Potholes

“Success is finding satisfaction in giving a little more than you take”

– Christopher Reeve

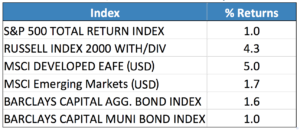

Spring. Finally! Pansies, crocuses, daffodils, hyacinths, and tulips are blooming and workers are busy repairing this winter’s bumper crop of potholes in the Northeast-apologies to those clients who dwell in Southern climes. Potholes are annoying and dangerous hazards. Capital and investment markets have their own potholes; cracks, bumps, holes and craters that investors run into with little if any warning. Volatility spiked higher in the first quarter of 2015. In 18 out of the 20 trading days of January, the S&P500 index fluctuated intraday more than 1%! February was well behaved but volatility resumed in March. For example, oil prices traded in a 24% range. Other commodities, bonds, and currencies also gyrated in the quarter with mixed results; cotton +4% and silver +6% were notable exceptions to commodity price weakness. Ten year U.S. Treasury yields bounced from 1.6% on January 30 to 2.24% on March 6 and ended March at 1.92% (1.83% on April 3rd). Even the US dollar took a breather in late March giving up 2% vs. the Euro after gaining 13% YTD through March 13th. As shown in Table One, small and international stocks led quarterly returns, a marked reversal from 2014 when large cap domestic stocks fared best.

Table One: First Quarter 2015 Returns, MSCI

Most developed European stock markets rose more than 6% (measured in US Dollars) and increased over 10% measured in Euros for the quarter. Asian stocks were also up led by Japan and China. Globally, bonds continued to rally (lower yields and higher prices) as most Central Banks added liquidity to spur investment growth. Ten year government bond yields dropped in 30 of the largest 33 countries (they rose in Greece, Brazil and Japan). Remarkably, yields are NEGATIVE for most European governments’ three year bonds (German bond yields are negative out to seven years). Although the U.S. ten year government bond yield is not compelling to us, it is attractive relative to the German equivalent yielding less than 0.2%!

Fundamentals

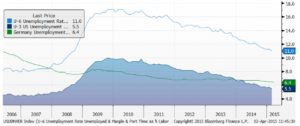

Weaker markets in an environment of stronger economic indicators often befuddle investors. Collectively, market participants look well ahead of current events and reposition investments accordingly. This year’s volatility likely reflects changing market expectations for the Federal Reserve to finally end six and a half years of extremely easy monetary conditions, i.e. they are poised to raise rates as early as June (the Fed Funds rate has been at 0-0.25% since late 2008). Consensus expectations are that the increases will be modest and gradual and may crest well below historical levels. Why does that matter? No one knows how much rates will rise and over what time frame. Typically, rate moves are directional and substantive – once they are rising they continue to do so until economic conditions weaken and require rate reversals. Higher rates get passed along to borrowers and to savers (with a lag). For borrowers, the higher cost of debt increases costs and diminishes returns. Lower profits engender less employment and vice versa. Stock markets can rise or fall in a rising rate environment; rising when the economy is expected to strengthen and stalling when slower growth or increases in inflation is foreseen. For now, the improved labor market together with low energy prices underpins U.S. economic expectations. German unemployment has also gradually improved as shown in Figure One prompting a rebound in European stocks.

Figure One: U.S. & German Unemployment

U.S. corporate revenues and earnings growth moderated in the fourth quarter 2014 and are expected to show weakness in the just completed quarter but are likely to resume growing in the remaining quarters of 2015 if consumer spending picks up and the dollar stabilizes. As we have previously noted, corporate America has refinanced their balance sheets at record low interest rates thereby significantly decreasing their financial risk. This translates to our sanguine view of stock market dynamics.

Valuations

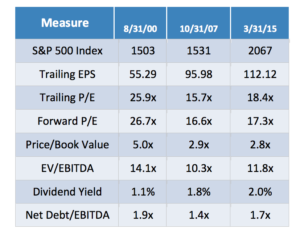

Are U.S. stocks overvalued? Some observers are waiving warning flags over current, near record market levels as reflected in Figure Two.

Figure Two: S&P 500 Market Peaks Comparisons

Source: RWM, Bloomberg L.P

When we examine previous market peaks to current valuations we indeed note the similarities to the 2007 peak (Table Two). Clearly the S&P 500 Index is not cheap but we posit that it is not overly expensive either. Dividend yields and liquidity are higher, and financial risk is muted. Interest rates remain unattractively low, but earnings growth will need to re-accelerate before equity investment returns rebound materially.

Table Two: S&P 500 Index vs. recent peaks

European stocks’ forward earnings estimates are about 6-10% lower than U.S. large caps’ rendering them competitive.

Outlook

The U.S. economic expansion should continue in 2015 and European growth is likely to improve. Just as the transportation department will endeavor to repair damaged roads, the collective market will “repair” securities valuations. While we wait, may we find success by giving more than we take. Call us with any questions.

Thank you for allowing us to help steer your finances clear of the ”potholes” so that you can grow and spread the wealth.

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, AAMS®

Click here to down load a pdf of this newsletter

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.