corporate debt spreads (nominal yield less the respective yield on US Treasuries) rose sharply as sellers dominated.

Figure Two: FED assets and US Investment Grade and High Yield Spreads

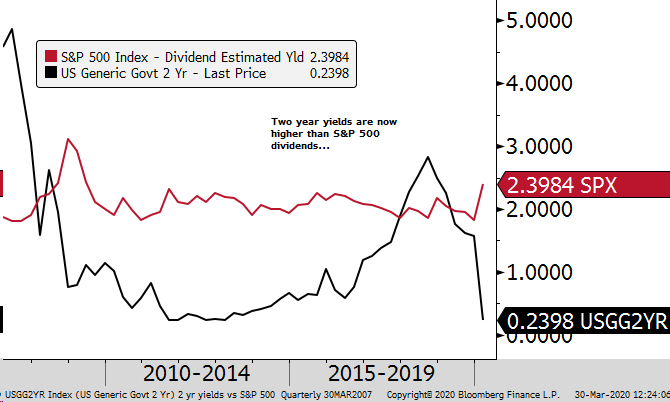

Figure two shows the spike in bond spreads and in FED assets as the central bank bought various investment grade assets to boost market liquidity. Meanwhile, volatility has been high in all bond sectors including Treasuries with the 10-year yield moving in a 50 basis point rage in March before closing at 0.65%. The yield curve steepened in response to FED largess with two-year notes at 0.23% as of month end March. Figure three shows that there is now a 2.1% advantage in owning the S&P 500 Index’s average dividend yield.

Figure Three: S&P 500 Index earnings yield vs. 2-year U.S. Treasury yields

Outlook

A deep recession likely lies ahead amidst continued extended health related limitations on travel and production. Government aid should help reduce permanent damage to some businesses and workers. This virus nightmare will end with a recovery likely to follow. Your Regency team will continue to diligently monitor health and economic developments as we navigate these challenges and opportunities together. In the near term we remain available for phone, conference, and video calls as well as by email to discuss any issues and questions.

May we maintain frequent contact with those we love and hold dear so that the distance between our relationships narrows. Thank you for your continued confidence and trust. Stay safe and healthy!

Click here to download printable version of this newsletter.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.