V!

“Anyone can hold the helm when the sea is calm”

– Publilius Syrus

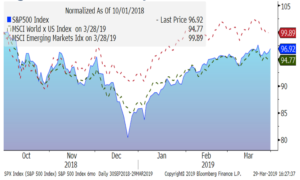

After a choppy 2018, 2019 promises to be a year requiring continued vigilance at the helm. The first quarter ended March 31 saw a steady and sharp rebound in stock prices recovering the big December, 2018 losses: a classic “V” shape. The Federal Reserve (FED) helped by going from Hawkish (raising rates) to Dovish (no change or reducing rates) in short order. Recall that they raised rates by a quarter of one percent seven times since 2016, including four times in 2018. The current rate range of 2.38-2.50% remains highly accommodative (low). The FED is now communicating patience and does not expect to raise their “discount” rate (an official rate that sets money market rates domestically) this year. The stated reason for neutrality is the apparent slowdown of economic growth globally. We suspect that part of their newfound shyness reflects concern about the steepness of December’s stock market drop, the U.S. Federal government closure early this year, and ongoing uncertainty surrounding trade negotiations with China. Investor concerns have shifted towards trying to ascertain how close we are to negative economic growth. We view the chances of a U.S. recession before mid-2020 as low.

Figure One: “V” shaped stock markets

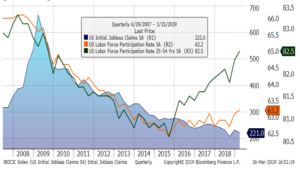

Economic and Earnings Fundamentals Weakening growth trends do not instill confidence. Fourth quarter U.S. GDP (Gross Domestic Product) growth moderated to 2.2% from the prior quarter’s 3.4% and is expected by economists to be 2.3%1 in the quarter ended 3/31/2019. Noise surrounding economic data, including the temporary and extended government shutdown, may understate the U.S. economy’s underlying strength. Labor remains strong. The participation rate measuring the rate of 25 to 54 year-olds (key productive years) in the labor force has spiked as shown below. This is constructive for continued consumer demand. Assuming this continues, economic activity is expected to rebound later this year.

Figure Two: Jobless claims and participation

Overseas, economic growth rates have decelerated since mid-2018. German GDP growth was a negative 0.2% quarter-over-quarter in the third quarter and 0% in the fourth quarter, 2018. Unemployment and inflation remain low, and manufacturing indicators, while slowing, remain positive. China expanded at 6.4% in the fourth quarter, 2018 and is anticipated to slow further towards 6% in 2019. Resolution of the ongoing U.S.-China trade tariff negotiations will be an important element for confidence in both countries.

Stock and bond valuations

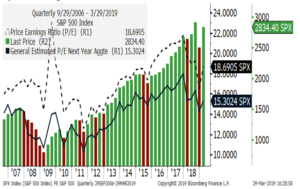

After a robust 2018, companies in the S&P 500 Index are expected to show slower revenue and earnings growth this year but should grow commensurate with economic expansion.

Figure Three: Lagging and Forward S&P500 Index Price/Earnings and quarterly returns

Higher earnings and lower prices in 2018 served to moderate equity valuations. Even with the S&P 500 Index’s 13.1% return in the first quarter, 2019, the index’s Price/Earnings ratios are reasonable at 18.7x and 15.3x, trailing and forward earnings, respectively. Overseas developed markets rose in the quarter, though modestly less than their U.S. counterparts. Germany, Japan, Spain, and Sweden lagged, rising only 5-7%. Stock indices in France, Italy, Switzerland and the U.K. rose 10% or more. Emerging markets lagged; up 8.2% in the first quarter. We are neutral in our equity risk budgets reflecting expectations for slower, but positive economic and earnings growth.

Bond markets rallied resulting in a first quarter return of 3.0% for the Bloomberg Barclays US Aggregate Bond Index as yields dropped across the curve. Three month yields now surpass that of the ten-year Treasury bond; an inversion that some are interpreting as an early recession indicator. Yield inversions tend to portend recessions but are not infallible predictors of an imminent recession. At a 2.41% yield, we are not enthused about the ten year Treasury bond’s value. With one-year T-bills offering 2.30%, why would anyone take an additional nine years of inflation risk to lock in 0.10% more in yield? If interest rates rise just 0.3% in yield, investors holding the ten-year bond will break-even; if rates rise 1% within twelve months, investors will LOSE 5%! Hmm, earn 2.4% +/- with a chance of losing 5% or more? No thanks. We are maintaining our below average duration (bond price sensitivity to interest rate changes) posture within fixed income allocations.

Outlook

The U.S. tariff and trade negotiations with China will hopefully be completed by mid-year. Success may not boost stock markets much and while lack of it may prompt some to sell stocks, by itself we don’t see it as material. However, higher tariffs are inflationary and growth detractors. Adverse developments may yet impact our navigation through shifting winds.

The Regency team is happy to welcome our latest crew member, Mark Andraos, Associate Portfolio Manager, who came aboard in early January. A Rutgers graduate (with honors), he achieved his Certified Financial Planner® designation in 2015. Please welcome Mark!

We are committed to working with you over the long term to help you reach your financial goals through constructive and impactful collaboration. Please call us to share any thoughts, concerns, and insights or to learn more about our wealth management process.

Regency filed our annual Investment Advisory Filing with the Securities & Exchange Commission in March reporting regulatory assets under management of $296.8 million, a new high-water mark. Thank you, clients, friends, and colleagues for this privilege.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.