Trump Transition

“Every government intervention creates unintended consequences, which lead to calls for further government interventions.”

– Ludwig von Mises

Twitter was atwitter as the world reacted to President Donald Trump’s rapid fire policies during his first months in office. U.S. equity markets quickly embraced his pro-growth policies. Putting aside the controversies surrounding immigration, trade, and health care, substantive policy action, including tax and regulatory reform, still lie ahead.

Stocks marched ahead to record highs post the February 28th State of the Union address reflecting optimism that a business friendly administration and its policies would lift economic growth. They held onto gains through the March 15th Federal Reserve 0.25% rate hike before weakening later in the month as Republicans proved unable to legislate health care reform. Nevertheless, stocks ended the first quarter with strong returns.

The S&P 500 index is up five consecutive months rising 5.5% in the quarter ended March 31, 2017. Some investors fear that a bubble is about to burst while others are less pessimistic. The fact that many are not euphoric is a good sign that U.S. stocks are not excessively priced, in our opinion.

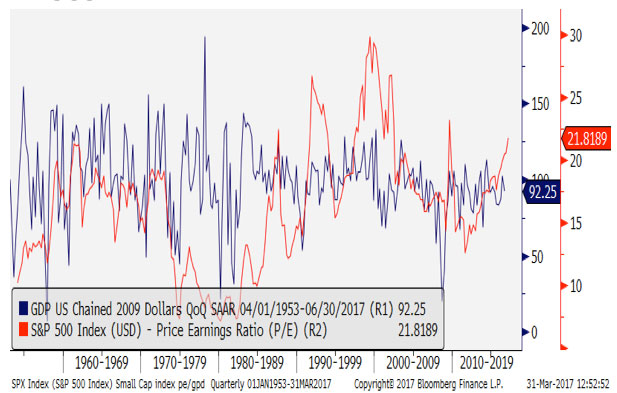

Figure One: S&P 500 P/E vs. normalized GDP %

Source: RWM, Bloomberg L.P.

Yet they are also not cheap. Assumptions of timely and substantive fiscal stimulus are, in part, discounted into current stock prices (see Figure One – red line shows higher P/Es). We believe that the market would likely sell off if it is disappointed by the scope or timing of fiscally constructive legislation. Initial Republican efforts to reform health care insurance were arguably amateurish and will need to be revisited. Successful tax reform together with higher infrastructure spending could still propel stocks higher.

Diversification kicked in to the good over the last three months as international developed markets outpaced the S&P 500 Index but in turn were beat by emerging market indices. The MSCI World Index and the MSCI Emerging Markets index returned 5.9% and 12.5%, respectively in the quarter ended March 31, 2017. Bond markets rebounded from their weak 2016 but fluctuated before and after the March Fed rate hike with U.S. investment grade bonds, as measured by the Barclays U.S. Aggregate Index, rose 0.7% in the quarter. The ten year U.S. treasury yield ended March at 2.39% and ranged from a low of 2.3% to a high of 2.63%. The U.S. yield curve “slope” flattened modestly in the quarter as rates on bonds maturing within one year rose about 0.15%. International sovereign bond rates remain unattractive and were little changed from year end 2016’s levels.

Oil reversed course with West Texas Intermediate oil dropping back to $50.6/barrel at March end from $53.72/barrel at 12/31/16. Gold prices rose $90/oz in the quarter, ending at $1,250/oz.

Economic Fundamentals

U.S. fourth quarter economic growth was lackluster at +2.1%, down from stronger third quarter (GDP +3.4%) and is expected to weaken in the first quarter to 1% or so. Domestic employment and housing remain steady: unemployment at 4.7% and average home prices up 5.5% year-over-year through February, 2017.

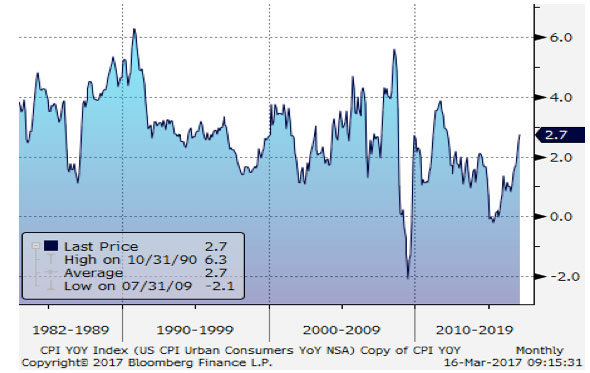

Figure Two: U.S. CPI is rising

Source: RWM, Bloomberg L.P.

February’s year-over-year consumer price index (CPI) rose 2.7%. While core inflation (excluding food and energy) is lower, the trend is clearly up. Eurozone inflation is also rising.

Stock and Bond Valuations remain elevated

Price/earnings multiples for the S&P 500 Index are 21.3 times (x) trailing earnings and 17.8x next twelve months’ estimated earnings –above long term averages but not yet egregious. The equity bull market is now eight years old and the S&P 500 index is up 250% from its March 9, 2009 low. Bond yields remain relatively low posing risk (when rates rise) to investors that reach for yield.

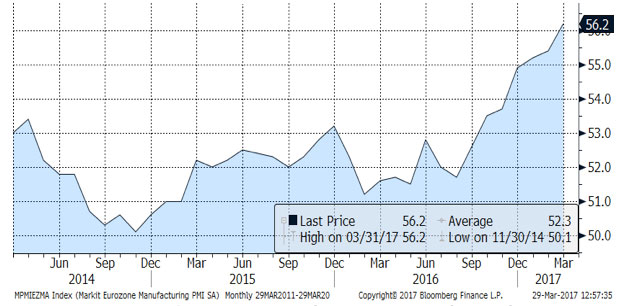

Figure Three: Markit Eurozone Manufacturing

Source: RWM, Bloomberg L.P.

Nationalistic Sentiment is Rising

Nationalistic sentiment is rising in Europe. Markets drew comfort from Dutch election results as Prime Minister Rutte was re-elected over controversial right wing candidate

Wilder. Several other key elections lie ahead; France (April) and Germany (September). In France, Marine Le Pen, the far-right candidate is sharing the lead in the first round polls with independent candidate Emmanuel Macron. The latter is expected to beat her in the second round by a wide margin. Angela Merkel is seeking a fourth term as German Chancellor and is expected to face strong competition. Any right-wing surprise victories may rock international markets as they could decelerate global growth and induce a recession.

Outlook

Political developments over the next three to six months will be important inputs domestically and abroad. Last quarter we noted that clouds remained on the horizon even as optimists partied on. We noted that pro-business moves, if enacted, would likely be constructive but we also cautioned that much of this was already discounted by markets (i.e. higher stock prices already reflected expectations for lower taxes, less regulations, and higher infrastructure spending). Our base case is for accelerating earnings growth partly offset with flat to declining price/earnings multiples. Undoubtedly, the late Austrian economist von Mises would be immersed in his praxeology1 if he were still alive. We will continue to consider how unintended consequences from well-intentioned government policy impact economic and financial matters.

Thank you for allowing us, your Regency team, the privilege of customizing a strategy to help you achieve your financial goals.

Please call us with any questions.

Please call us with any questions.

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, CFP®, AAMS®

Click here to download a printable version of this newsletter.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.