Vol

“Do not put all your trust in money, but put all your money in trust.” – Oliver Wendell Holmes

Volatility, or “vol” as it is called by market pundits, returned from its vacation in a loud and discomforting fashion. After three years of almost languid, rising stock markets, sellers were plentiful rendering declines in equities around the world noteworthy and concerning. Factors blamed for this sell off included sharply lower Chinese stocks, fear that a slowing China would drag down global economic activity, decreased market liquidity, and the uncertainty around a Federal Reserve (FED) interest rate increase. Add doses of government dysfunction and perennial concerns over geo-political risk and you have some very nervous investors. Fortunately, domestic economic progress continues and the Fed’s initial rate hike is closer to fruition. Together with more reasonable equity valuations and sans a surprising Lehman Brothers style mega-default of a major financial institution we may be approaching a bottom. Fundamentals The U.S. economy continues its progress after a weak start to 2015, paralleling 2014’s pattern.

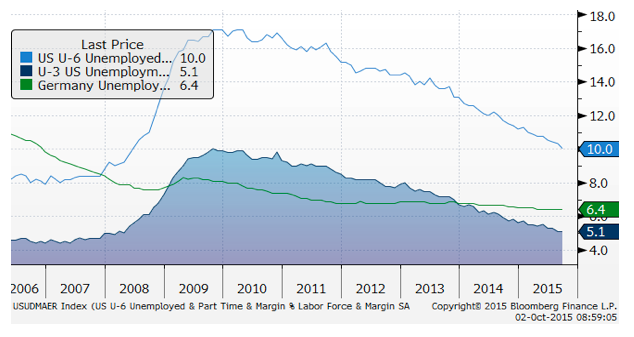

Figure One: Unemployment Down

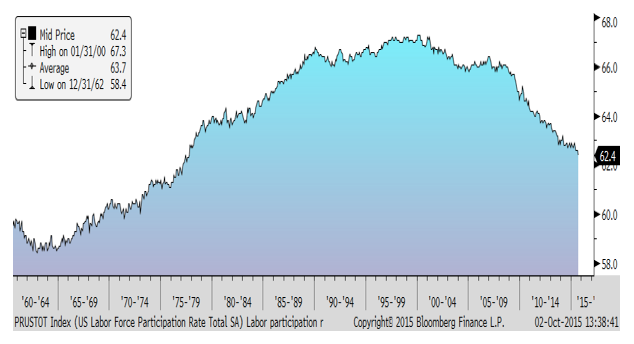

As shown in Figure One, unemployment in the U.S. and Germany continues to improve. Much has been written about our low labor participation rate but as seen in Figure Two, it has reverted to 1980 levels. New job creation is steady but the pace of baby-boomer retirements is mudding the labor picture.

Figure Two: Labor Participation Rate

U.S. economic growth in the second quarter was revised up to +3.9%, better than its initial and secondary estimates. Job growth has been steady with the unemployment rate dropping to 5.1%. A number of other indicators are flashing constructive patterns including rising household income, high new-auto sales, and consumption spending. Corporate earnings, as measured by S&P 500 firms, dropped 2.1% in the second quarter; held back by a 57% drop in Energy and a stronger US dollar. Aside from a 4.1% drop in Industrials and a 1.1% drop in Consumer Staples, all other sectors were positive led by Health Care (+14.9%) and Telecommunication Services (+10.2%). We look for earnings growth acceleration from higher demand along with low long-term interest rates leading to a rebound in stock prices. While we don’t see a recession looming, meaningful economic deceleration and investment outflows could pressure equities further. The S&P 500 Index’s 2.25% dividend yield continues to be attractive relative to short-term and intermediate-term bonds yields.

Returns and Valuations

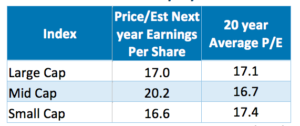

After trading at near record market levels in May, the S&P 500 dropped sharply in August and September (approaching 2014’s 1865 low) before closing the quarter at 1920 (down 7%). We were surprised at the severity of the sell-off and the degree of investors’ discomfort with valuations and agnostic view of underlying fundamentals. The long awaited overdue “correction” (a drop of 10% or more) finally arrived. European stock markets fared worse than US markets, dropping 8% in Switzerland and France and 10% or more elsewhere in the quarter in US dollar terms. The weakest markets were in Asia with Chinese indices dropping 30% and non-Chinese markets shedding 11-20% in the quarter. Emerging markets were down 15-40% in the quarter as the fear of lower global growth led investors to sell en masse. The negative performance reflects significant investor outflows: the Investment Company Institute estimated that $58.3 billion was withdrawn from mutual funds in the third quarter with $56.6 billion of it flowing into money market funds. This represented the worst negative quarter since the third quarter of 2011. Valuations naturally now represent a better risk/reward landscape as shown in Table One.

Table One: Valuations: 9/30/2015

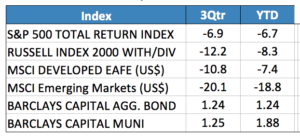

As shown in Table Two, international, emerging markets, and small cap stocks underperformed large cap U.S. stocks. Bond indices rallied in the latest quarter as the Fed punted on raising rates until later this year.

Table Two: 2015 3rd Qtr. and YTD Index Returns

Ten year U.S. Treasury yields rallied ending below 2.05% at September 30th, down from 2.36% on June 30th. The Merrill Lynch US High Yield Index dropped 3.8%. Curiously, Gold dropped 5% in the third quarter reflecting a lack of inflationary or currency concerns.

Outlook We continue to anticipate U.S. GDP growth of about 2.5% in the second half of 2015. This should allow the unemployment rate to approach 5% (currently 5.1%) by year end. Europe’s absorption of refugees will require higher government spending – a short term economic stimulus – and may lead to a more flexible and diverse working class. As the FED looks to begin raising rates the potentially challenging transition to “normal” market-led yields begins but European quantitative easing is still in the early stages. We anticipate that longer-dated Treasury bonds will continue to offer lower than typical yields for some time before rising and thus are moderating our shorter maturity bond positions.

Volatility is normal and uncertainty often creates opportunity. All of these issues are considered in our investment process. Our main goal is to allow our clients to meet their financial goals without taking on more or any less risk than appropriate. A prudent, highly diversified approach that reflects financial flexibility, time horizon, and risk profile will continue to serve clients well.

Call us with any questions.

Thank you for your continued trust in us.

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, CFP®, AAMS®