Climate Change

“Success seems to be largely a matter of hanging on after others have let go.” – William Feather

No sooner did 2016 start did stocks swoon with the S&P 500 Index dropping over 9% in the first half of January before rallying to post a 5% loss for the month. February also started on a weak note as stocks dropped in the first half of the month before recovering to pare back losses to 0.4%. March took a contrarian track, much like Northeastern weather warming up early and getting progressively hotter; gaining about 7% for the month. For all of its drama, the first quarter performance of the S&P 500 was a subdued 0.8% gain. Yet it felt like a major victory as this was a 13% rebound from its mid- February low.

As noted in our January 19th note, No Time to Panic, fears of an imminent global economic swoon seemed overblown to us. Our expectation for further modest employment and economic growth in a world of low but stabilizing energy prices continued. Oil prices rebounded as demand held steady and supply was curtailed.

Our disciplined strategy served us well as we compounded modest returns in a low rate world while avoiding compounding emotional mistakes in a volatile one (i.e. we did not succumb to fears of the unknown and sell into weak markets). Conversely, we did not escalate risks in client portfolios since we did not have strong convictions that high market volatility was close to ending.

Central Banks are working overtime

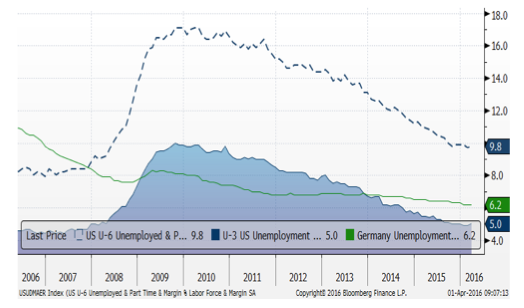

Major global central banks are working hard to avoid recession. The Bank of Japan (BOJ), the European Central Bank (ECB), and the U.S. Federal Reserve Bank (FED) continue to pursue highly accommodative and loose monetary policies. BOJ has embraced negative interest rates; i.e. investors will get less money back when the 10 year JGBs mature than they spent to buy them. They are currently locking in a -0.04% annual rate! The ECB has also embraced negative rates allowing banks to borrow at a -0.4% rate overnight and for up to four years if they use the money to on-lend it to consumers and corporations. The FED now expects two quarter point rate hikes this year, down from four that were anticipated just three or four months ago. All are trying to spur lending and support liquidity. Investors and borrowers are encouraged to borrow at low rates and productively invest the money. Ironically, success will be measured by a rebound in prices – inflation will pick up from very low levels if the money is borrowed and invested. Employment growth should also continue as demand for goods expands. Chart one shows the significant decline in U.S. unemployment (bottom shaded area shows the unemployment rate, top dashed line the under-employment rate) and the subtler improvement in Germany’s (middle green line).

Figure One: Unemployment

Gold bugs may be right for the wrong reasons

Some investors are called “gold bugs” because they strongly view gold as a store of value that will not be negatively affected by profligate government policy, geopolitics or economic weakness. In reality gold, while attractive to some as jewelry, is a very speculative investment instrument that doesn’t pay interest or dividends. It has historically trended with inflation. Some investors, spooked by the 2008-2009 stock market tumble chased after it in 2009-2011 as it rose from $879/oz to $1880/oz. It then dropped to $1050/oz late last year before rebounding to $1270/oz in early March and closing the quarter at $1232/oz. Figure two shows gold’s trading channel and the breakout earlier this year (dark line) tracking an uptick in the consumer price index (dashed line). The solid line is the Euro/Dollar exchange rate. Gold usually trades with an inverse relationship to the U.S. dollar. The dollar weakened and gold prices rose in the first quarter.

Figure Two: Gold, CPI, and EUR/Dollar

If central bankers are successful in accelerating demand and inflation, gold prices could rise further. Investors that bought gold as a proxy for low fiscal confidence may be right for the wrong reasons.

Retirees are in a tough place

Another unintended consequence from loose monetary policy and historically low rates is the absence of real returns for savers on their bank balances. Savers are losing purchasing power by holding CDs that yield U.S. government real rates, that is nominal rates net of inflation are arguably negative inside of ten years. Two year CDs yield about 1.5%, lagging core inflation in the U.S. (+2.3% for the year ended February, 2016).

U.S. ten year treasury yields declined 42 basis points (0.42%) from year-end closing March at 1.78%. This represents a negative real rate (net of inflation) and remain unattractive to us when compared to the 2.19% average dividend yield in the S&P 500 index. However, the U.S. ten year note remains compelling to international investors in light of German Bunds 10 year nominal yields of just 0.15% and negative Japanese ten year government note yields (-0.04%, yes, they offer a negative rate). So rates are in a weird place: they are unattractive relative to stocks and inflation but in the U.S. they are higher than most overseas rates. To complicate matters, FED rate hikes may support the U.S. Dollar relative to other major currencies. This space (bonds) continues to require careful monitoring and management.

Fundamentals & Outlook

The U.S. economy has grown at a very modest pace for over three years and 2016 is expected to maintain the 2-2.5% pace. We may well be stuck in a low growth, low rate world for a while implying lower than normal investment returns for the near term. Corporations continue to seek efficiencies and are financially engineering greater returns to shareholders by increasing debt to boost stock buybacks and dividends. As income is hard to come by, access to funding should continue to be ample. We are energized to continue serving the best clients in the world. Thank you for “hanging on when others let go”. Together we will continue to successfully pursue your financial goals over the long term even as climates change.

Call us with any questions.

Happy Spring!

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, CFP®, AAMS®

Click here to download a pdf of this newsletter.

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.