Excitement

“Investors should remember that excitement and expenses are their enemies. And if they insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful.” – Warren Buffett, 2004

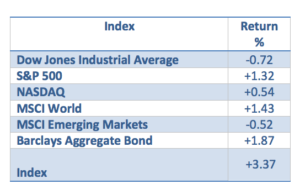

Markets don’t go up forever as January’s mini correction attested. Weaker weather-induced data, stumbling emerging markets, and Russia’s greedy incursion and annexation of Ukraine’s Crimea increased uncertainty and volatility. Interest rates confounded consensus expectations by dropping in the face of a steadily tapering Federal Reserve Bank (FED) before weakening in March as the FED modified their guidance. Consequently, both stock and bond markets recorded mixed results in a volatile quarter ended March 31st. The S&P 500 Index dropped 5.75% through February 3rd before rallying in late March to manage a modest 1.3% return for the quarter. The Dow Jones Industrial Average declined modestly while the benchmark bond index rose. Municipal bonds were favorably impacted by lower interest rates.

Table 1: First Quarter 2014 Returns

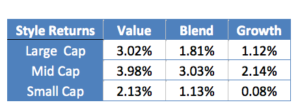

For the quarter, mid and large cap U.S. stocks outpaced those of smaller firms as shown below:

Table 2: US Style Returns 1Q 2014

Earnings per share for the S&P 500 rose 8% in the fourth quarter 2013 versus the prior year’s but revenues were anemic; only up 0.8%. Russia’s aggressive “defense” of Russians in Crimea culminated in their annexing the region amidst feeble G7 protests and sanctions. Russian stocks, as measured by the MICEX, dropped over 20.2% before rallying in late March to lose only 9% in the quarter. All major European markets except for the FTSE 100 managed positive returns in the first quarter, 2014 (1Q2014). Italian stocks outperformed neighbors with their FTSE MIB index rising 14.6% (measured in USD). Asian stocks were mixed with the Nikkei down 7% and the ASX 200 up 5%. In Asian emerging markets, Jakarta rose 20% while the China’s Hang Seng dropped 10%.

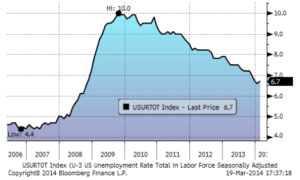

Figure 1: U. S. Unemployment Rate

The U.S. economy ended 2013 growing at a modest 2.6% rate in the fourth quarter. Unemployment improved to a still high 6.7% after touching 6.5%, a typical pattern as people re-enter the jobs pool as employment improves. We expect 2.5-3.0% GDP growth in the U.S. for 2014 and an unemployment rate approaching 6% by year-end.

Bonds rallied – complacency risk?

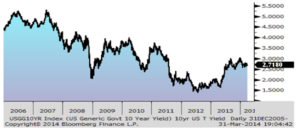

The consensus entered 2014 looking for higher U.S. interest rates but geo-political tremors led to a flight to quality rally instead. The ten year note dropped to 2.61% from 3.04% before settling at 2.72% at quarter end.

Figure 2 : 10 Yr U.S. Treasury Yield, YTD 2014

We caution against investors being complacent as the FED will be challenged to navigate the inevitable transition to “normal” yields over the next two to three years. Treasury bond yields will probably resume their march above 3% when economic growth accelerates modestly so we continue to favor bonds with shorter maturities. Municipal bonds rallied along with Treasuries in 1Q2014 after their losses in 2013. Puerto Rico managed to raise $3.5 billion of general obligation bonds at an 8.73% yield. This may be enough liquidity to delay a potential restructuring of its sizeable debt burden but that will ultimately depend on the Commonwealth achieving substantive public sector reform.

Outlook

Volatility will likely continue to be higher for the ensuing months of 2014 as underlying economic demand and its implications for earnings is clarified. Full year returns for domestic stocks are less likely to exceed 10% unless underlying demand picks up materially. If it does, multiple expansion to 18-19x price/earnings (P/E) for the S&P 500 is possible. If it doesn’t, the current 17x P/E will be hard to maintain. Ahead of mid-term U.S. Congressional elections, we don’t expect any meaningful legislative progress. Figure three shows the seasonality of S&P 500 returns over the last ten years – April is usually positive…

Figure 3 : S&P Seasonality – April tends to be +

Stocks in the U.S. continue to remain reasonably priced overall but individual bargains are getting harder to find. Europe is showing signs of resuming economic growth. Hopefully Russia’s “recapture” of its Crimean region satiates President Putin and thus avoids any disruptive events. The less visible economic battle is one of negative real returns for savers that slowly but pervasively erodes their purchasing power. Earning between zero and 0.3% annually on savings and CDs results in a negative real return (after inflation) of 0.8-1.1% ex food & energy inflation at best. The cumulative loss of purchasing power over five years of this scenario will be hard to overcome and hurts risk averse investors and retirees alike. Please call us if you would like to discuss any of these issues.

Thank you for allowing us to be on your team.

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, AAMS®

Click to download a pdf of this newsletter

Regency Wealth Management is a SEC Registered Investment Advisor managing over $500 million for families and small institutional investors. Regency was founded in 2004, is headquartered in New Jersey, and serves clients across the country.