Change

“It is better to know some of the questions than all of the answers .”

– James Thurber

Change! Weather, employment, relationships, health, politics, stocks, inflation, life – all change; some seasonally, some gradually, and others unexpectedly. Is it windier this year than last? Warmer? Is the political rhetoric louder? Is Washington less effective? For answers to those questions look elsewhere. For investment insights, read on.

Stocks continue to climb a wall of worry, bonds remain richly valued

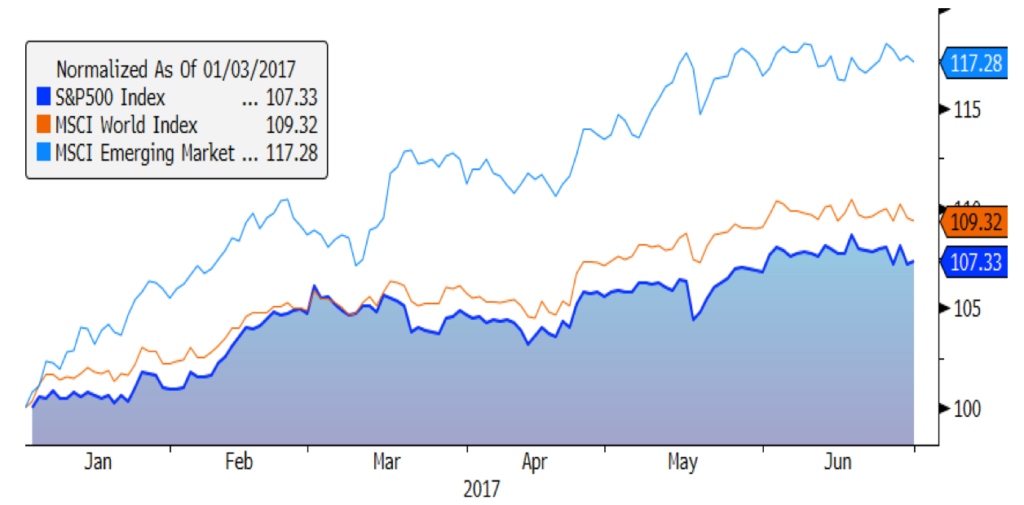

Stocks in most developed markets continued their upward march in the first half of 2017. International developed and emerging stock markets outperformed, in part reflecting a modestly weaker U.S dollar. Positive results also reflect relatively steady economic progress both domestically and abroad. The S&P 500 index rose 2.6% in the second quarter and is up 8.2% year to date as of June 30. The MSCI World Index and the MSCI Emerging Markets index returned 3.4% and 5.5%, respectively in the quarter ended June 30, 2017. Year to date through June 30 they rose 9.4% and 17.2%, respectively. Are they too high? This question is always asked in up markets as investors brace for anticipated pullbacks and corrections. Timing such inflections is impossible – hence the climb over a “wall of worry” (as investors fret over economics, growth, valuations, etc.).

Figure One: S&P 500, MSCI World, and MSCI Emerging Markets Indices all up…

In a slow growth, low interest rate world we argue that current valuations are not (yet) excessive. Price/earnings multiples for the S&P 500 Index are 21.4 times (x) trailing earnings and 17.6x next twelve months’ estimated earnings –above long term averages and not cheap. Consequently, we are targeting below average risk within our client’s investment policies.

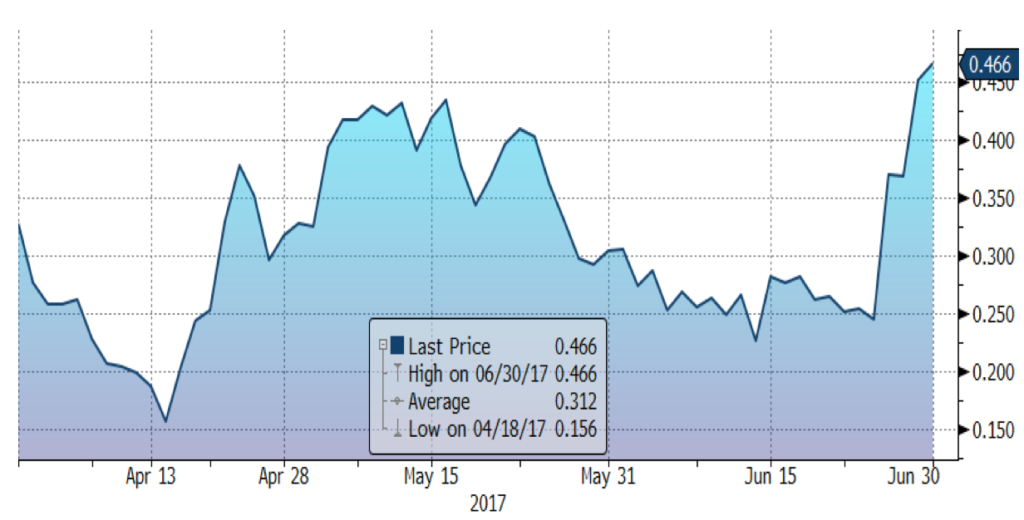

Bond yields are lower than year-end 2016, even after two Federal Reserve rate hikes in 2017. The ten year yield reached a low of 2.12% mid-June before spiking up to close June at 2.30%. Global bond yields also rose sharply from low levels in late June (Figure Two). The U.S. yield curve “slope” flattened modestly in the quarter as rates on bonds maturing within one year rose and yields on longer date bonds dropped. The yield curve (yields plotted against maturities) is still upward sloping – a flat curve is often accompanied by recessions.

Figure Two: German 10 year bund yields spike

Oil prices extended their weakness until the last week of June when they recovered 7% yet closed the quarter at $46.00/barrel. Down from $50.60/barrel at March-end. Gold prices were little changed at $1,242.00/oz.

Economic Fundamentals

U.S. first quarter 2017 economic growth was a seasonally weak 1.4%. It is expected to surpass 2% for the second quarter and continue over that level in the second half of the year driven by a rebound in consumption. Domestic employment and housing remain steady: unemployment at 4.3% and average home prices up 5.8% year-over-year through May, 2017. U.S. job openings are at record levels but wages are not yet rising.

Economic Fundamentals

U.S. first quarter 2017 economic growth was a seasonally weak 1.4%. It is expected to surpass 2% for the second quarter and continue over that level in the second half of the year driven by a rebound in consumption. Domestic employment and housing remain steady: unemployment at 4.3% and average home prices up 5.8% year-over-year through May, 2017. U.S. job openings are at record levels but wages are not yet rising.

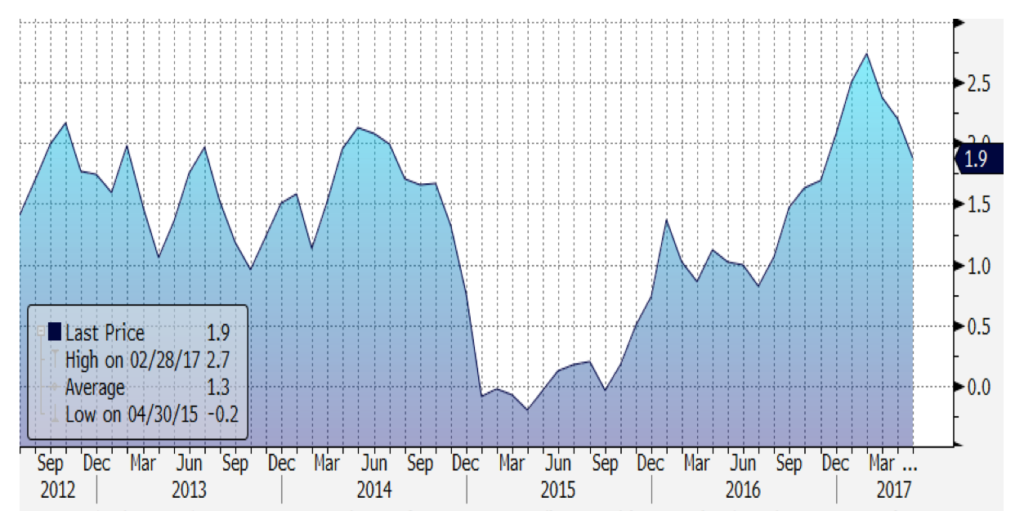

Figure Three: U.S. CPI is bouncing around

After trending up in 2016, inflation has reversed itself in 2017. Explanations include the weakness in retail employment and lower energy prices. We suspect that productivity improvements and the shift to internet services are also contributing to a lower, and later, labor inflation picture.

Outlook

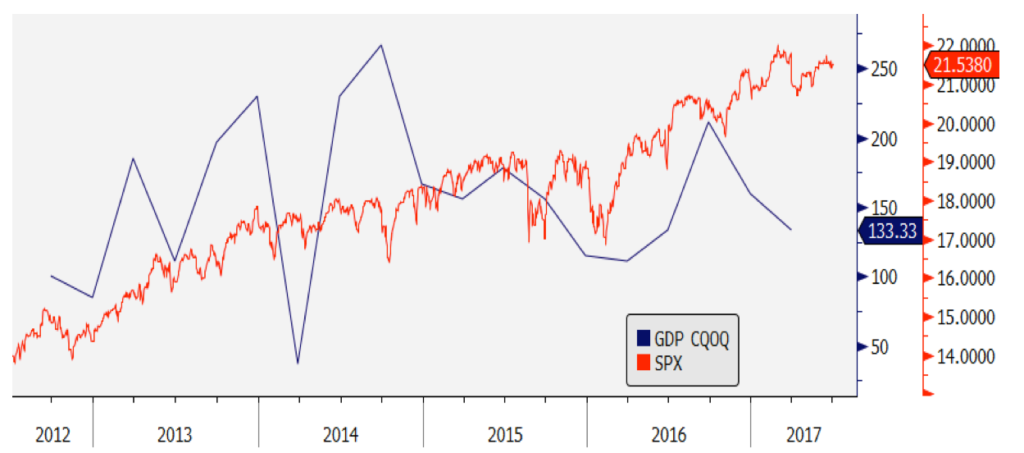

U.S. stock price to earnings multiples have expanded significantly over the last three years in a slow growth economic environment. This is, in our opinion, unsustainable in the long run.

Figure Four: S&P 500 P/E vs. normalized GDP%

Significantly higher stock market returns over the next few years will likely require higher earnings and faster economic growth. Successful tax reform, favorable repatriation of overseas earnings for U.S. companies, and higher infrastructure spending may be important contributors to the upside case. Our base case continues to be more cautious; moderately accelerating earnings growth partly offset with flat to declining price/earnings multiples. Rising interest rates are also likely over the next two years but are far from presenting serious competition for stocks.

We will continue to diligently track developments and endeavor to identify meaningful changes.

Thank you for allowing us, your Regency team, to ask the right questions on your behalf as we assist you in achieving your financial goals. Please call us to share any thoughts, concerns, or insights.

Please call us with any questions.

Andrew M. Aran, CFA

Mark D. Reitsma, CFP®, CMFC

Timothy G. Parker, CFA

Bryan D. Kabot, CFP®, AAMS®

Click here to download a printable version of this newsletter.